DEF 14A: Definitive proxy statements

Published on March 28, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant ☒ |

|

|

|

|

|

Filed by a Party other than the Registrant ☐ |

|

|

|

|

|

Check the appropriate box: |

|

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under §240.14a‑12 |

|

Papa John’s International, Inc. |

||

|

(Name of Registrant as Specified In Its Charter) |

||

|

|

||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||

|

|

||

|

Payment of Filing Fee (Check the appropriate box): |

||

|

☒ |

No fee required. |

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

|

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

Notice of Annual Meeting of Stockholders |

|

Wednesday, May 2, 2018 |

Papa John’s International, Inc. |

Items of Business

|

· |

Election of the six directors nominated by the Board of Directors named in the attached Proxy Statement; |

|

· |

Ratification of the selection of KPMG LLP as the Company’s independent auditors for 2018; |

|

· |

Approve the Papa John’s International, Inc. 2018 Omnibus Incentive Plan; |

|

· |

Advisory approval of the Company’s executive compensation; and |

|

· |

Such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Record Date March 12, 2018

A Proxy Statement describing matters to be considered at the Annual Meeting is attached to this Notice. Only stockholders of record at the close of business on March 12, 2018 are entitled to receive notice of and to vote at the meeting or any adjournment or postponement thereof.

Stockholders are cordially invited to attend the meeting. Following the formal items of business to be brought before the meeting, we will discuss our 2017 results and answer your questions. Please join us after the meeting for a slice of Papa John’s pizza!

Thank you for your continued support of Papa John’s. We look forward to seeing you on May 2.

By Order of the Board of Directors,

|

John H. Schnatter |

|

||||||

|

Founder Chairman |

March 28, 2018 |

||||||

|

|

|

||||||

|

Internet |

|

Telephone |

|

|

|

In Person |

|

|

|

|

|

|

|

|

|

|

|

Visit the Web site noted on |

|

Use the toll‑free telephone |

|

Sign, date and return your |

|

Attend the meeting in person. |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 2, 2018 — this Proxy Statement and the Papa John’s 2017 Annual Report are available at www.papajohns.com/investor.

|

Proxy Statement |

The Board of Directors (the “Board”) of Papa John’s International, Inc. (the “Company”) is soliciting proxies for use at the Annual Meeting of Stockholders to be held at 11:00 a.m. Eastern Time on May 2, 2018 at the Company’s corporate offices located at 2002 Papa John’s Boulevard, Louisville, Kentucky, and at any adjournment or postponement of the meeting. This Proxy Statement and the enclosed proxy card are first being mailed or given to stockholders on or about March 28, 2018.

At the Annual Meeting, stockholders will be asked to vote on the matters outlined in the Notice of Annual Meeting of Stockholders. These include the election of six directors to the Board of Directors; ratification of the selection of the Company’s independent auditors for 2018; approval of the Papa John’s International, Inc. 2018 Omnibus Incentive Plan; and an advisory approval of the Company’s executive compensation.

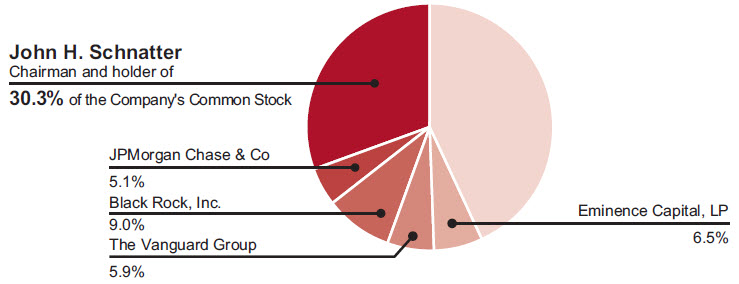

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of March 12, 2018 (except as noted otherwise), with respect to the beneficial ownership of common stock by (i) Mr. Schnatter and each of the other named executive officers identified in the Summary Compensation Table in this Proxy Statement, (ii) each director or nominee for director of the Company, (iii) all directors and executive officers as a group and (iv) each person known to the Company to be the beneficial owner of more than five percent of the outstanding common stock.

|

Percent of |

|||||

|

|

|

Amount and Nature of |

|

Common Stock |

|

|

Name of Beneficial Owner |

|

Beneficial Ownership(1)(2) |

|

Outstanding |

|

|

John H. Schnatter |

|||||

|

P.O. Box 991339, Louisville, KY 40269 |

|

9,914,849 |

(3) |

30.3 |

% |

|

Steven R. Coke |

|

10,516 |

(4) |

* |

|

|

Christopher L. Coleman |

|

26,000 |

|

* |

|

|

Olivia F. Kirtley |

|

193,110 |

(5) |

* |

|

|

Laurette T. Koellner |

|

19,105 |

(6) |

* |

|

|

Sonya E. Medina |

|

8,063 |

|

* |

|

|

Timothy C. O’Hern |

|

50,721 |

(7) |

* |

|

|

Steve M. Ritchie |

|

109,845 |

(8) |

* |

|

|

Mark S. Shapiro |

|

42,389 |

|

* |

|

|

W. Kent Taylor |

|

60,733 |

|

* |

|

|

Lance F. Tucker |

|

19,541 |

(9) |

* |

|

|

All 13 directors and current executive officers as a group |

|

10,487,681 |

(10) |

31.8 |

% |

*Represents less than one percent of class.

2018 Proxy Statement 1

PROXY STATEMENT

|

|

|

|

|

Percent of |

|

|

|

|

Amount and Nature of |

|

Common Stock |

|

|

Other 5% Beneficial Owners |

|

Beneficial Ownership(1) |

|

Outstanding |

|

|

JPMorgan Chase & Co(11) |

|

|

|

|

|

|

270 Park Avenue |

|

|

|

|

|

|

New York, NY 10017 |

|

1,794,932 |

|

5.1 |

% |

|

BlackRock Inc.(12) |

|

|

|

|

|

|

55 East 52nd Street |

|

|

|

|

|

|

New York, NY 10055 |

|

3,144,563 |

|

9.0 |

% |

|

The Vanguard Group(13) |

|

|

|

|

|

|

100 Vanguard Blvd. |

|

|

|

|

|

|

Malvern, PA 19355 |

|

2,078,859 |

|

5.9 |

% |

|

Eminence Capital, LP(14) |

|

|

|

|

|

|

65 East 55th Street, 25th Floor |

|

|

|

|

|

|

New York, NY 10022 |

|

2,192,305 |

|

6.5 |

% |

|

(1) |

Based upon information furnished to the Company by the named persons and information contained in filings with the Securities and Exchange Commission (“SEC”). Under SEC rules, a person is deemed to beneficially own shares over which the person has or shares voting or investment power or of which the person has the right to acquire beneficial ownership within 60 days. Unless otherwise indicated, the named persons have sole voting and investment power with respect to their shares and such shares are not subject to any pledge. |

|

(2) |

Includes the following shares subject to options exercisable within 60 days after March 12, 2018, and time‑based restricted stock over which the named persons have sole voting power. |

|

|

|

Options |

|

|

|

|

|

Options |

|

|

|

|

|

|

exercisable |

|

Restricted |

|

|

|

exercisable |

|

Restricted |

|

|

Name |

|

within 60 days |

|

Stock |

|

Name |

|

within 60 days |

|

Stock |

|

|

John H. Schnatter |

|

463,879 |

|

7,056 |

|

Timothy C. O’Hern |

|

24,317 |

|

7,058 |

|

|

Steven R. Coke |

|

6,017 |

|

1,234 |

|

Steve M. Ritchie |

|

64,074 |

|

26,872 |

|

|

Christopher L. Coleman |

|

18,543 |

|

1,924 |

|

Mark S. Shapiro |

|

17,319 |

|

1,924 |

|

|

Olivia F. Kirtley |

|

26,738 |

|

2,738 |

|

W. Kent Taylor |

|

25,551 |

|

883 |

|

|

Laurette T. Koellner |

|

10,591 |

|

1,924 |

|

Lance F. Tucker |

|

19,541 |

|

— |

|

|

Sonya E. Medina |

|

4,855 |

|

2,029 |

|

|

|

|

|

|

|

|

(3) |

Includes 64,500 shares held in a 501(c)(3) charitable foundation of which Mr. Schnatter has both voting and investment power, and 31,391 shares owned by Mr. Schnatter’s spouse. |

|

(4) |

Includes 1,513 shares held in the 401(k) Plan. |

|

(5) |

Ms. Kirtley also holds units deemed invested in 71,525 shares of common stock through a deferred compensation plan provided by the Company, 48,386 of which are distributable in an equivalent number of shares of common stock within 60 days of termination of service on the Board and are included in the shares reported, and 23,139 of which are not included in the shares reported. |

|

(6) |

Ms. Koellner also holds units deemed invested in 2,456 shares of common stock through a deferred compensation plan provided by the Company, all of which are distributable in an equivalent number of shares of common stock within 60 days of termination of service on the Board and are included in the shares reported. |

|

(7) |

Includes 4,110 shares owned by Mr. O’Hern’s spouse of which 1,928 are subject to options exercisable within 60 days after March 12, 2018, 210 are restricted stock, and 235 are held in the 401(k) Plan. Mr. O’Hern also holds units deemed invested in 1,532 shares of common stock through a deferred compensation plan provided by the Company, which are not included in the shares reported. |

|

(8) |

Includes 1,794 shares owned by Mr. Ritchie’s spouse of which 1,314 are subject to options exercisable within 60 days after March 12, 2018, and 266 are restricted stock. |

|

(9) |

Mr. Tucker also holds units deemed invested in 3,493 shares of common stock through a deferred compensation plan provided by the Company, which are not included in the shares reported. Mr. Tucker’s last day of employment with the Company was March 2, 2018. |

2 2018 Proxy Statement

PROXY STATEMENT

|

(10) |

Includes 689,168 shares subject to options exercisable within 60 days, 68,641 shares of unvested restricted stock and 50,842 shares which may be acquired within 60 days of termination of service under the deferred compensation plan, held by all directors and executive officers. Holders of units deemed invested in common stock under the deferred compensation plan have no voting or investment power over any of the shares represented by these units. |

|

(11) |

All information regarding JPMorgan Chase & Co and its affiliates is based on a Schedule 13G filed with the SEC on January 10, 2018 by JPMorgan Chase & Co. JPMorgan Chase & Co has sole power to vote 1,660,081 shares, shared power to vote 71 shares, sole dispositive power over 1,794,861 shares and shared dispositive power over 71 shares. |

|

(12) |

All information regarding BlackRock Inc. and its affiliates is based on an Amendment to Schedule 13G filed with the SEC on January 29, 2018 by BlackRock, Inc. BlackRock has sole power to vote 3,075,251 shares and has sole dispositive power over 3,144,563 shares. |

|

(13) |

All information regarding The Vanguard Group is based on an Amendment to Schedule 13G filed with the SEC on February 9, 2018. The Vanguard Group has sole voting power over 50,529 shares, shared voting power over 3,600 shares, sole dispositive power of 2,026,730 shares, and shared dispositive power of 52,129 shares. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 48,529 shares or 0.13% of the Common Stock outstanding of the Company as a result of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 5,600 shares or 0.01% of the Common Stock outstanding of the Company as a result of its serving as investment manager of Australian investment offerings. |

|

(14) |

All information regarding Eminence Capital LP (“Eminence LP”) is based on a Schedule 13G filed with the SEC on March 12, 2018 by Eminence LP, Eminence GP, LLC (“Eminence GP”) and Ricky C. Sandler (“Sandler” and collectively with Eminence LP and Eminence GP, “Eminence”). Eminence LP has shared voting and dispositive power over 2,192,305 shares; Eminence GP has shared voting and dispositive power over 1,713,373 shares; and Sandler has shared voting and dispositive power over 2,192,305 shares. |

2018 Proxy Statement 3

Who is entitled to vote at the Annual Meeting?

The Board has set March 12, 2018, as the record date (“Record Date”) for the Annual Meeting. If you were a stockholder of record at the close of business on the Record Date, you are entitled to vote at the meeting. As of the Record Date, 32,216,478 shares of common stock, representing all of our voting stock, were issued and outstanding and eligible to vote at the meeting.

Holders of our common stock are entitled to one vote per share. There are no cumulative voting rights.

How many shares must be present to hold the Annual Meeting?

In accordance with the Company’s bylaws, shares equal to a majority of the voting power of the outstanding shares of common stock entitled to vote as of the Record Date must be present at the Annual Meeting in order to hold the meeting and conduct business. This is called a quorum. Your shares are counted as present at the meeting if:

|

· |

you are present and vote in person at the meeting; or |

|

· |

you have properly and timely submitted your proxy as described below under “How can I submit my proxy?” |

Abstentions and broker “non‑votes” are counted as present and entitled to vote for purposes of determining whether a quorum exists. A broker “non‑vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee has not received voting instructions from the beneficial owner and does not have discretionary voting power with respect to that item.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares. If your shares are held in a brokerage account or by a bank, trust or other nominee, then you are considered the beneficial owner of those shares. In that case, your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the method described below under “How can I submit voting instructions to my broker?”

If you are a stockholder of record, you can submit a proxy to be voted at the Annual Meeting in any of the following ways:

|

· |

electronically, using the Internet; |

|

· |

over the telephone by calling a toll‑free number; or |

|

· |

by completing, signing and mailing the enclosed proxy card. |

The Internet and telephone voting procedures have been set up for your convenience. These procedures have been designed to authenticate your identity, allow you to give voting instructions, and confirm that those instructions have been recorded properly. When you vote by Internet or telephone, you reduce the Company’s mailing and handling expenses. If you are a stockholder of record and would like to submit your proxy by Internet or telephone, please refer to the specific instructions provided on the enclosed proxy card. If you wish to vote using a paper proxy card, please return your signed proxy card promptly to ensure we receive it before the Annual Meeting.

How can I submit voting instructions to my broker?

If you hold your shares in street name, you must vote your shares in the manner prescribed by your broker, bank, trust or other nominee. Your broker, bank, trust or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker, bank, trust or other nominee how to vote your shares. In many cases, you may be permitted to submit your voting instructions by Internet or telephone.

To vote in person at the Annual Meeting, you must obtain a legal proxy from your broker, bank, trust or other nominee.

4 2018 Proxy Statement

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

How do I vote if I hold shares in the Papa John’s International, Inc. 401(k) Plan?

If you hold shares of the Company’s common stock in the Papa John’s International, Inc. 401(k) Plan, please refer to the voting instructions provided by the plan’s trustee. Your voting instructions must be received by the plan trustee at least three days prior to the Annual Meeting in order to be counted. If you do not timely direct the plan trustee how to vote, the trustee will vote your shares in the same proportion as those shares for which the trustee received direction.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials or multiple control numbers for use in submitting your proxy, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or voting instruction card you receive or, if you submit your proxy by Internet or telephone, vote once for each card or control number you receive.

Can I vote my shares in person at the Annual Meeting?

If you are a stockholder of record, you may vote your shares in person at the Annual Meeting by completing a ballot at the Annual Meeting. Even if you currently plan to attend the Annual Meeting, the Company recommends that you also submit your proxy as described above so your vote will be counted if you later decide not to attend the Annual Meeting. If you submit your vote by proxy and later decide to vote in person at the Annual Meeting, the vote you submit at the Annual Meeting will override your proxy vote.

If you are a street name holder, you may vote your shares in person at the Annual Meeting only if you obtain and bring to the Annual Meeting a signed letter or other form of proxy from your broker, bank, trust or other nominee giving you the right to vote the shares at the Annual Meeting.

If you are a participant in the Company’s 401(k) Plan, you may submit voting instructions as described above, but you may not vote your shares held in the Company’s 401(k) Plan in person at the Annual Meeting.

How does the Board recommend that I vote?

The Board of Directors recommends a vote:

|

· |

FOR each of the nominees for director; |

|

· |

FOR the ratification of the selection of KPMG LLP as the independent auditors of the Company for the fiscal year ending December 30, 2018; |

|

· |

FOR approval of the 2018 Omnibus Incentive Plan; and |

|

· |

FOR the advisory approval of the Company’s executive compensation. |

What if I do not specify how I want my shares voted?

If you are a stockholder of record and submit a signed proxy card or submit your proxy by Internet or telephone but do not specify how you want to vote your shares on a particular item, your shares will be voted by the proxies in accordance with the Board’s recommendations.

If you are a street name holder and hold your shares with a broker, and do not instruct your broker as to how to vote, your shares may be voted by your broker in its discretion on the proposal to ratify the independent auditors. As described below, your broker does not have discretion to vote your uninstructed shares on the remaining proposals.

Your vote is important. The Company urges you to vote, or to instruct your broker, bank, trust or other nominee how to vote, on all matters before the Annual Meeting.

Can I change my vote after submitting my proxy?

If you are a stockholder of record, you may revoke your proxy and change your vote at any time before your proxy is voted at the Annual Meeting, in any of the following ways:

|

· |

by submitting a later‑dated proxy by Internet or telephone before the deadline stated on the enclosed proxy card; |

|

· |

by submitting a later‑dated proxy to the Corporate Secretary of the Company, which must be received by the Company before the time of the Annual Meeting; |

2018 Proxy Statement 5

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

|

· |

by sending a written notice of revocation to the Corporate Secretary of the Company, which must be received by the Company before the time of the Annual Meeting; or |

|

· |

by voting in person at the Annual Meeting. |

If you are a street name holder, you may change your vote only if you comply with the procedures contained in the voting instructions provided to you by your broker, bank, trust or other nominee.

If you are a participant in the Company’s 401(k) Plan, you may change your vote only if you comply with the procedures contained in the voting instructions provided by the plan’s trustee.

What vote is required to approve each item of business included in the Notice of Annual Meeting?

A majority of votes cast at the meeting is required to elect directors. A majority of the votes cast means that the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” that director (with abstentions and broker non‑votes not counted as a vote cast with respect to that director) in order for the director to be elected. The affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter is required to ratify the selection of our independent auditors, approve the 2018 Omnibus Incentive Plan, and for the advisory approval of the Company’s executive compensation. In determining whether these three proposals have received the requisite number of affirmative votes, abstentions will have the same effect as a vote against the proposal.

If your shares are held by a broker, bank, trust or other nominee, that entity will ask you how you want your shares to be voted. If you give instructions, your shares will be voted as you direct. If you do not give instructions, one of two things can happen, depending on the type of proposal. For the ratification of the independent auditors, the broker, bank, trust or other nominee is permitted to vote your shares in its discretion. For all other proposals, the broker, bank, trust or other nominee is not permitted to vote your shares at all.

We have adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, we will deliver at your request only one copy of our fiscal 2017 Annual Report on Form 10-K and this Proxy Statement, to multiple stockholders who share the same address (if they appear to be members of the same family) unless we have received contrary instructions from an affected stockholder. Stockholders who participate in householding will continue to receive separate proxy cards if they received a paper copy of proxy materials in the mail. This procedure reduces our printing costs, mailing costs and fees, and also reduces waste.

Upon written or oral request, we will deliver a separate copy of our fiscal 2017 Annual Report on Form 10‑K and this Proxy Statement to a stockholder at a shared address to which a single copy of the documents has been delivered.

If you are a stockholder, share an address and last name with one or more other stockholders and would like to revoke your householding consent or you are a stockholder eligible for householding and would like to participate in householding, please contact Broadridge, either by calling toll free at (866) 540‑7095 or by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. You will be removed from the householding program within 30 days of receipt of the revocation of your consent.

A number of brokerage firms have instituted householding. If you hold your shares in “street name,” please contact your bank, broker or other holder of record to request information about householding.

Who pays for the cost of proxy preparation and solicitation?

The accompanying proxy is solicited by the Board of Directors of the Company. This Proxy Statement is being mailed to the stockholders on or about March 28, 2018 along with the Company’s fiscal 2017 Annual Report on Form 10‑K. We have also retained the firm of D.F. King to aid in the solicitation of brokers, banks, institutional and other stockholders for a fee of approximately $10,000, plus reimbursement of expenses. All costs of the solicitation of proxies will be borne by the Company. The Company pays for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or other nominees for forwarding proxy materials to street name holders. The Company is soliciting proxies primarily by mail. In addition, the Company’s directors, officers and regular employees may solicit proxies by telephone or facsimile or personally. The Company’s directors, officers and regular employees will receive no additional compensation for these services other than their regular compensation.

6 2018 Proxy Statement

Principles of corporate governance that guide the Company are set forth in the Company’s Board of Director committee charters, the Company’s Corporate Governance Guidelines and the Company’s Code of Ethics and Business Conduct, all of which are available on our website at www.papajohns.com by first clicking “Investor Relations” and then “Corporate Governance.” (The information on the Company’s website is not part of this Proxy Statement and is not soliciting material.) The principles set forth in those governance documents were adopted by the Board to ensure that the Board is independent from management, that the Board adequately oversees management, and to help ensure that the interests of the Board and management align with the interests of the stockholders. The Board annually reviews its corporate governance documents.

Majority Voting Standard for Director Elections

Our amended and restated bylaws provide for a majority voting standard for uncontested director elections and a mechanism for consideration of the resignation of an incumbent director who does not receive a majority of the votes cast in an uncontested election. Under the majority voting standard, a majority of the votes cast means that the number of shares voted “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee. In contested elections where the number of nominees exceeds the number of directors to be elected, the vote standard will be a plurality of votes represented in person or by proxy and entitled to vote on the election of directors. In addition, if an incumbent director is nominated in an uncontested election, the director nominee is required, as a condition of the director’s nomination, to submit an irrevocable letter of resignation to the Chairman of the Board. If an incumbent director nominee does not receive a majority of the votes cast, the Corporate Governance and Nominating Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Committee’s recommendation and publicly disclose its decision and the rationale behind the decision within 90 days from the date of certification of the election results. The director whose resignation is being considered will not participate in the recommendation of the Committee or the Board’s decision.

Code of Ethics and Business Conduct

The Company’s Code of Ethics and Business Conduct, which is the Company’s code of ethics applicable to all directors, officers and employees worldwide, embodies the Company’s global principles and practices relating to the ethical conduct of the Company’s business and its longstanding commitment to honesty, fair dealing and full compliance with all laws affecting the Company’s business.

The Board has established a means for employees, customers, suppliers, stockholders and other interested parties to submit confidential and anonymous reports of suspected or actual violations of the Company’s Code of Ethics and Business Conduct relating, among other things, to:

|

· |

violations of the federal securities laws; |

|

· |

fraud or weakness in the Company’s accounting, audit or internal controls, financial statements and records; or |

|

· |

misconduct by any member of the Company’s senior management. |

Any employee, stockholder, or interested party may contact the Company’s General Counsel, or submit a confidential, anonymous report by following procedures established by the Company, approved by the Corporate Governance and Nominating Committee of the Company’s Board of Directors and communicated to team members from time to time. Any employee, stockholder or interested party may also learn about these procedures for reporting issues and concerns by visiting our website at www.papajohns.com, by first clicking “Investor Relations” and then “Corporate Governance.”

The Board of Directors has determined that the following six of the Company’s seven current directors are “independent” as defined by applicable law and NASDAQ listing standards: Christopher L. Coleman, Olivia F. Kirtley, Laurette T. Koellner, Sonya E. Medina, Mark S. Shapiro, and W. Kent Taylor. Each of our Audit, Compensation, and Corporate Governance and Nominating committees is comprised only of independent directors, as identified below under the heading “Committees of the Board of Directors.”

2018 Proxy Statement 7

CORPORATE GOVERNANCE

Based on such standards, John H. Schnatter is not independent because he was an executive officer of the Company until January 1, 2018, when he changed his status to a non-employee, Founder Chairman. Mr. Schnatter also has contractual relationships with the Company that define his role as our Founder Chairman and spokesperson as described in the Compensation Discussion and Analysis section.

Ms. Kirtley, our lead independent director and Chairman of the Compensation Committee, is a member of the board of directors of U.S. Bancorp. We have a banking relationship with U.S. Bancorp that predates Ms. Kirtley’s appointment to the U.S. Bancorp board of directors. Ms. Kirtley is also a member of the board of directors of Delta Dental. Based on a comprehensive request for proposal in 2009, the Company chose Delta Dental as its dental insurance carrier. The Board reviewed these relationships and determined that they do not impact Ms. Kirtley’s independence or her business judgment.

Mr. Shapiro, Chairman of the Corporate Governance & Nominating Committee and a member of the Audit Committee, is Co-President and Chief Content Officer of WME | IMG (“IMG”), a global sports and media business. The Company and the Papa John’s marketing fund have a business relationship with IMG College which predates Mr. Shapiro’s employment with IMG. The Board reviewed these relationships and determined that the dollar amount of the relationship between the Company and IMG is immaterial to IMG compared to IMG’s gross revenues, and that the relationship does not impact Mr. Shapiro’s independence or his business judgment.

Board Leadership Structure and Risk Management

During 2017, the positions of Chairman of the Board and Chief Executive Officer were held by our Founder, John Schnatter. Effective January 1, 2018, the Board split the Chairman and CEO roles with the appointment of Steve Ritchie as President and Chief Executive Officer. The Board currently includes six independent directors and one non-independent director (John Schnatter).

The Board of Directors believes that Mr. Schnatter is best suited to serve as Chairman because, as our Founder, he is the director most familiar with our business, industry and franchise system, and can lead the Board in identifying and prioritizing our strategies and initiatives. Our independent directors and management have different perspectives and roles in business and strategy development. Our independent directors bring diverse experience, oversight and expertise from outside the Company and industry, while Mr. Schnatter offers specific Company and industry experience and expertise.

Under our Corporate Governance Guidelines, our independent directors elect a lead independent director. Olivia F. Kirtley currently serves as the lead independent director of the Board. The Board believes having Mr. Schnatter serve as Chairman and Mr. Ritchie focusing on business matters in his role as Chief Executive Officer, together with a lead independent director having the duties described below, is in the best interests of stockholders at this time because it provides the appropriate balance for strategy development, leadership and independent oversight of management.

Our Board has three standing committees — Audit, Compensation, and Corporate Governance and Nominating. Each of the Board committees is comprised solely of independent directors, with each of the three committees having a separate chair. See “Committees of the Board of Directors” below for a description of each of these Board committees and its members. The key responsibilities of the Board include developing the strategic direction for the Company and providing oversight for the execution of that strategy by management. The Board has an active role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s financial, strategic and operational issues, as well as the risks associated with each, and that oversight includes a thorough and comprehensive annual review of the Company’s strategic plan. At the committee level, risks are reviewed and addressed as follows:

|

· |

The Audit Committee oversees management of financial risks, legal and regulatory risks, food safety, information technology and cyber security risks, as well as the Company’s Enterprise Risk Management program, reporting on such matters to the full Board. The Audit Committee’s agendas include discussions of individual and emerging risk areas throughout the year, and through its oversight of our Enterprise Risk Management program, the Audit Committee monitors management’s responsibility to identify, assess, manage and mitigate risks. Our Enterprise Risk Management program is comprised of a cross‑functional management level Enterprise Risk Management team that helps establish a culture of managing and mitigating risk and coordination of risk management between our executive team and the Board. |

|

· |

The Compensation Committee is responsible for overseeing the management of risks relating to the Company’s compensation plans and arrangements and also oversees succession planning. The Compensation Committee reviews our compensation policies and practices to determine whether they subject us to unnecessary or excessive risk. As a result of that evaluation, including a review of the plan design and governance aspects of our compensation programs discussed below in the Compensation Discussion and Analysis, the Compensation Committee concluded that the risks arising from those policies and practices are not reasonably likely to have a material adverse effect on the Company. |

8 2018 Proxy Statement

CORPORATE GOVERNANCE

|

· |

The Corporate Governance and Nominating Committee manages risks associated with potential conflicts of interest and reviews governance and compliance issues with a view to managing associated risks, including oversight of our compliance program with respect to our Code of Ethics and Business Conduct. |

While each committee is responsible for evaluating and overseeing the management of such risks, the Board of Directors is regularly informed through committee reports about such risks. In addition, the Board and the committees receive regular reports from the President and Chief Executive Officer, Chief Financial Officer, General Counsel and other Company officers with roles in managing risks.

In April 2017, our independent directors elected Olivia F. Kirtley to serve as the lead independent director of the Board. The lead independent director has the duties and responsibilities, as approved by the Board’s Corporate Governance and Nominating Committee, to perform the following functions:

|

· |

preside at meetings of the Board in the absence of or when requested to do so by the Chairman; |

|

· |

serve as ex officio member of all standing Board Committees; |

|

· |

serve formally as liaison between the independent Board members, the Founder Chairman, and the Chief Executive Officer; |

|

· |

establish the dates, agendas, schedules and information distributed for each Board meeting, in conjunction with the Chief Executive Officer; |

|

· |

monitor information sent to the Board for quality, quantity and timeliness and discuss this information with the Chief Executive Officer; |

|

· |

as needed, call sessions of the independent directors and work with the other independent directors to establish the agenda for those sessions; and |

|

· |

make herself available for consultation with and direct communication from major stockholders. |

Meetings of the Board of Directors

The Board held nine meetings in 2017. Each director attended at least 75% of the meetings of the Board and the Board committees on which he or she served during the period of service in 2017.

Meetings of the Independent Directors

At both the Board and committee levels, the Company’s independent directors meet in regular executive sessions in which members of management do not participate. These sessions typically occur in conjunction with regularly scheduled Board or committee meetings. The lead independent director chairs executive sessions of the Board of Directors.

Annual Meetings of Stockholders

The Company does not have a policy regarding director attendance at the Annual Meeting, but we encourage each of our directors to attend each Annual Meeting of the Company’s stockholders whenever attendance does not unreasonably conflict with the director’s other business and personal commitments. All of our directors attended the 2017 Annual Meeting of Stockholders, except for W. Kent Taylor, who could not attend due to a prior commitment.

Committees of the Board of Directors

The Board has three standing committees to facilitate and assist the Board in the execution of its responsibilities: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. In accordance with NASDAQ listing standards, all of the committees are comprised solely of independent directors. Charters for each of our committees are available on the Company’s website at www.papajohns.com by first clicking on “Investor Relations” and then “Corporate Governance.” The charter of each committee is also available in print to any stockholder who requests it.

2018 Proxy Statement 9

CORPORATE GOVERNANCE

Audit Committee

The Audit Committee’s purpose is to assist the Board in fulfilling its oversight responsibilities for the accounting, financial reporting and internal control functions of the Company and its subsidiaries. The Audit Committee is responsible for the appointment, compensation and retention of the independent auditors and oversees the performance of the internal auditing function and the Company’s compliance program with respect to legal and regulatory requirements and risk management. The Audit Committee meets with management and the independent auditors to review and discuss the annual audited and quarterly unaudited financial statements, reviews the integrity of our accounting and financial reporting processes and audits of our financial statements, and prepares the Audit Committee Report included in this Proxy Statement. The responsibilities of the Audit Committee are more fully described in the Audit Committee’s Charter.

As previously noted, each member of the Audit Committee is independent as determined by the Company’s Board of Directors, based upon applicable laws and regulations and NASDAQ listing standards. In addition, the Board has determined that each of Ms. Koellner, the Chair of the Audit Committee, and Mr. Coleman is an “audit committee financial expert” as defined by SEC rules. The Audit Committee met five times during 2017.

Compensation Committee

The Compensation Committee oversees the Company’s compensation programs and is responsible for overseeing and making recommendations to the Board of Directors regarding the Company’s overall compensation strategies and succession planning. Specifically, the Compensation Committee reviews and approves annually the compensation of the Company’s executive officers, including the executive officers named in the Summary Compensation Table below (our “named executive officers” or “NEOs”). The Committee has the authority to administer our equity plans and is responsible for all determinations with respect to participation, the form, amount and timing of any awards to be granted to any such participants, and the payment of any such awards. In addition, the Committee is responsible for recommending stock ownership guidelines for the executive officers and directors, for recommending the compensation and benefits to be provided to non‑employee directors, and for reviewing and approving the establishment of broad‑based incentive compensation, equity‑based, and retirement or other material employee benefit plans. The Committee also reviews risks, if any, created by the Company’s compensation policies and practices and provides recommendations to the Board on compensation‑related proposals to be considered at the Annual Meeting.

The Committee has the authority to retain compensation consultants, outside counsel and other advisers. The Committee has engaged Frederick W. Cook & Company (“F. W. Cook”) to advise it and to prepare market studies of the competitiveness of components of the Company’s compensation program for its senior executive officers, including the named executive officers. F. W. Cook does not provide any other services to the Company. The Committee performed an assessment of F. W. Cook’s independence to determine whether the consultant is independent and, based on that assessment, determined that the firm’s work has not raised any conflict of interest and the firm is independent. See “Compensation Discussion and Analysis” for a further description of the Compensation Committee’s use of F. W. Cook during 2017, as well as the role of our executive officers in determining or recommending the amount or form of compensation paid to our named executive officers during 2017, and the Committee’s process in setting compensation.

The responsibilities of the Compensation Committee are more fully described in the Committee’s Charter. The Compensation Committee met five times during 2017.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee assists the Board in identifying qualified individuals for service as directors of the Company and as Board committee members, evaluates incumbent directors before recommending renomination, and recommends all such approved candidates to the Board for appointment or nomination to the Company’s stockholders. The Corporate Governance and Nominating Committee selects as candidates for appointment or nomination individuals of high personal and professional integrity and ability who can contribute to the Board’s effectiveness in serving the interests of the Company’s stockholders. The Corporate Governance and Nominating Committee recommended the nomination of six directors for election to the Board at the 2018 Annual Meeting.

In addition, the Committee develops and monitors the process for evaluating Board effectiveness, oversees the development and administration of the Company’s corporate governance policies and the Company’s compliance program with respect to the Company’s Code of Ethics and Business Conduct. It also reviews and approves matters pertaining to possible conflicts of interest and related person transactions. See the discussion under “Approval of Related Person Transactions” below.

The responsibilities of the Corporate Governance and Nominating Committee are more fully described in the Committee’s Charter. The Corporate Governance and Nominating Committee met four times during 2017.

10 2018 Proxy Statement

CORPORATE GOVERNANCE

Stockholders of the Company may communicate with the Board in writing addressed to:

Board of Directors

c/o Corporate Secretary

Papa John’s International, Inc.

P.O. Box 99900

Louisville, Kentucky 40269‑0900

The Secretary will review each stockholder communication. The Secretary will forward to the entire Board (or to members of a Board committee, if the communication relates to a subject matter clearly within that committee’s area of responsibility) each communication that (a) relates to the Company’s business or governance, (b) is not offensive and is legible in form and reasonably understandable in content, and (c) does not merely relate to a personal grievance against the Company or a team member or further a personal interest not shared by the other stockholders generally.

Identifying Qualified Candidates

The Corporate Governance and Nominating Committee assists the Board in identifying qualified persons to serve as directors of the Company. The Committee evaluates all proposed director nominees, evaluates incumbent directors before recommending renomination, and recommends all approved candidates to the Board for appointment or nomination to the Company’s stockholders.

The Corporate Governance and Nominating Committee expects qualified candidates will have high personal and professional integrity and ability and will be able to contribute to the Board’s effectiveness in serving the interests of the Company’s stockholders. The Committee considers diversity in its nomination of directors to the Board, and in its assessment of the effectiveness of the Board and its committees. In considering diversity, the Corporate Governance and Nominating Committee looks at a range of different personal factors in light of the business, customers, suppliers and employees of the Company. The range of factors includes diversity of race, ethnicity, gender, age, cultural background and personal and business backgrounds. This includes prior board service, financial expertise, international experience, industry experience, leadership skills, including prior management experience, and a variety of subjective factors. In addition, the Committee also considers qualifications that include: independence, judgment, integrity, the ability to commit sufficient time and attention to Board activities, and the absence of potential conflicts with the Company’s interests. The Committee considers these criteria in the context of the perceived needs of the Board as a whole and seeks to achieve and maintain the diversity of the Board. Although the Board does not establish specific goals with respect to diversity, the overall diversity of the Board is a significant consideration in the nomination process. Three of the six nominees for election at the 2018 Annual Meeting are women, and the Board’s collective experience covers a range of experience across different countries and industries. The Corporate Governance and Nominating Committee also considers the length of service of the Company’s Board members, balancing the value of long-standing Board service with the perspective of directors more recently joining the Board.

2018 Proxy Statement 11

CORPORATE GOVERNANCE

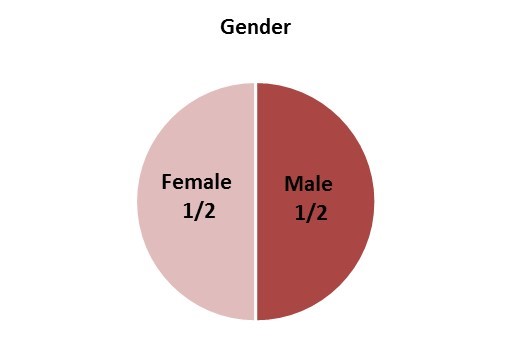

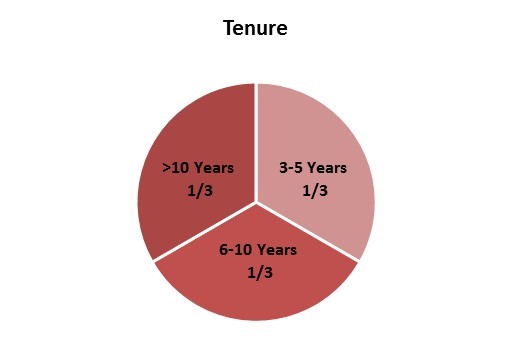

The charts below illustrate board composition by gender and tenure:

The Corporate Governance and Nominating Committee reports regularly to the full Board on its assessment of the composition and functioning of the Board. The Company has focused on assembling a group of Board members who collectively possess the skills and experience necessary to oversee the business of the Company, structure and oversee implementation of the Company’s strategic plan and maximize stockholder value in a highly competitive environment. In particular, the Company relies on the skills of its Board members described under “Item 1. Election of Directors” below.

The Corporate Governance and Nominating Committee will consider candidates for election to the Board recommended by a stockholder in accordance with the Company’s Certificate of Incorporation and will do so in the same manner as the Committee evaluates any other properly recommended nominee. Any nomination by a stockholder of a person for election to the Board at an annual meeting of stockholders, or a special meeting of stockholders called by the Board for the purpose of electing directors, must be received at the Company’s principal offices not less than 60 days nor more than 90 days prior to the scheduled date of the meeting and must comply with certain other requirements set forth in the Company’s Certificate of Incorporation. However, if less than 70 days’ notice of the date of the annual meeting is given, notice by the stockholder must be received no later than 10 days following the earlier of (i) the day on which such notice of the date of the meeting was mailed or (ii) the day on which public disclosure of the date of the meeting was made by the Company.

Nominations must be addressed to the Chairman of the Corporate Governance and Nominating Committee in care of the Secretary of the Company at the Company’s headquarters address listed below and must be received on a timely basis in order to be considered for the next annual election of directors:

Chairman of the Corporate Governance and Nominating Committee

c/o Corporate Secretary

Papa John’s International, Inc.

P.O. Box 99900

Louisville, Kentucky 40269‑0900

12 2018 Proxy Statement

The Board of Directors is authorized to fix from time to time the number of directors within the range of three to fifteen members, and currently the Board size is set at seven members. W. Kent Taylor is not standing for re-election to our Board of Directors at the Annual Meeting. The Board has reduced the size of the Board to six members effective immediately prior to the commencement of the Annual Meeting. Directors are elected annually to one-year terms. All current directors other than Mr. Taylor have been nominated for election by the Board to hold office until the 2019 annual meeting and the election of their successors. Committee members and Chairs are appointed following the Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR.

Set forth below is information concerning the nominees for election and their ages as of the date of this Proxy Statement.

Nominees for Election to the Board

|

Christopher L. Coleman |

|

|

|

Age: 49 Director since 2012 Committees: Audit, Corporate Governance & Nominating |

|

Mr. Coleman is based in the UK, where he is Group Head of Banking at Rothschild & Co. He is a Global Partner of Rothschild & Co, Chairman of Rothschild Bank International and also serves on a number of other boards and committees of the Rothschild & Co Group, which he joined in 1989. Mr. Coleman’s extensive financial experience and international business acumen provide insight and expertise to the Board in these key areas. Mr. Coleman currently serves as non-executive chairman of the board of Randgold Resources. Mr. Coleman has served on the board of Randgold Resources since 2008 (currently as the chairman of its governance and nomination committee and member of its remuneration committee and previously a member of its audit committee). |

|

|

|

|

2018 Proxy Statement 13

ITEM 1. ELECTION OF DIRECTORS

|

Olivia F. Kirtley |

|

|

|

Age: 67 Director since 2003 Lead Independent Director Committee: Compensation (Chair) |

|

Ms. Kirtley, a certified public accountant, is a business consultant on strategic and corporate governance issues. She is a former chief financial officer and former senior manager at a predecessor to the accounting firm Ernst & Young LLP (“Ernst & Young”). From 2014 to 2016, she served as President and Board Chairman of the International Federation of Accountants. She has also served as Chairman of the American Institute of Certified Public Accountants and Chairman of the AICPA Board of Examiners. Ms. Kirtley brings extensive experience, expertise and insight to our Board in the areas of audit, risk management and public company corporate governance and compensation. In addition to her expertise in audit and tax issues developed in part as a senior manager at a predecessor to Ernst & Young, Ms. Kirtley also brings corporate management experience from her tenure at Vermont American Corporation, including the positions of Treasurer, Vice President Finance and Chief Financial Officer at that company. Ms. Kirtley has served as a director of U.S. Bancorp since 2006 (including service as the chairman of its audit committee, chairman of its risk committee, and member of its governance, compensation and executive committees), as a director of ResCare, Inc. since 1998 (including service as the chairman of its audit committee and member of its governance committee), and as a director of Randgold Resources since 2017 (including service as a member of its audit and remuneration committees). |

|

|

|

|

|

Laurette T. Koellner |

|

|

|

Age: 63 Director since 2014 Committees: Audit (Chair); Compensation |

|

Ms. Koellner most recently served as Executive Chairman of International Lease Finance Corporation, a subsidiary of American International Group, Inc. (“AIG”) from June 2012 until its May 2014 sale to AerCap Holdings N.V. Ms. Koellner served as President of Boeing International, a division of The Boeing Company, where she held a variety of financial and business leadership roles from 1997 until 2008, including as a member of the Office of the Chairman and Boeing’s Chief Administration and Human Resources Officer. Prior to her time with Boeing, Ms. Koellner spent 19 years at McDonnell Douglas Corp, which merged with The Boeing Company in 1997. As a former executive of a large publicly traded company, Ms. Koellner brings extensive experience to the Board in the areas of complex business operations, finance and accounting, and international business. In addition, she brings extensive corporate governance and compensation experience and insight as a director of other public companies. Ms. Koellner served as an independent director of Hillshire Brands, Inc. from 2001 to 2014, when it was sold to Tyson Foods. She served as an independent director of AIG from 2009 to 2012. She currently serves on the board of directors of Celestica, Inc. (including service as the chairman of its audit committee, and member of its compensation and corporate governance and nominating committees), The Goodyear Tire & Rubber Company (including service as a member of its audit and finance committees) and Nucor Corporation (including service as a member of its compensation and executive development and corporate governance and nominating committees). |

14 2018 Proxy Statement

ITEM 1. ELECTION OF DIRECTORS

|

Sonya E. Medina |

|

|

|

Age: 42 Director since 2015 Committee: Corporate Governance & Nominating |

|

Ms. Medina is a government and public affairs strategist. She has served as a consultant to the City of San Antonio since March 2015, and as a consultant to Silver Eagle Distributors, the nation’s largest distributor of Anheuser-Busch products, since July 2013. She served as Vice President, Community and External Affairs for Silver Eagle Distributors from 2009 to 2013. Ms. Medina served as a White House Commission Officer from 2001 to 2006 and again in 2008, and as Director of the AT&T Global Foundation from 2006 to 2008. Ms. Medina brings leadership, strategy and multi-cultural marketing experience to the Board. She also brings insight into government affairs, through her prior experience as a White House Commission Officer. She is active in community and civic affairs and currently serves on the Next Gen Board Leaders Advisory Council, a joint initiative launched by Nasdaq, Spencer Stuart and Boardroom Resources. |

|

|

|

|

|

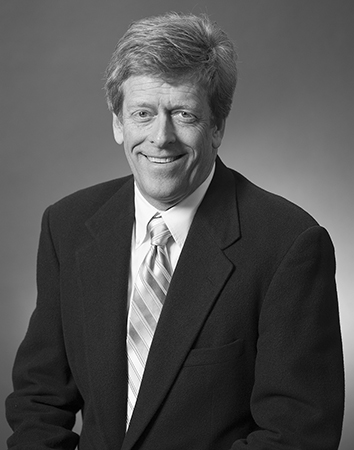

John H. Schnatter |

|

|

|

Age: 56 Director since 1990 Founder Chairman |

|

Mr. Schnatter founded Papa John’s in 1984 and opened the first Company restaurant in 1985. He currently serves as Founder Chairman. He previously served as Chief Executive Officer from April 2011 to December 2017, as Co‑Chief Executive Officer from April 2010 to April 2011, Chief Executive Officer from April 2009 to April 2010, Interim Chief Executive Officer from December 2008 to April 2009, Executive Chairman from 2005 until May 2007, as Chairman of the Board and Chief Executive Officer from 1990 until 2005, and as President from 1985 to 1990, from 2001 to 2005, and from 2014 to 2015. Mr. Schnatter’s role as our Founder and brand spokesperson makes him uniquely qualified to chair the Board of Directors. Mr. Schnatter’s experience and entrepreneurial skills offer vision in leading the Board and building our brand, with a consistent focus on maintaining product quality and providing a superior customer service experience. His experience in research and development, quality assurance and supply chain management are critical to our business and our franchise business model. |

|

|

|

|

2018 Proxy Statement 15

ITEM 1. ELECTION OF DIRECTORS

|

Mark S. Shapiro |

|

|

|

Age: 48 Director since 2011 Committees: Audit; Corporate Governance & Nominating (Chair) |

|

Mr. Shapiro has served as Co-President of WME | IMG since November 2016 and Chief Content Officer since September 2014. He served as Chief Executive Officer of Dick Clark Productions from May 2010 to October 2012, and as an executive producer at Dick Clark Productions from October 2012 until 2014. Prior to that, he served as a Director, President and Chief Executive Officer of Six Flags, Inc., a theme park company, from 2005 to 2010. Prior to joining Six Flags in 2005, Mr. Shapiro spent 12 years at ESPN, Inc. where he served as Executive Vice President, Programming and Production and in various other capacities for both ESPN and ABC Sports. Coupling his board service with experience in executive level positions at large organizations facing complex business challenges, Mr. Shapiro brings business acumen and operational expertise to many of the issues and challenges facing public companies, along with innovation and insight in the areas of content creation, marketing and branding. Mr. Shapiro has served as a director of Live Nation Entertainment, Inc. since 2008 (including service on its compensation committee); as a trustee of Equity Residential since January 2010 (including service on its audit, compensation and nominating and governance committees); and as a director of Frontier Communications Corporation since March 2010 (including service on its nominating and governance and retirement plan committees). Mr. Shapiro is also Chairman of Captivate Network, a privately held company. |

There are no family relationships among the Company’s directors and executive officers.

Director Not Continuing in Office

|

W. Kent Taylor |

|

|

|

Age: 62 Director since 2011 Committee: Compensation |

|

Mr. Taylor is the founder and Chief Executive Officer of Texas Roadhouse, Inc. a full‑service, casual dining restaurant chain with locations across the U.S. and in several foreign countries. He served as Chief Executive Officer of Texas Roadhouse from 2000 until 2004, and again from August 2011 to the present, and he has served as its executive Chairman since 2004. Before founding the Texas Roadhouse concept in 1993, Mr. Taylor founded and co‑owned Buckhead Bar and Grill in Louisville, Kentucky. His more than 25 years of experience in the restaurant industry provided the Board with additional expertise in the Company’s industry, and he also brought to the Board experience in founding and serving as a chief executive officer and director of a public company. The Board of Directors gratefully acknowledges the service of Mr. Taylor on the Board.

|

16 2018 Proxy Statement

Introduction

This discussion and analysis explains the Company’s compensation philosophies and programs for its named executive officers (“NEOs”) for fiscal year 2017: Steve M. Ritchie, President and Chief Executive Officer; John H. Schnatter, Chairman of the Board and Former Chief Executive Officer; Lance F. Tucker, former Senior Vice President, Chief Financial Officer and Chief Administrative Officer; and Timothy C. O’Hern, Senior Vice President and Chief Development Officer.

The Board promoted Mr. Ritchie to President and Chief Executive Officer effective January 1, 2018; he served as President and Chief Operating Officer in 2017. Mr. Schnatter served as Founder, Chairman and Chief Executive Officer in 2017 and he continues to serve as Founder Chairman. On March 2, 2018, Mr. Tucker left the Company to become chief financial officer of Jack in the Box Inc.

Executive Summary

We focus our compensation program for our NEOs and other executives on financial, strategic and operational goals established by the Board of Directors to create value for our stockholders. Our guiding compensation principle is to pay for performance, supporting our objective to create value for our stockholders by delivering on our Better Ingredients. Better Pizza. brand promise. Our compensation program is designed to motivate, measure and reward the achievement of our strategic goals without promoting excessive or unnecessary risk taking.

Tying Pay to Performance

To execute our strategy and continue to deliver strong growth, the Compensation Committee closely aligns the majority of NEO compensation to both short- and long-term performance objectives. While salary is a fixed element of compensation, increases in salary are tied to individual performance, and all other elements of compensation are tied to Papa John’s overall performance.

In 2017, the Committee applied our pay-for-performance philosophy by:

|

· |

Basing the 2017 Short‑Term Management Incentive Plan (“MIP”), our formula‑based annual cash incentive plan, on pre‑tax income as well as non‑income measures of net global unit development, and domestic and international combined comparables (comparable sales + comparable transactions), each of which we consider critical to our strategic, financial, and operational success. For the combined comparables performance metric, payouts were based on results compared to pre-established targets for performance, directly linking pay to performance. Consistent with our pay for performance philosophy, our pre-tax income and net global unit development metrics did not yield a payout in 2017 since those metrics fell short of threshold performance targets. The Committee sets targets with the objective of providing challenging yet reasonably achievable goals. The 2017 MIP results reflect the rigor of our performance targets. |

|

· |

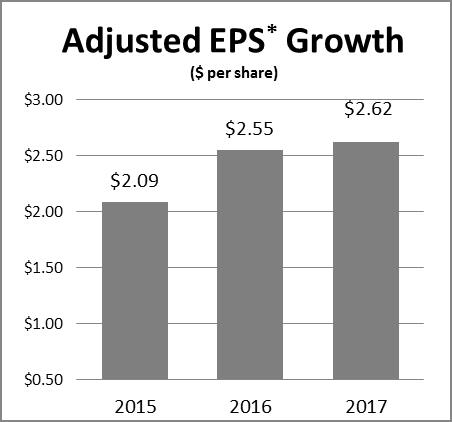

Granting performance‑based restricted stock units (“performance-based units”) that pay out only if the Company achieves targeted goals over three years on three key metrics: domestic system comparable sales, international system comparable sales, and net global unit openings. These metrics are the primary drivers of the Company’s business, and the targeted goals align with our strategic plan, align the interests of executives with long-term value creation and promote retention. Payouts under these awards are also subject to a threshold achievement of EPS growth. Payments under the performance-based unit plan for the three-year period ending at 2017 fiscal year end yielded a 66% payout. |

|

· |

Granting both stock option and restricted stock awards that vest over a period of years, tying executive compensation to long‑term service and the creation of long‑term stockholder value. Award levels are tied to individual performance and individual success in driving results. |

The Committee believes the executive compensation structure has been effective in achieving sound financial and operating results in a challenging operating environment.

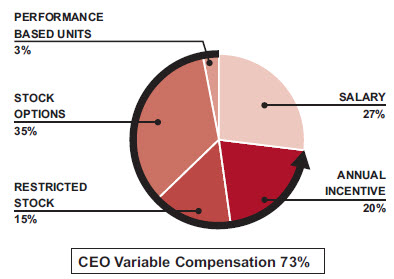

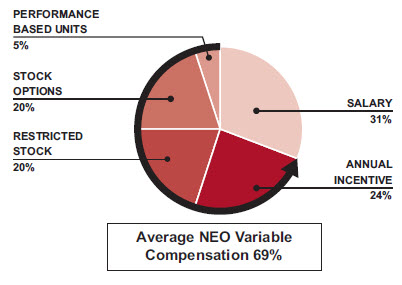

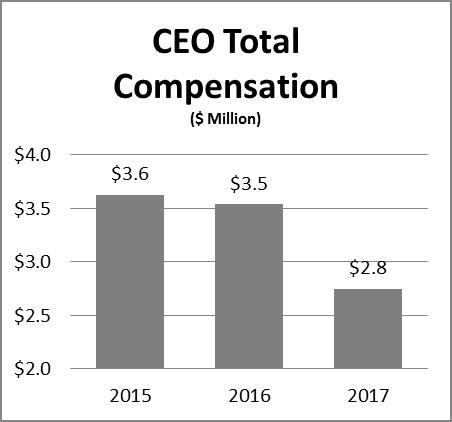

Consistent with our “pay for performance” compensation philosophy, executives with the greatest potential to impact the Company’s success receive a greater proportion of variable compensation. The Company believes that placing a heavier

2018 Proxy Statement 17

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS

emphasis on “at-risk” or variable compensation focuses the NEOs on achieving the Company’s strategic and performance objectives. For 2017, 73% of our CEO’s compensation and 69% of our other NEOs’ compensation was tied to specific performance objectives or appreciation in our stock price.

|

|

|

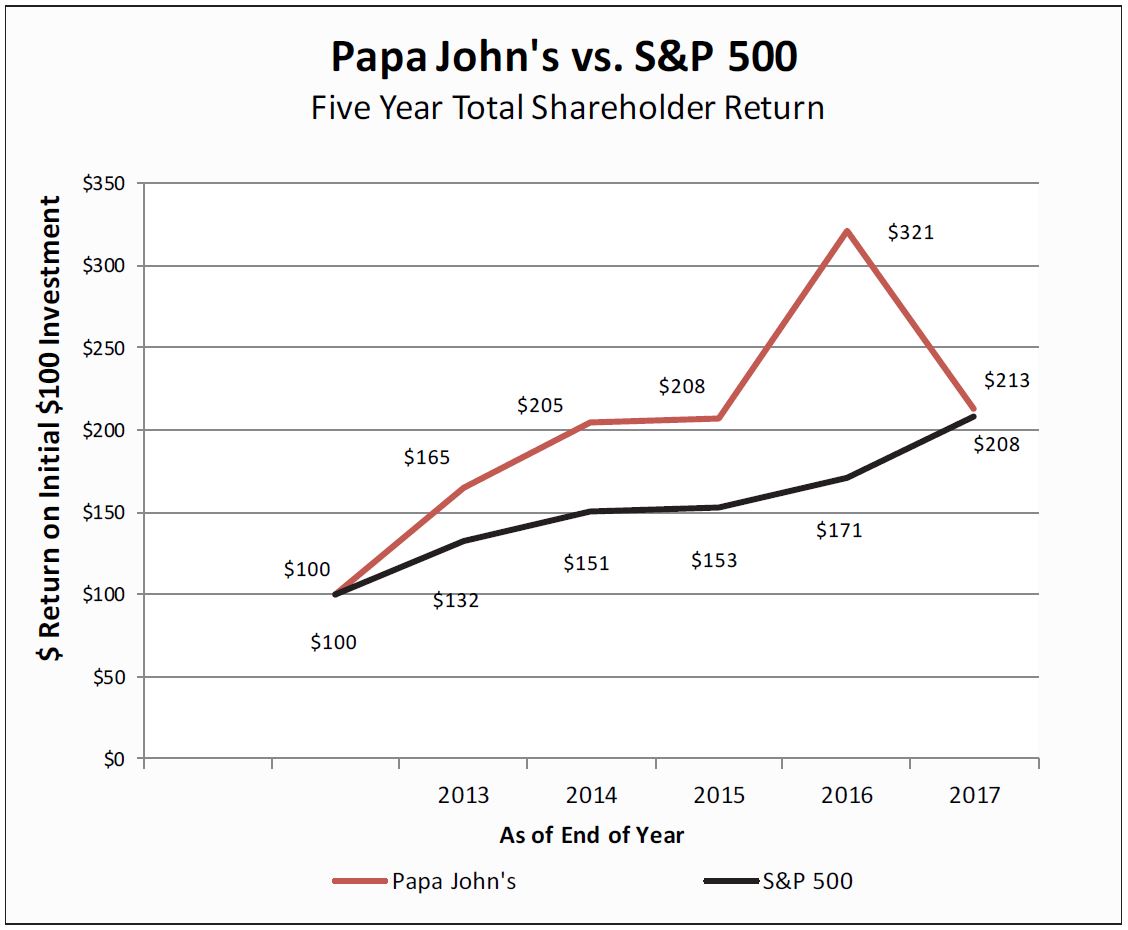

Over the five-year period ending December 31, 2017, Papa John’s has delivered total shareholder return of 113%, with an annual compound shareholder return of 16% during that same period. A $100 investment in Papa John’s at the beginning of 2013 would have grown to $213 at the end of 2017 (assuming reinvestment of dividends).

18 2018 Proxy Statement

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS

Stockholder Input/Say‑on‑Pay Vote

The Company considers input from stockholders, including the results of the annual advisory vote on executive compensation (“say‑on-pay proposal”), in determining compensation for our NEOs. At our 2017 annual meeting of stockholders, 99% of the votes cast were in favor of the say‑on‑pay proposal. Stockholders’ overwhelming support of our executive compensation program with respect to the NEOs was one of many factors the Committee considered in determining compensation for our NEOs, and in particular was a factor in not making significant changes to the program. The Compensation Committee will continue to consider the outcome of the Company’s say‑on‑pay votes when making future compensation decisions for the NEOs.

Governance Aspects of Our Executive Compensation Program

Consistent with stockholder interests and market best practices, our executive compensation program includes the following sound governance features:

|

· |

No tax “gross‑ups” or “single‑trigger” change of control payments. |

|

· |

No guaranteed bonus or base pay increases. |

|

· |

No repricing or cash buyouts of underwater stock options. |

|

· |

Our annual grants of equity awards for executives and employees provide for a three‑year graded vesting period and performance-based units have a three-year period for full vesting of awards and rolling three-year performance periods. |

|

· |

Our incentive plans provide for the “claw back” of certain compensation payments in the event the Company is required to prepare an accounting restatement, and an executive received a cash or equity award based on the achievement of performance goals that are later determined, as a result of the accounting restatement, not to have been achieved. |

|

· |

Other risk mitigation features include stock ownership requirements, multiple performance metrics to deter excessive focus on a singular performance goal, and limits on quarterly payouts under the MIP, as well as an annual risk assessment by the Compensation Committee. |

|

· |

The Compensation Committee engages an independent compensation consultant. |

|

· |

No dividends or dividend equivalent rights on unexercised stock options or unearned performance‑based units. |

|

· |

No pledging Company stock by executive officers or directors. |

|

· |

No hedging or other derivative transactions in Company stock by executive officers or directors. |

Competitive Compensation

Market pay levels and practices, including those of a self-selected peer group, are among many factors the Compensation Committee considers in making compensation decisions. The market review is intended to provide an external framework on the range and reasonableness of compensation and to ensure we are able to provide competitive compensation needed to attract and retain the caliber of leadership critical to success. The Compensation Committee reviews market data for all pay elements, but does not target NEO compensation with respect to a specific benchmark, such as “median” or “50th percentile.” The Compensation Committee believes that dependence solely on benchmark data can detract from the focus on the performance of the individual NEO and its relation to Company performance.

The Compensation Committee periodically reviews compensation practices of its self-selected peer group, developed in consultation with F. W. Cook, its independent compensation consultant. This peer group, listed below, was used in the 2017 compensation decisions. The Committee believes the companies in the peer group share many characteristics with the Company, including a common industry, similar market capitalization and other financial criteria and are an appropriate group of comparable companies with which we compete for executive talent.

2018 Proxy Statement 19

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS

|

PEER GROUP* |

||||

|

BJ's Restaurants, Inc. |

|

Denny’s Corp. |

|

Panera Bread Company |

|

Brinker International, Inc. |

|

DineEquity, Inc. |

|

Red Robin Gourmet Burgers, Inc. |

|

Buffalo Wild Wings, Inc. |

|

Domino’s Pizza, Inc. |

|

Sonic Corp. |

|

The Cheesecake Factory, Inc. |

|

Dunkin' Brands Group, Inc. |

|

Texas Roadhouse, Inc. |

|

Chipotle Mexican Grill, Inc. |

|

Jack in the Box Inc. |

|

The Wendy’s Company |

|

Cracker Barrel Old Country Store, Inc. |

|

Krispy Kreme Doughnuts, Inc. |

|

|

*BJ’s Restaurants, Inc. and Dunkin’ Brands Group, Inc. replaced CEC Entertainment and Ruby Tuesday, Inc. in the Company peer group in 2017.

Role of Compensation Consultant

The Compensation Committee directly retained F.W. Cook as its independent compensation consultant. F.W. Cook reports directly to the Compensation Committee and does not provide any other services to the Company. The Compensation Committee regularly reviews and assesses F.W. Cook’s independence pursuant to SEC and NASDAQ rules and has determined that the firm is independent and has no conflicts of interest with the Company. The Committee seeks input from F. W. Cook on compensation trends, appropriate peer group companies and market survey data, and specific compensation decisions as discussed in this Compensation Discussion and Analysis.

Role of the CEO in Compensation Decisions

In making 2017 compensation decisions, the Compensation Committee considered input from Mr. Schnatter, who reviewed the performance of the NEOs and other executives (other than himself), provided his recommendations to the Committee on NEO and other executives’ compensation, and provided perspective on the performance of the management team (other than himself). Our Senior Vice President, Human Resources, Chief Financial Officer, and President and Chief Operating Officer also supported the Compensation Committee’s executive compensation process in 2017 and regularly attended portions of Committee meetings at the invitation of the Committee. The Committee reviews and discusses pay decisions related to the CEO in executive session without the CEO present, and in accordance with NASDAQ rules, Mr. Schnatter was not present when his compensation was being discussed or approved.

Effective with his new responsibilities as CEO on January 1, 2018, the Committee expects that Mr. Ritchie will play a similar role as Mr. Schnatter did in 2017 with respect to compensation decisions. The Compensation Committee expects to continue to seek the input of Mr. Schnatter in the Founder Chairman role in making compensation decisions.

Elements and Analysis of 2017 Executive Compensation

In 2017, the Compensation Committee continued its annual practice of reviewing for each NEO the following components of executive compensation, collectively referred to as “total direct compensation”:

|

· |

base salary; |

|

· |

short‑term cash incentives (which may be realized only to the extent quarterly or annual performance targets are met); and |

|

· |

long‑term compensation, consisting of equity‑based incentives (a combination of performance‑based units, time‑based restricted stock, and stock options). |

The Committee’s determination of each NEO’s compensation was based on a qualitative and quantitative review and assessment of many factors, including the individual’s performance, experience, scope of responsibilities, leadership and leadership development, and the importance of the NEO to the successful execution of our strategies.

Target total direct compensation for 2017 approved by the Compensation Committee for each NEO, other than Mr. Schnatter, increased from 2016 due to a number of factors, including succession planning, individual performance, and increased scope of responsibilities. The Compensation Committee believes NEO compensation is appropriate given the Company’s business, relative size, geographic location, scope of responsibilities of the NEOs, and performance. Actual total cash compensation paid was dependent on the achievement of specific performance goals, discussed in detail below,

20 2018 Proxy Statement

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS

while the ultimate value of long‑term equity awards will depend on future stock performance, and in the case of performance‑based units, the achievement of three-year performance goals.

Compensation of our Founder, Chairman and Chief Executive Officer