DEF 14A: Definitive proxy statements

Published on April 1, 2005

|

UNITED STATES |

|||

|

SECURITIES AND EXCHANGE COMMISSION |

|||

|

Washington, D.C. 20549 |

|||

|

|

|||

|

SCHEDULE 14A |

|||

|

|

|||

|

Proxy Statement

Pursuant to Section 14(a) of |

|||

|

|

|||

|

Filed by the Registrant ý |

|||

|

|

|||

|

Filed by a Party other than the Registrant o |

|||

|

|

|||

|

Check the appropriate box: |

|||

|

o |

Preliminary Proxy Statement |

||

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||

|

ý |

Definitive Proxy Statement |

||

|

o |

Definitive Additional Materials |

||

|

o |

Soliciting Material Pursuant to §240.14a-12 |

||

|

|

|||

|

Papa Johns International, Inc. |

|||

|

(Name of Registrant as Specified In Its Charter) |

|||

|

|

|||

|

|

|||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|||

|

|

|||

|

Payment of Filing Fee (Check the appropriate box): |

|||

|

ý |

No fee required. |

||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

|

P.O. Box

99900

Louisville, Kentucky 40269-0900

April 1, 2005

Dear Stockholder:

On behalf of the entire Papa Johns team, I invite you to join us for the Companys upcoming Annual Meeting of Stockholders. The meeting will begin at 11:00 a.m. on Tuesday, May 3, 2005, at the Companys corporate offices located at 2002 Papa Johns Boulevard, Louisville, Kentucky.

Following the formal items of business to be brought before the meeting, we will discuss our 2004 results and answer your questions. After the meeting, we hope you will join us for a slice of Papa Johns pizza!

Thank you for your continued support of Papa Johns. We look forward to seeing you on May 3.

|

|

Sincerely, |

|

|

|

|

|

|

|

/s/ John H. Schnatter |

|

|

|

JOHN H. SCHNATTER |

|

|

|

Founder and Executive Chairman |

|

PAPA JOHNS

INTERNATIONAL, INC.

P.O. Box 99900

Louisville, Kentucky 40269-0900

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 3, 2005

To the Stockholders:

The Annual Meeting of Stockholders of Papa Johns International, Inc. (the Company) will be held at the Companys corporate offices located at 2002 Papa Johns Boulevard, Louisville, Kentucky on Tuesday, May 3, 2005, at 11:00 a.m. (E.D.T.), for the following purposes:

(1) To elect four directors to the class serving a term expiring at the Annual Meeting of Stockholders in 2008;

(2) To consider and approve an amendment to the Papa Johns International, Inc. 2003 Stock Option Plan for Non-Employee Directors;

(3) To ratify the selection of Ernst & Young LLP as the Companys independent auditors for the fiscal year ending December 25, 2005; and

(4) To transact such other business as may properly come before the meeting or any adjournment thereof.

A Proxy Statement describing matters to be considered at the Annual Meeting is attached to this Notice. Only stockholders of record at the close of business on March 23, 2005, are entitled to receive notice of and to vote at the meeting.

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

/s/ Charles W. Schnatter |

|

|

|

CHARLES W. SCHNATTER |

|

|

|

Senior Vice President, Chief

Development Officer |

|

|

|

|

|

|

|

|

|

|

Louisville, Kentucky |

|

|

|

April 1, 2005 |

|

|

IMPORTANT

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN THE ENVELOPE THAT HAS BEEN PROVIDED. IN THE EVENT YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

PAPA JOHNS

INTERNATIONAL, INC.

P.O. Box 99900

Louisville, Kentucky 40269-0900

PROXY STATEMENT

ANNUAL

MEETING OF STOCKHOLDERS

TO BE HELD MAY 3, 2005

GENERAL INFORMATION

This Proxy Statement and accompanying proxy card are being furnished in connection with the solicitation of proxies by the Board of Directors (the Board) of Papa Johns International, Inc., a Delaware corporation (the Company), to be voted at the Companys Annual Meeting of Stockholders (the Annual Meeting) and any adjournments thereof. The Annual Meeting will be held at the Companys corporate offices located at 2002 Papa Johns Boulevard, Louisville, Kentucky on Tuesday, May 3, 2005, at 11:00 a.m. (E.D.T.) for the purposes set forth in this Proxy Statement and the accompanying Notice of Annual Meeting. This Proxy Statement and accompanying proxy card are first being mailed to stockholders on or about April 1, 2005.

A stockholder signing and returning a proxy has the power to revoke it at any time before the shares subject to it are voted by (i) notifying the Secretary of the Company in writing of such revocation, (ii) filing a duly executed proxy bearing a later date or (iii) attending the Annual Meeting and voting in person. If a proxy is properly signed and returned to the Company and not revoked, it will be voted in accordance with the instructions contained therein. Unless contrary instructions are given, the proxy will be voted FOR the nominees for director named in the Proxy Statement, FOR the amendment to the 2003 Stock Option Plan for Non-Employee Directors and FOR the ratification of Ernst & Young LLP as the Companys independent auditors for the 2005 fiscal year and in the discretion of proxy holders on such other business as may properly come before the Annual Meeting.

The original solicitation of proxies by mail may be supplemented by telephone and other means of communication and through personal solicitation by officers, directors and other employees of the Company, at no compensation. Georgeson Shareholder Communications, Inc. has been retained to distribute proxy materials and to provide proxy solicitation services for a fee of approximately $5,500, plus reasonable out-of-pocket expenses. Proxy materials will also be distributed through brokers, custodians and other like parties to the beneficial owners of the Companys common stock, par value $.01 per share (the Common Stock), and the Company will reimburse such parties for their reasonable out-of-pocket and clerical expenses incurred in connection therewith.

RECORD DATE AND VOTING SECURITIES

The Board has fixed the record date for the Annual Meeting as the close of business on March 23, 2005 (the Record Date), and all holders of record of Common Stock on the Record Date are entitled to receive notice of and to vote at the Annual Meeting and any adjournment thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder, for any purpose reasonably related to the Annual Meeting, for a period of ten days prior to the Annual Meeting at the Companys principal executive offices at 2002 Papa Johns Boulevard, Louisville, Kentucky. At the Record Date, there were 16,511,752 shares of Common Stock outstanding. For each share of Common Stock held on the Record Date, a stockholder is entitled to one vote on each matter to be considered at the Annual Meeting. A majority of the outstanding shares present in person or by proxy is required to constitute a quorum to transact business at the meeting.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspectors of election appointed for the meeting, who also will determine whether a quorum exists. Abstentions or withheld votes will be treated as present and entitled to vote for purposes of determining a quorum, but as unvoted for purposes of determining the approval of matters submitted to the stockholders. Since Delaware law treats only those shares voted for a matter as affirmative votes, abstentions or withheld votes will have the same effect as negative votes or votes against a particular matter. If a broker indicates that it does not have discretionary authority as to certain shares to vote on a particular matter, such shares will not be considered as present and entitled to vote with respect to that matter.

SECURITY OWNERSHIP OF MANAGEMENT AND PRINCIPAL HOLDERS

The following table sets forth certain information as of March 23, 2005 (except as noted otherwise), with respect to the beneficial ownership of Common Stock by (i) each director or nominee for director of the Company, (ii) each of the executive officers named in the Summary Compensation Table in this Proxy Statement, (iii) all directors and executive officers as a group and (iv) each person known to the Company to be the beneficial owner of more than five percent of the outstanding Common Stock.

|

Directors,

Director Nominees and |

|

Number of Shares(1) |

|

Percent of Class(2) |

|

|

|

|

|

|

|

|

|

John H. Schnatter |

|

4,844,066 |

(3) |

28.9 |

% |

|

|

|

|

|

|

|

|

William M. Van Epps |

|

20,149 |

(4) |

|

* |

|

|

|

|

|

|

|

|

Charles W. Schnatter |

|

218,790 |

(5) |

1.3 |

% |

|

|

|

|

|

|

|

|

Julie Larner |

|

83,796 |

(6) |

|

* |

|

|

|

|

|

|

|

|

J. David Flanery |

|

85,125 |

(7) |

|

* |

|

|

|

|

|

|

|

|

F. William Barnett |

|

15,750 |

(8) |

|

* |

|

|

|

|

|

|

|

|

Norborne P. Cole, Jr. |

|

14,000 |

(9) |

|

* |

|

|

|

|

|

|

|

|

Owsley Brown Frazier |

|

16,000 |

(10) |

|

* |

|

|

|

|

|

|

|

|

Philip Guarascio |

|

13,250 |

(11) |

|

* |

|

|

|

|

|

|

|

|

Olivia F. Kirtley |

|

14,000 |

(12) |

|

* |

|

|

|

|

|

|

|

|

Jack A. Laughery |

|

43,500 |

(13) |

|

* |

|

|

|

|

|

|

|

|

Timothy C. OHern |

|

2,657 |

|

|

* |

|

|

|

|

|

|

|

|

Wade S. Oney |

|

600,257 |

(14) |

3.5 |

% |

|

|

|

|

|

|

|

|

William M. Street |

|

10,917 |

(15) |

|

* |

|

|

|

|

|

|

|

|

Nigel Travis |

|

27,434 |

|

|

* |

|

|

|

|

|

|

|

|

All directors and executive officers as a group (17 persons, including those named above) |

|

6,147,884 |

(16) |

34.5 |

% |

2

|

Other 5% Beneficial Owners |

|

Number of Shares(1) |

|

Percent of Class(2) |

|

|

|

|

|

|

|

|

|

FMR Corp. |

|

2,244,300 |

(17) |

13.4 |

% |

|

|

|

|

|

|

|

|

Arnhold and S.

Bleichroeder Advisers, LLC |

|

1,665,000 |

(17) |

9.9 |

% |

* Represents less than one percent of class.

(1) Based upon information furnished to the Company by the named persons and information contained in filings with the Securities and Exchange Commission (SEC). Under SEC rules, a person is deemed to own beneficially shares over which the person has or shares voting or investment power or of which the person has the right to acquire beneficial ownership within 60 days. Unless otherwise indicated, the named persons have sole voting and investment power with respect to shares shown as owned by them.

(2) Based on 16,511,752 shares outstanding as of March 23, 2005, except as noted otherwise. Shares of Common Stock subject to currently exercisable options are deemed outstanding for purposes of computing the percentage of class for the person or group holding such options but are not deemed outstanding for purposes of computing the percentage of class for any other person or group.

(3) Includes 267,778 shares subject to options exercisable within 60 days and 634,026 shares held in a family limited partnership. Mr. Schnatter holds sole voting and investment power for all such shares.

(4) Represents shares subject to options exercisable within 60 days.

(5) Includes 77,000 shares subject to options exercisable within 60 days.

(6) Includes 78,796 shares subject to options exercisable within 60 days.

(7) Includes 82,500 shares subject to options exercisable within 60 days.

(8) Includes 12,250 shares subject to options exercisable within 60 days.

(9) Represents shares subject to options exercisable within 60 days.

(10) Includes 14,000 shares subject to options exercisable within 60 days.

(11) Includes 12,250 shares subject to options exercisable within 60 days.

(12) Includes 13,000 shares subject to options exercisable within 60 days. Ms. Kirtley also holds units deemed invested in 1,580 shares of Common Stock through a deferred compensation plan provided by the Company, which are not included in the shares reported.

(13) Includes 41,000 shares subject to options exercisable within 60 days. Mr. Laughery also holds units deemed invested in 282 shares of Common Stock through a deferred compensation plan provided by the Company, which are not included in the shares reported.

(14) Includes 554,161 shares subject to options exercisable within 60 days.

(15) Includes 9,917 shares subject to options exercisable within 60 days.

(16) Includes 1,331,801 shares subject to options exercisable within 60 days held by all directors and executive officers.

(17) As disclosed in a Schedule 13G filed with the SEC. Reflects beneficial ownership (based on sole or shared voting or dispositive power) of the reporting entity and its affiliates reported as of December 31, 2004. Percentage of class is shown as disclosed in the filing.

1. ELECTION OF DIRECTORS

The Companys Certificate of Incorporation provides for a classified board of directors, with three classes of directors each nearly as equal in number as possible. Each class serves for a three-year term and one class is elected each year. The Board of Directors is authorized to fix the number of directors within the range of three to fifteen members, and, effective at the 2005 Annual Meeting, the Board size has been set at ten members.

The Nominating and Corporate Governance Committee of the Board assists the Board in identifying qualified persons to serve as directors of the Company. The Committee evaluates all proposed director nominees, evaluates

3

incumbent directors before recommending renomination, and recommends all approved candidates to the Board for appointment or nomination to the Companys stockholders. The Committee selects as candidates for appointment or nomination individuals of high personal and professional integrity and ability, who can contribute to the Boards effectiveness in serving the interests of the Companys stockholders.

The Nominating and Corporate Governance Committee will consider candidates recommended by stockholders in accordance with the Companys Certificate of Incorporation, and will do so in the same manner as the Committee evaluates any other properly recommended nominee. See STOCKHOLDER PROPOSALS on page 21.

Nigel Travis, the Companys President and Chief Executive Officer, effective April 1, 2005, was appointed by the Board as a director on January 31, 2005, for a term to expire at the 2005 Annual Meeting. Mr. Traviss appointment to the Board coincided with his employment by the Company as Executive Vice President, pending his assuming the positions of President and Chief Executive Officer. The terms of Owsley Brown Frazier, Wade S. Oney and John H. Schnatter, who were elected as directors at the 2002 Annual Meeting, also expire at the 2005 Annual Meeting.

Upon the recommendation of the Nominating and Corporate Governance Committee, Messrs. Frazier, Oney, Schnatter and Travis have been nominated as directors in the class to serve a term expiring at the 2008 Annual Meeting. The remaining six directors will continue to serve in accordance with their previous election or appointment.

It is intended that shares represented by proxies received in response to this Proxy Statement will be voted for the nominees listed below, unless otherwise directed by a stockholder in his or her proxy. Although the Company does not anticipate that any of the nominees will decline or be unable to serve, if that should occur the proxy holders may, in their discretion, vote for a substitute nominee or nominees. Directors are elected by a plurality of the votes cast.

Set forth below is information concerning the nominees for election and each director whose term will continue after the 2005 Annual Meeting.

|

Name |

|

Age |

|

Company |

|

Director |

|

|

|

|

|

|

|

|

|

|

|

NOMINEES FOR ELECTION TO THE BOARD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Term Expiring in 2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owsley Brown Frazier |

|

69 |

|

Director |

|

2001 |

|

|

|

|

|

|

|

|

|

|

|

Wade S. Oney |

|

43 |

|

Director and Executive Business Advisor |

|

1999 |

|

|

|

|

|

|

|

|

|

|

|

John H. Schnatter |

|

43 |

|

Founder and Executive Chairman of the Board |

|

1990 |

|

|

|

|

|

|

|

|

|

|

|

Nigel Travis |

|

55 |

|

President, Chief Executive Officer and Director |

|

2005 |

|

|

DIRECTORS CONTINUING IN OFFICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Term Expiring in 2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip Guarascio |

|

63 |

|

Director |

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

Olivia F. Kirtley |

|

54 |

|

Director |

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

Jack A. Laughery |

|

70 |

|

Director |

|

1993 |

|

4

|

Term Expiring in 2007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. William Barnett |

|

58 |

|

Director |

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

Norborne P. Cole, Jr. |

|

63 |

|

Director |

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

William M. Street |

|

66 |

|

Director |

|

2003 |

|

Owsley Brown Frazier. Mr. Frazier retired in 2000 as Vice Chairman of Brown-Forman Corporation. He continues to serve as a director of Brown-Forman and a subsidiary, Lenox, Inc. Mr. Frazier is owner and chairman of Bittners, LLC, an interior and commercial design firm. He is actively involved in numerous business, civic, charitable and educational organizations.

Wade S. Oney. Wade Oney served as Chief Operating Officer of the Company from 1995 until 2000; he continues to serve the Company as a part-time executive business advisor responsible for providing advice to the executive leadership team on strategic Company initiatives. From 1992 to 1995, Mr. Oney served as the Companys Regional Vice President of Southeast Operations. From 1989 to 1992, Mr. Oney held various positions with Dominos Pizza, Inc. Mr. Oney has been a franchisee of the Company since 1993.

John H. Schnatter. John Schnatter created the Papa Johns concept and founded the Company in 1985. He served as Chairman of the Board and Chief Executive Officer from 1990 until April 1, 2005, and as President from 1985 to 1990 and from 2001 until April 1, 2005. Effective April 1, 2005, Mr. Schnatter became Executive Chairman of the Company, an executive officer position; he continues to chair the Board. Mr. Schnatter has been a Papa Johns franchisee since 1986.

Nigel Travis. Mr. Travis became President and Chief Executive Officer of the Company effective April 1, 2005. On January 31, 2005, he was engaged by the Company as Executive Vice President and was appointed by the Board as a director. From 2001 to 2004, Mr. Travis served as President and Chief Operating Officer of Blockbuster Inc., a global provider of in-home rental and retail movie and game entertainment. From 1994 to 2001, Mr. Travis held various leadership positions at Blockbuster, including Executive Vice President and President, Worldwide Stores Division (1999-2001). From 1985 to 1994, Mr. Travis served in various capacities for Grand Metropolitan PLC (London, England), including leadership positions at Burger King Corporation for five years. Mr. Travis is the lead director of The Bombay Company, Inc.

Philip Guarascio. Mr. Guarascio is a marketing and advertising business consultant and serves in a senior advisory capacity with the National Football League. He retired in 2000 as Vice President, Advertising and Corporate Marketing, of General Motors. Mr. Guarascio is a director of Arbitron, Inc.

Olivia F. Kirtley. Ms. Kirtley is a Certified Public Accountant and business consultant. She is a past Chairman of the American Institute of Certified Public Accountants (AICPA). From 1979 to 2000, Ms. Kirtley held several key management positions at Vermont American Corporation, a global manufacturer and marketer of power tool accessories, including Vice-President of Finance and Chief Financial Officer, Treasurer and Director of Tax. Ms. Kirtley serves on the boards of directors of Alderwoods Group, Inc., Lancer Corporation and ResCare, Inc.

Jack A. Laughery. Mr. Laughery is a restaurant investor and consultant, and has been a Papa Johns franchisee since 1992. From 1990 until his retirement in 1994, Mr. Laughery was Chairman of Hardees Food Systems, Inc. From 1962 to 1990, Mr. Laughery was employed by Hardees Food Systems, Inc., retiring as Chief Executive Officer in 1990. Mr. Laughery serves on the boards of directors of Mass Mutual Corporate Investors and Mass Mutual Participation Investors.

F. William Barnett. Mr. Barnett retired in 2003 as a director with management consulting firm McKinsey & Company, Inc., with a consulting practice focused on advising and assisting companies with strategic planning, resolving complex organizational issues and implementing operational improvements. Mr. Barnett has served as an adjunct faculty member at Yale University and serves as a director of Eagle Materials, Inc.

Norborne P. Cole, Jr. Mr. Cole is a consultant for Silver Eagle Distributors, L.P. of Houston, Texas, which distributes Anheuser-Busch and other products, and serves as vice-chairman of its board of directors. Mr. Cole retired in 1998 after a 32-year career with the Coca-Cola Company and its bottlers, most recently serving as Managing Director and

5

Chief Executive Officer of Coca-Cola Amatil in Sydney, Australia, and previously as President and Chief Executive Officer of Coca-Cola Bottling S.A. in Paris, France. Mr. Cole also serves on the board of directors of Lancer Corporation.

William M. Street. Mr. Street retired in 2003 as president of Brown-Forman Corporation, a diversified producer of high-quality consumer products, including wine and spirits and consumer durables, and as president and chief executive officer of Brown-Forman Beverages Worldwide. He remains a director of Brown-Forman Corporation. Mr. Street serves as chairman of the Kentucky Horse Racing Authority and on the boards of several business, civic, charitable and educational organizations.

John Schnatter and Charles Schnatter, an executive officer and former director of the Company, are brothers. There are no other family relationships among the Companys directors, executive officers and other key personnel.

Meetings of the Board of Directors

The Board met on seven occasions during 2004. Each director attended at least 75% of the meetings of the Board and the Board committees on which he or she served during the period of service in 2004. Five Board meetings currently are scheduled for 2005. Meetings of non-employee directors, without management directors or employees present, are typically scheduled in conjunction with each regularly scheduled Board meeting.

Director Independence

The Board of Directors has determined that the following six of the Companys ten directors are independent as defined by applicable law and NASDAQ listing standards: Ms. Kirtley and Messrs. Barnett, Cole, Frazier, Guarascio and Street. All of the members of the Boards Audit, Compensation and Nominating and Corporate Governance committees are similarly deemed independent.

Committees of the Board of Directors

In addition to an Executive Committee, which is currently comprised of Messrs. John Schnatter, Barnett, Frazier and Street and Ms. Kirtley, the Board of Directors has standing Audit, Compensation, and Nominating and Corporate Governance committees. The charters of the Audit, Compensation, and Nominating and Corporate Governance committees are available in the Investor Relations section of the Companys website (www.papajohns.com).

Audit Committee. The Audit Committee currently is comprised of Ms. Kirtley and Messrs. Barnett and Street. The principal functions of the Audit Committee are to assist the Board in overseeing the Companys accounting and financial reporting processes and audits of the Companys financial statements. The Board has determined that Ms. Kirtley qualifies as an audit committee financial expert as defined under applicable SEC rules. The Audit Committee met nine times in 2004. See AUDIT COMMITTEE REPORT on page 11.

Compensation Committee. The Compensation Committee currently is comprised of Messrs. Barnett, Cole and Guarascio. The principal functions of the Compensation Committee are to execute the Boards overall responsibilities related to compensation of directors and officers of the Company and to administer the Companys compensation plans. The Compensation Committee met eight times in 2004. See COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION on page 9.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently is comprised of Messrs. Cole, Frazier and Street. The principal functions of the Nominating and Corporate Governance Committee are to assist the Board in identifying qualified individuals for service as directors of the Company and as Board committee members, to develop and monitor a process for evaluating Board effectiveness, and to oversee the development and administration of the Companys corporate governance guidelines, including its Code of Ethics and Business Conduct. See CODE OF ETHICS on page 21. The Nominating and Corporate Governance Committee recommended the nominations of Messrs. Frazier, Oney, Schnatter and Travis for election to the Board at the 2005 Annual Meeting. The Nominating and Corporate Governance Committee met once in 2004.

6

Compensation of Directors

In 2003, the Board adopted a compensation program for non-employee directors (the Director Compensation Program) that provides for cash compensation in the form of an annual retainer and fees based on attendance at Board and committee meetings. Under the terms of the Director Compensation Program, non-employee directors receive an annual retainer of $25,000 ($30,000 for Board committee chairs), a fee of $1,500 for each Board meeting attended in person and $750 for participation in a telephonic meeting. Non-employee Board committee members also receive $1,000 for participating in each committee meeting and $500 for participating in each telephonic committee meeting ($1,000 for quarterly telephonic Audit Committee meetings in connection with the Companys earnings releases). Similar fees may be paid from time to time for Board service involving extraordinary time commitments, such as on an ad hoc committee. All retainer payments are prorated for any non-employee director who is elected or appointed on a date other than an Annual Meeting date.

The Director Compensation Program also includes an equity-based component. Under the terms of the Companys 2003 Stock Option Plan for Non-Employee Directors (the Director Plan), each non-employee director receives an annual award of an option to purchase 7,000 shares of Common Stock. All option grants under the Director Plan become exercisable one year following the grant date and have a term of 30 months. Grants are prorated for any non-employee director who is elected or appointed on a date other than an Annual Meeting date.

The following table lists the cash and equity compensation paid by the Company to each of its non-employee directors for services in 2004:

|

Name

of |

|

Annual |

|

Board |

|

Committee |

|

Committee |

|

Equity Grant |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

F. William Barnett |

|

$ |

25,000 |

|

$ |

9,000 |

|

$ |

5,000 |

|

$ |

16,000 |

|

7,000 |

|

|

Norborne P. Cole |

|

25,000 |

|

8,250 |

|

|

|

8,000 |

|

7,000 |

|

||||

|

Owsley Brown Frazier |

|

25,000 |

|

9,000 |

|

5,000 |

|

2,000 |

|

7,000 |

|

||||

|

Philip Guarascio |

|

25,000 |

|

7,500 |

|

|

|

5,000 |

|

7,000 |

|

||||

|

Olivia F. Kirtley |

|

25,000 |

|

9,000 |

|

5,000 |

|

10,000 |

|

7,000 |

|

||||

|

Jack Laughery |

|

25,000 |

|

9,000 |

|

|

|

2,500 |

|

7,000 |

|

||||

|

William M. Street |

|

25,000 |

|

9,000 |

|

|

|

8,000 |

|

7,000 |

|

||||

(1) All of the stock options were granted under the Director Plan on May 13, 2004, at an exercise price of $29.93, the fair market value of the Common Stock on that date; the options vest after one year and have a term of 30 months.

Non-employee directors also receive reimbursement of reasonable out-of-pocket expenses incurred in connection with their Board and committee service. Directors who are employees of the Company do not receive additional compensation for services rendered as a director.

The Company makes available to non-employee directors a deferred compensation plan, administered by the Boards Compensation Committee through an independent plan provider, that permits participants to defer all or part of their cash compensation. The Company contributes amounts deferred by participants to a trust (known as a rabbi trust), of which the Company is the owner, and in which funds are deemed invested in mutual funds available through variable universal life insurance products. Participants may also elect to have all or part of their deferred compensation deemed invested in the Companys Common Stock. Each participants plan account is credited or debited, as the case may be, with the net investment return or loss on the deemed investments. Payments from the participants accounts are made upon termination of service as a director, or earlier in accordance with certain in-service elections available under the plan. Payments are made to participants in a lump sum, unless the participant has elected to receive installment payments as provided in the plan.

In December 2004, the Company adopted stock ownership guidelines applicable to directors and officers of the Company, establishing certain minimum ownership levels to be achieved over five years. Under the guidelines, the

7

Companys non-employee directors are required to acquire shares of Common Stock, or their equivalent under the deferred compensation plan, equal in value to a multiple of five times the amount of their annual retainer.

Effective March 21, 2005, the Board adopted, subject to stockholder approval, an amendment to the Director Plan. The amendment (a) increases the maximum term of stock options awarded to non-employee directors from 30 months to five years, (b) increases the vesting period for stock options from one year to two years, and (c) eliminates the prescribed level of annual stock option awards under the Director Plan and gives the Board the authority to establish and change the award levels from time to time. The amendment does not increase the number of shares of Common Stock reserved for issuance under the Director Plan. The Board has recommended that the Companys stockholders approve the amendment. See PROPOSAL TO APPROVE AMENDMENT OF THE COMPANYS 2003 STOCK OPTION PLAN FOR NON-EMPLOYEE DIRECTORS on page 18.

EXECUTIVE COMPENSATION

The following table sets forth information concerning the annual and long-term compensation paid, earned or accrued by the Companys Chief Executive Officer and its next four most highly compensated executive officers for services rendered in all capacities to the Company for the years indicated.

SUMMARY COMPENSATION TABLE

|

|

|

|

|

|

|

Annual Compensation |

|

Long-Term |

|

|

|

|||||

|

Name

and Principal |

|

Year |

|

Salary($ ) |

|

Bonus($ ) |

|

Other Annual |

|

Securities |

|

All Other |

|

|||

|

John H. Schnatter |

|

2004 |

|

$ |

575,200 |

|

$ |

0 |

|

|

|

0 |

|

$ |

0 |

|

|

Founder, Chairman, |

|

2003 |

|

649,785 |

|

0 |

|

|

|

0 |

|

0 |

|

|||

|

Chief Executive Officer |

|

2002 |

|

750,923 |

|

293,649 |

|

|

|

0 |

|

0 |

|

|||

|

and President(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

William M. Van Epps |

|

2004 |

|

418,887 |

|

152,755 |

|

|

|

0 |

|

0 |

|

|||

|

Senior Vice President |

|

2003 |

|

330,500 |

|

166,890 |

|

|

|

10,000 |

|

2,875 |

|

|||

|

and Chief Operations |

|

2002 |

|

325,000 |

|

61,616 |

|

|

|

2,871 |

|

0 |

|

|||

|

Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Charles W. Schnatter |

|

2004 |

|

376,521 |

|

56,714 |

|

|

|

0 |

|

0 |

|

|||

|

Senior Vice President, |

|

2003 |

|

366,092 |

|

0 |

|

|

|

25,000 |

|

3,000 |

|

|||

|

Chief Development |

|

2002 |

|

355,385 |

|

115,914 |

|

|

|

0 |

|

2,750 |

|

|||

|

Officer and Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Julie Larner |

|

2004 |

|

367,816 |

|

41,010 |

|

|

|

0 |

|

35,006 |

|

|||

|

Senior Vice President, |

|

2003 |

|

335,585 |

|

0 |

|

|

|

25,000 |

|

2,911 |

|

|||

|

and President, PJ Food |

|

2002 |

|

321,538 |

|

136,583 |

|

|

|

0 |

|

2,750 |

|

|||

|

Service, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

J. David Flanery |

|

2004 |

|

308,071 |

|

5,174 |

|

|

|

0 |

|

0 |

|

|||

|

Senior Vice President, |

|

2003 |

|

279,654 |

|

0 |

|

|

|

20,000 |

|

1,400 |

|

|||

|

Chief Financial Officer |

|

2002 |

|

257,500 |

|

85,018 |

|

|

|

0 |

|

1,660 |

|

|||

|

and Treasurer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(1) Other annual compensation paid to each named executive officer, including perquisites and other personal benefits, did not exceed reporting thresholds.

8

(2) The amounts in this column represent the amount of the Companys matching contribution to the officers account in the Companys 401(k) defined contribution plan and, for Ms. Larner in 2004, the amount of a payment for accrued but unused vacation through PJ Food Service, Inc., that could not be carried forward in connection with the Companys adoption of a new paid leave policy for all employees.

(3) Effective April 1, 2005, Mr. Schnatter became Executive Chairman of the Company, an executive officer position; he continues to chair the Board.

AGGREGATED OPTION EXERCISES

IN LAST

FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

Set forth below is information with respect to option exercises by the named executive officers in the 2004 fiscal year and unexercised stock options held by the named executive officers at the end of the Companys 2004 fiscal year. There were no stock appreciation rights (SARs) outstanding at 2004 fiscal year-end.

|

|

|

Number of Securities |

|

|||||||||||||

|

|

|

Shares |

|

Value |

|

Underlying Unexercised |

|

Value of Unexercised |

|

|||||||

|

Name |

|

On Exercise |

|

($)(1) |

|

Exercisable |

|

Unexercisable |

|

Exercisable |

|

Unexercisable |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

John H. Schnatter |

|

45,000 |

|

$ |

955,108 |

|

267,778 |

|

0 |

|

$ |

2,018,798 |

|

|

|

|

|

William M. Van Epps |

|

0 |

|

|

|

20,149 |

|

7,722 |

|

128,344 |

|

$ |

57,282 |

|

||

|

Charles W. Schnatter |

|

85,502 |

|

998,216 |

|

108,000 |

|

0 |

|

599,151 |

|

|

|

|||

|

Julie Larner |

|

1,125 |

|

26,501 |

|

79,971 |

|

0 |

|

586,241 |

|

|

|

|||

|

J. David Flanery |

|

25,000 |

|

208,306 |

|

82,500 |

|

0 |

|

568,417 |

|

|

|

|||

(1) The Value Realized represents the difference between the fair market value on the date of exercise and the total option exercise price.

(2) Based on the difference between the option exercise price and the last reported sale price of the Common Stock ($33.96) as reported on The Nasdaq Stock Market on December 23, 2004, the last trading day of the Companys 2004 fiscal year.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is responsible for determining the compensation of the Companys Chief Executive Officer, reviewing and approving the compensation of the Companys executive officers and administering the Companys incentive compensation and stock option plans. The Committee held eight meetings in 2004.

Discussed below are the principles and components of executive compensation for 2004, including the compensation of the Companys Chief Executive Officer. The discussion is followed by a general description of certain changes in the Companys executive incentive compensation guidelines, particularly with respect to long-term compensation, beginning in 2005.

2004 Executive Compensation. The Committee historically has been guided by the following principles in compensating executive officers:

Base compensation awarded by the Company should be effective in attracting, motivating and retaining key executives.

Incentive compensation should be awarded based on the achievement of identified goals for the Company, as well as on individual scope of responsibilities and performance.

9

Executive officers should have an equity interest in the Company to encourage them to manage the Company for the long-term benefit of stockholders.

For 2004, the Committee reviewed salary levels of the Companys executive officers and made adjustments the Committee deemed appropriate or necessary in light of market pricing information and consideration of each officers scope of responsibilities and individual performance, as well as the importance of the position to the implementation of the Companys strategies. The Company previously established a general target for base compensation of officers, including executive officers, at the 50th percentile based on a market review of similar positions in other companies of comparable size based on revenues. The Committee also considered the recommendations of the Chief Executive Officer with respect to the salary levels of other executive officers.

The Companys Management Incentive Plan (the Short-Term Plan), approved by the Committee, is designed to reward executive and other officers and certain management personnel for the achievement of certain corporate goals established by the Committee from time to time. The Company previously established a general target for cash incentive compensation of officers, including executive officers, at the 50th percentile based on a market review of similar positions in other companies of comparable size based on revenues.

For 2004, the Committee established target funding levels for the Short-Term Plan based upon the Companys operating income. For 2004, the Short-Term Plan contemplated aggregate quarterly incentive pools, each calculated based upon the Companys operating income exceeding each quarterly target, with a portion of each quarterly pool set aside to fund awards based on achievement of an annual target. A prescribed formula was used to allocate the Short-Term Plan pools among participants, including executive officers, based primarily upon the relative strategic importance of the participants position in the Company, with adjustments to reflect individual performance. Because the Company did not meet most of the established quarterly or annual operating income thresholds during 2004, payments under the Short-Term Plan for 2004 performance were minimal.

During 2004, certain officers and employees within the Companys restaurant operations, development, international and commissary areas, including four executive officers, received bonuses based on the attainment of operational goals during the year. The operational goals include targeted sales and profits at the restaurant or commissary level, or on a Company-wide basis, depending upon the employees position, or the development or opening of a targeted number of Company-owned or franchised restaurants.

During 2004, each executive officer of the Company held stock options granted under the Companys stock option plans. No stock options were granted during fiscal 2004.

The Committee determined the compensation of John H. Schnatter as Founder, Chairman of the Board, Chief Executive Officer and President of the Company, for services rendered in 2004. The Committee previously had reviewed market survey data for chief executive officer compensation at restaurant and other companies of comparable size based on revenues and evaluated Mr. Schnatters base compensation based upon the market pricing information and in light of the compensation policies and components described above and Mr. Schnatters scope of responsibilities. The survey data indicated that Mr. Schnatters base compensation was lower than the Companys general percentile target. However, at Mr. Schnatters request, his base compensation for 2004 remained at $575,200, the same salary set during 2003.

Mr. Schnatter elected not to accept a payment under the Short-Term Plan for 2004 performance to which he otherwise would have been entitled.

Mr. Schnatter received no stock options or other equity-based compensation from the Company in 2004.

2005 Executive Compensation. In December 2004, the Committee adopted a new statement of compensation philosophy and principles, similar to the statement applicable to 2004 and described above. The Committee approved, and the Company has begun implementing in 2005, a new executive incentive compensation program, which includes an emphasis on long-term incentive compensation, consisting of cash awards and stock-based incentives, to encourage executives to focus on the long-term success and enhanced wealth of the Company and its shareholders. The new program has the following components:

10

the Short-Term Plan, which rewards participants with cash bonuses based upon the achievement of certain cumulative quarterly and annual incentive measures approved by the Committee, including corporate, business unit or department, and individual performance, with the mix of measures and target award levels varied depending upon position;

annual awards of stock options under the Companys 1999 Team Member Stock Ownership Plan (the Ownership Plan), including supplemental, matching option grants based upon shares of the Companys stock owned by the participant and designated under the incentive program, with all options to vest after two years and have a term of five years, and including a requirement that the proceeds of the exercise of new option grants, net of the option price and applicable taxes, be held in Company stock for at least one year;

annual awards of performance shares under the Ownership Plan, with performance measured based on the Companys total shareholder return over a three-year period relative to a peer group of companies, with awards paid in cash at the end of each performance measurement period; and

requirements of minimum ownership of Company stock by executive officers (and directors), to be implemented over five years.

OBRA Deductibility Limitation. The Omnibus Budget Reconciliation Act of 1993 (OBRA) limits the deduction by public companies of compensation of certain executive officers to $1 million per year, per executive officer, unless certain criteria are met. It is the Companys policy to comply whenever appropriate and possible with the requirements of OBRA applicable to the qualification of any such compensation for deductibility, and the Committee continues to review issues relating to this compensation deduction limitation.

|

|

COMPENSATION COMMITTEE |

|

|

|

|

|

F. William Barnett, Chairman |

|

|

Norborne P. Cole, Jr. |

|

|

Philip Guarascio |

AUDIT COMMITTEE REPORT

The charter of the Audit Committee of the Board specifies that the purpose of the Committee is to assist the Board in fulfilling its oversight responsibilities for the accounting, financial reporting and internal control functions of the Company and its subsidiaries, including the appointment, compensation and retention of the independent auditor, and to oversee the performance of the internal auditing function. A copy of the Audit Committees charter is available in the Investor Relations section of the Companys website (www.papajohns.com).

Each member of the Committee is independent as determined by the Companys Board of Directors, based on applicable law and regulation and NASDAQ listing standards. In addition, the Board has determined that Olivia F. Kirtley is an audit committee financial expert as defined by SEC rules.

In fulfilling its oversight responsibilities with respect to the Companys financial statements, the Committee reviews and discusses with both management and the Companys independent auditors all annual and quarterly financial statements (including any required management certifications), and the Companys quarterly earnings announcements, prior to issuance. Management has the primary responsibility for preparing the financial statements and complying with the reporting process, including the systems of internal controls. The independent auditors are responsible for expressing an opinion on the conformity of audited financial statements with accounting principles generally accepted in the United States and for providing their judgments as to the quality, not just the acceptability, of the Companys accounting principles.

During 2004, Company management advised the Committee that each set of financial statements reviewed had been prepared in accordance with generally accepted accounting principles, and reviewed significant accounting and disclosure issues with the Committee. These reviews included discussion with the independent auditors of matters

11

required to be discussed with the Committee by Statement on Auditing Standards (SAS) No. 61 (Communication with Audit Committees). The Committee also discussed with the independent auditors matters relating to their independence from management and the Company, including the written disclosures from the independent auditors required by Independence Standards Board (ISB) Standard No. 1 (Independence Discussions with Audit Committees). The Committee pre-approved all audit and non-audit fees paid to the independent auditors.

The Committee held nine meetings during fiscal year 2004. The Committee discussed with the Companys independent auditors and the Companys internal audit staff the overall scope and plans for their audits. The Committee meets with both the independent auditors and the Companys internal audit staff to discuss the results of their examinations and their evaluations of the Companys internal controls. The Committee also meets in separate executive sessions periodically with the Companys independent auditors, internal auditors, Chief Financial Officer and General Counsel. The Committee has adopted policies requiring the Committees consideration and approval of transactions involving related parties of the Company.

In reliance upon the reviews and discussions referred to above, the Committee recommended to the Board that the Board approve the inclusion of the Companys audited consolidated financial statements in the Annual Report on Form 10-K for the year ended December 26, 2004, for filing with the Securities and Exchange Commission. The Committee also has reappointed Ernst & Young LLP as the Companys independent auditors for the fiscal year ending December 25, 2005.

|

|

AUDIT COMMITTEE |

|

|

|

|

|

Olivia F. Kirtley, Chairman |

|

|

F. William Barnett |

|

|

William M. Street |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During fiscal 2004 none of the executive officers or directors of the Company was a member of the board of directors of any other company such that the relationship would be construed to constitute a committee interlock within the meaning of the rules of the SEC. Jack Laughery, a director and franchisee of the Company, was a member of the Boards Compensation Committee until May 2004.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

This section describes transactions by the Company during the last fiscal year that involved directors and executive officers of the Company and their affiliates.

Franchise and Development Arrangements

Executive officers and directors of the Company hold equity interests in entities that are franchisees of the Company, as described in the table below. Some of these individuals acquired their interests before the Companys 1993 initial public offering, and some of the entities in which they hold interests acquired development rights at reduced development fees and also pay a reduced franchise fee when each restaurant is opened. The Company has since entered into additional franchise and development agreements with non-employee directors and executive officers of the Company and entities in which they have an equity interest, and may continue to do so in the future. Under the Companys policy governing transactions with related-party franchisees, which is described below, any such franchise arrangements into which the Company enters in the future will be on terms no more favorable to directors and officers than with independent third parties.

The following table describes franchise and development arrangements during 2004 between the Company and entities in which the Companys executive officers and directors, as well as their immediate family members, had an equity interest as of the end of the fiscal year, and the amount of royalties earned by or paid to the Company from such entities during 2004. None of the entities paid any franchise or development fees in 2004. Such entities also purchase various

12

food and other products from the Companys commissary system and may purchase from or through the Company certain goods and services, including insurance, needed to operate a Papa Johns restaurant. All such purchases and sales are made on terms and at rates identical to those that may be obtained from the Company by an independent franchisee.

|

Name and Percentage Owned |

|

Franchise Entity Amounts Earned |

|

|

|

|

|

John H. Schnatter

(76.0%) |

|

Joe K Corporation Operates one restaurant in Louisville, Kentucky. Paid royalties of $42,108 in 2004. Annette Schnatter is Mr. Schnatters wife. |

|

|

|

|

|

John H. Schnatter (8.3%) |

|

Sherfiz, Inc. Operates one restaurant in Ohio. Paid royalties of $39,216 in 2004. |

|

|

|

|

|

John H. Schnatter (8.0%) |

|

Sherfiz II, Inc. Operates one restaurant in Ohio and one in West Virginia. Paid royalties of $58,971 in 2004. |

|

|

|

|

|

John H. Schnatter (8.0%) |

|

P.J. Cambridge, Inc. Operates one restaurant in Ohio and two in West Virginia. Paid royalties of $85,184 in 2004. |

|

|

|

|

|

Charles W. Schnatter

(31.3%) |

|

Capital Pizza, Inc. Operates ten restaurants in Illinois and Indiana. Paid royalties of $291,684 in 2004. Messrs. Schnatter, Emmett and OHern are executive officers of the Company. |

|

|

|

|

|

Charles W. Schnatter

(31.3%) |

|

Indiana Capital Pizza Company Operates five restaurants in Indiana. Paid royalties of $140,002 in 2004. |

|

|

|

|

|

Wade S. and Elizabeth Oney (100%) |

|

Bam-Bam Pizza, Inc. Operates 21 restaurants in Florida. Paid royalties of $835,238 in 2004. Elizabeth Oney is Mr. Oneys wife. |

|

|

|

|

|

Wade S. Oney (100%) |

|

L-N-W Pizza, Inc. Operates 12 restaurants in Florida. Paid royalties of $525,536 in 2004. |

|

|

|

|

|

Wade S. Oney (50.0%) |

|

Browns Pizza, Inc. Operates two restaurants in Florida. Paid royalties of $77,828 in 2004. |

|

|

|

|

|

Wade S. Oney (90.0%) |

|

Eagle Eye Pizza, Inc. Operates three restaurants in Oregon. Paid royalties of $84,690 in 2004. |

|

|

|

|

|

Jack A. Laughery (12.0%) |

|

PJ United, Inc. and subsidiaries Operate 127 restaurants in Alabama, California, Louisiana, Ohio, Texas, Utah and Virginia. Paid royalties of $3,851,382 in 2004. |

|

|

|

|

|

Jack A. Laughery (21.2%) |

|

PJIOWA, L.C. Operates 21 restaurants in Iowa and two restaurants in Illinois. Paid royalties of $671,481 in 2004. |

|

|

|

|

|

Jack A. Laughery

(18.7%) |

|

Houston Pizza Venture, LP Operates 56 restaurants in Texas. Paid royalties of $1,509,444 in 2004. Helen Laughery is Mr. Laugherys wife, and the other persons named are his daughters. |

13

In December 2004, the Audit Committee and the Board approved policies and procedures for consideration of restaurant development, acquisition and disposition transactions involving franchisees in which directors or executive officers of the Company, or their immediate families, have significant ownership, generally defined as ten percent or more. Under the policy, the Audit Committee ultimately must consider and determine whether to approve or disapprove any subject transaction involving a related party. Acquisitions and dispositions of restaurants involving the Company and related parties must be evaluated in light of an appraisal by a reputable, disinterested third party. With respect to proposed new development by related parties, if the Company declines to exercise its right of first refusal, the policy requires that the opportunity be made available to qualified franchisees without related-party ownership. Similarly, with respect to a proposed acquisition of a restaurant by a related party from another franchisee, if the Company declines to exercise its right of first refusal, the Company must consider making recommendations concerning possible alternative, nonrelated-party franchisee parties. Finally, the policy requires that any proposed disposition of a restaurant by a related party to another franchisee must be disclosed to the Audit Committee, and must be approved by the Audit Committee if the proposed transaction includes any consideration by or from the Company outside the ordinary course of business with other franchisees.

Employment Arrangements with Directors and Executive Officers

Nigel Travis. On January 30, 2005, the Company entered into an employment agreement with Nigel Travis, effective January 31, 2005. Under the agreement, effective April 1, 2005, Mr. Travis became President and Chief Executive Officer of the Company; until April 1 Mr. Travis worked on a part-time basis and held the title of Executive Vice President. He was also appointed by the Board of Directors of the Company as a director.

The agreement provides for the employment of Mr. Travis for a term of five years, unless the agreement is terminated earlier in accordance with its terms. The agreement provides for a base annual salary of $730,000 for Mr. Travis as President and Chief Executive Officer and a base annual salary of $146,000 during Mr. Traviss part-time service as Executive Vice President. The agreement provides for a grant on January 31, 2005, of an option to purchase 200,000 shares of the Companys common stock under the Companys 1999 Team Member Stock Ownership Plan (the Ownership Plan). In addition, pursuant to the Companys new executive officer incentive compensation guidelines, during each year of the agreement (prorated for 2005) Mr. Travis will (a) be eligible to receive an annual bonus targeted at 100% of base salary, with a maximum payout equal to 190% of base salary, currently based upon the Companys achievement of certain target levels of operating income, comparable store sales growth and restaurant-level transactions; (b) receive an option to purchase 85,000 shares of Common Stock under the Ownership Plan; (c) receive an award of 10,000 performance shares under the Ownership Plan, payable in cash, measured over a three-year performance period based on total return to the Companys stockholders compared to a peer group of companies; and (d) receive an additional grant of an option to purchase up to 20,000 shares of Common Stock, representing two times the number of shares of Common Stock Mr. Travis purchases on the open market or owns and designates under the compensation guidelines. The agreement provides Mr. Travis with the one-time right, in lieu of receiving the matching stock option grant in 2006 and 2007, to receive an option in 2005 to purchase up to 60,000 shares of Common Stock, representing two times the number of shares of Common Stock Mr. Travis purchases on the open market or owns and designates under the compensation guidelines in 2005. All stock options granted to Mr. Travis as described above have been or will be granted at fair market value (defined in the Ownership Plan as the closing price of the Common Stock on the grant date), vest after two years and have a term of five years. The agreement also permits Mr. Travis to participate in the Companys deferred compensation plan, 401(k) plan, and medical, dental, life and disability insurance programs, as well as to receive other standard benefits offered by the Company to its employees from time to time. The agreement further provides that the Company will make a lump-sum payment to Mr. Travis in the amount of $175,000, plus a 39% gross-up payment for income taxes, to cover Mr. Traviss expenses to be incurred in relocating his family to the Louisville, Kentucky area. The agreement provides for the parties to begin discussion of a possible renewal of the agreement during the fifth year of the agreements term.

Mr. Travis will receive severance benefits under the employment agreement if the Company terminates his employment for any reason other than for cause, as defined in the agreement, or if Mr. Travis terminates his employment for good reason, as defined in the agreement. In either instance Mr. Travis would be entitled to receive, if termination occurs within the first three years of employment, two years base salary over 24 months, or one years base salary over 12 months if termination occurs after three years of employment. During the severance period Mr. Travis would be retained as a consultant.

14

To facilitate his participation in the new executive incentive compensation program, Mr. Travis purchased from the Company 27,434 shares of Common Stock on March 15, 2005, for approximately $1,000,000 ($36.45 per share). The shares were priced at the closing price of the Common Stock on March 14, 2005, the day immediately preceding the date of the sale.

William M. Van Epps. On March 9, 2005, the Company entered into an employment agreement with William M. Van Epps. Under the agreement, Mr. Van Epps will continue to hold the position of Chief Operations Officer, a position he has held since January 2004, through August 31, 2006.

The agreement provides for the employment of Mr. Van Epps for a term beginning March 9, 2005 and ending August 31, 2006, unless the agreement is terminated earlier in accordance with its terms. The agreement provides for a base annual salary of $500,000 for service as Chief Operations Officer, and during each year of the term Mr. Van Epps will be eligible to receive bonus payments in accordance with the then-existing applicable bonus plan as approved by the Compensation Committee of the Board. In addition, pursuant to the Companys new executive officer incentive compensation guidelines, during each year of the agreement Mr. Van Epps will (a) receive an option to purchase 10,000 shares of Common Stock under the Ownership Plan; (b) receive an award of 2,000 performance shares under the Ownership Plan, payable in cash, measured over a three-year performance period based on total return to the Companys stockholders compared to a peer group of companies, with awards settled in cash; and (d) receive an annual stock option grant under the Ownership Plan of up to two times the number of shares of the Companys common stock purchased by Mr. Van Epps on the open market or owned by Mr. Van Epps and designated under the incentive program (such option not to exceed 12,000 shares per annum). The agreement also permits Mr. Van Epps to participate in the Companys deferred compensation plan, 401(k) plan, and medical, dental, life and disability insurance programs, as well as to receive other standard benefits offered by the Company to its employees from time to time.

Mr. Van Epps will receive severance benefits under the employment agreement if the Company terminates his employment for any reason other than for cause, as defined in the agreement. In that instance Mr. Van Epps would be entitled to receive an amount equal to the greater of the base salary that would be paid to him under the terms of the agreement or $500,000.

Wade Oney. Mr. Oney served as Chief Operating Officer of the Company from 1995 to 2000. He remains a director and franchisee of the Company, and is employed by the Company as a part-time executive business advisor responsible for providing advice to the executive leadership team on strategic Company initiatives. Mr. Oney received an annualized salary of $37,500 for his services in 2004, the same salary applicable in 2005.

Other Transactions

During 2004, the Company paid $309,000 to Hampton Airways, Inc. (Hampton), for charter aircraft services. Hamptons sole shareholder is John Schnatter. The Company periodically reviews pricing data from other, independent air charter services and, on that basis, believes that the discounted rates charged by Hampton to the Company are at or below rates that the Company could obtain from the independent third parties for similar aircraft.

The Company and entities controlled by Mr. Schnatter have agreed to share the services of certain employees of the Company. The cost of compensation and benefits of those employees is paid by the Company and Mr. Schnatter based on an allocation, updated annually, of each employees respective responsibilities performed for the Company and the entities controlled by Mr. Schnatter. In addition, Mr. Schnatter pays the Company rent for office space used by the shared employees, based on the same allocation of responsibilities. In 2004, Mr. Schnatter was charged $473,000 for his allocated cost of the shared employees compensation and benefits and $11,410 in rent for the allocated office space.

During 2004, the Company waived royalty payments totaling $290,000 from a franchisee, PJ United, Inc., with respect to restaurants located in one market area. In consideration for the royalty waiver, the franchisee agreed to increase its level of local marketing expenditures in that market area in amounts equal to the waived royalties. Separately, in 2004 PJ United sold 13 restaurants in the same market area to another franchisee, and Capital Delivery, Ltd., a wholly owned subsidiary of the Company, provided financing to the other franchisee related to the transaction on terms, including interest rate and collateral security, reached after arms-length negotiation. Jack Laughery, a director of the Company, holds a 12.0% ownership interest in PJ United.

15

In 1999, the Papa Johns Franchise Advisory Council, an advisory group comprised of certain Papa Johns franchisees that meets periodically to discuss issues of importance to the Company and its franchisees, initiated a program that allows the cost of cheese to Papa Johns restaurants to be established on a quarterly basis. Certain franchisees of the Company formed a corporation, BIBP Commodities, Inc. (BIBP), that purchases cheese at the prevailing market price and sells it to the Companys distribution subsidiary, PJ Food Service, Inc. (PJFS), at a fixed quarterly price based in part upon historical average market prices. PJFS in turn sells cheese to Papa Johns restaurants at a set quarterly price. The purchase of cheese by PJFS from BIBP is not guaranteed. Capital Delivery, Ltd., has made available a $17.6 million line of credit to BIBP to fund cash deficits as they may arise; as of March 1, 2005, a balance of $10,000,000 under the line was outstanding. The shareholders of BIBP include Wade Oney (9.09%) and PJ United, Inc. (18.18%), a franchisee entity owned in part by Jack Laughery. BIBP has paid its shareholders a total annual dividend equal to eight percent of each shareholders initial investment; payment of future dividends is at the discretion of BIBPs board of directors and will depend upon the financial condition of BIBP and general business conditions.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the Exchange Act) requires the Companys directors and executive officers, and persons who own more than ten percent of the Companys Common Stock, to file stock ownership reports and reports of changes in ownership with the Securities and Exchange Commission. Based on a review of these reports and written representations from the reporting persons, the Company believes that all applicable Section 16(a) reporting requirements were complied with for all Common Stock transactions in 2004, except as follows: Wade Oney reported late on Form 4 an acquisition of shares through a stock option exercise.

16

STOCK PERFORMANCE GRAPH

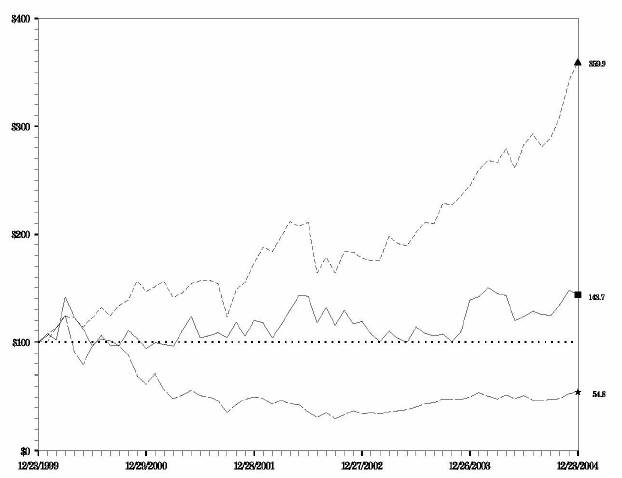

The following performance graph compares the cumulative total return of the Companys Common Stock to the NASDAQ Stock Market (U.S.) Index and a group of the Companys peers consisting of U.S. companies listed on NASDAQ with standard industry classification (SIC) codes 5800-5899 (Eating and drinking places). Relative performance is compared for the five-year period extending through the end of fiscal 2004. The graph assumes that the value of the investments in the Companys Common Stock and in each index was $100 at the end of fiscal 1999, and, with respect to the index and peer group, that all dividends were reinvested.

Legend

|

Symbol |

|

CRSP Total Returns Index for: |

|

12/1999 |

|

12/2000 |

|

12/2001 |

|

12/2002 |

|

12/2003 |

|

12/2004 |

|

|

|

|

Papa Johns International, Inc. |

|

100.0 |

|

94.2 |

|

119.8 |

|

119.1 |

|

139.0 |

|

143.7 |

|

|

|

|

Nasdaq Stock Market (US Companies) |

|

100.0 |

|

61.8 |

|

50.0 |

|

34.2 |

|

50.0 |

|

54.8 |

|

|

|

|

NASDAQ Stocks (SIC 5800 5899 US Companies) Eating and drinking places |

|

100.0 |

|

146.7 |

|

173.5 |

|

177.9 |

|

245.0 |

|

359.9 |

|

Notes:

A. The lines represent monthly Index levels derived from compounded daily returns that include all dividends.

B. The indexes are reweighted daily, using the market capitalization on the previous trading day.

C. If the monthly interval, based on the fiscal year end, is not a trading day, the preceding trading day is used.

D. The index level for all series was set to $100.0 on 12/23/1999.

17

2. PROPOSAL TO APPROVE AMENDMENT OF THE COMPANYS

2003 STOCK OPTION PLAN FOR NON-EMPLOYEE DIRECTORS

The Board of Directors has adopted, and recommends that stockholders approve, an amendment to the Companys 2003 Stock Option Plan for Non-Employee Directors (the Director Plan). The amendment (a) increases the maximum term of stock options awarded to non-employee directors from 30 months to five years, (b) increases the vesting period for stock options from one year to two years, and (c) eliminates the prescribed level of annual stock option awards under the Director Plan and gives the Board of Directors, or a committee designated by the Board that consists solely of independent directors, the authority to establish and change the award levels from time to time. The amendment does not increase the number of shares of Common Stock reserved for issuance under the Director Plan.

Description of the Director Plan

In August 2003, the Board adopted a compensation program for non-employee directors that consists of a combination of retainer and meeting fees as well as annual awards of stock options. See Compensation of Directors on page 7. As part of the compensation program, the Board adopted the Director Plan, which was approved by the Companys stockholders at the 2004 Annual Meeting.

The purpose of the Director Plan is to promote the interests of the Company and its stockholders by encouraging non-employee directors to acquire an ownership interest in the Company. The Company believes that such investments should increase the personal interest and special effort of those persons in working for the continued success and progress of the Company, and that the incentives provided by the Director Plan should enhance the Companys efforts to attract and retain highly qualified non-employee directors.