DEF 14A: Definitive proxy statements

Published on March 20, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant ☒ |

|

|

|

|

|

Filed by a Party other than the Registrant ☐ |

|

|

|

|

|

Check the appropriate box:

|

|

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under §240.14a‑12 |

|

Papa John’s International, Inc. |

||

|

(Name of Registrant as Specified In Its Charter) |

||

|

|

||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||

|

|

||

|

Payment of Filing Fee (Check the appropriate box): |

||

|

☒ |

No fee required. |

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

|

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

Notice of Annual Meeting of Stockholders |

|

Thursday, April 23, 2020 |

Virtual Meeting Site : www.virtualshareholdermeeting.com/PZZA2020 |

Items of Business

|

· |

Election of the ten directors nominated by the Board of Directors named in the attached Proxy Statement; |

|

· |

Ratification of the selection of Ernst & Young LLP as the Company’s independent auditors for 2020; |

|

· |

Advisory approval of the Company’s executive compensation; and |

|

· |

Such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Record Date February 24, 2020

A Proxy Statement describing matters to be considered at the Annual Meeting is attached to this Notice. Only stockholders of record at the close of business on February 24, 2020 are entitled to receive notice of and to vote at the meeting or any adjournment or postponement thereof.

Stockholders are cordially invited to participate in the meeting virtually via our live webcast. Following the formal items of business to be brought before the meeting, we will discuss our 2019 results and answer your questions.

Thank you for your continued support of Papa John’s.

By Order of the Board of Directors,

|

Jeffrey C. Smith |

|

||||||

|

Chairman |

March 20, 2020 |

||||||

|

Internet |

|

Telephone |

|

|

|

Webcast |

|

|

|

|

|

|

|

|

|

Visit the Web site noted on |

|

Use the toll‑free telephone |

|

Sign, date and return your |

|

Participate in the meeting and vote at www.virtualshareholdermeeting.com/PZZA2020 |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 23, 2020 — this Proxy Statement and the Papa John’s 2019 Annual Report are available at www.papajohns.com/investor.

|

To Fellow Stockholders: |

||

|

|

||

|

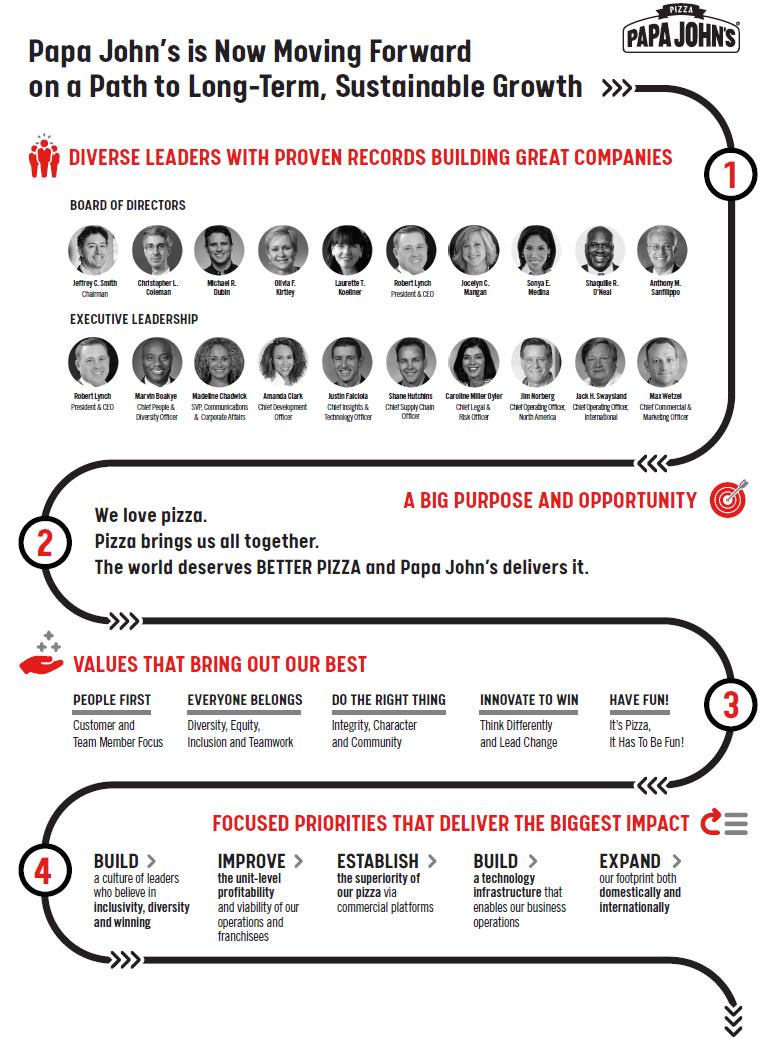

I made a large investment in Papa John’s in 2019 and joined the board as Chairman. Papa John’s is my favorite pizza in the category with a truly differentiated Better Ingredients. Better Pizza.® position. The company, however, was having an acute challenge with a need for a catalyst to jump start its re-invigoration. Thanks to the incredible passion, talent, and partnership of our team members and franchisees, we are moving further and faster than we could have expected.

When I joined the board in 2019, we needed to strengthen and diversify the company’s leadership. The company added five new directors to the board in 2019, who bring talent and perspective from different backgrounds. A significant milestone for Papa John’s is our partnership with Shaquille O’Neal, who has joined as a brand ambassador, franchisee, and member of our board of directors. The positive impact across our franchise system and on our stakeholders has been remarkable.

Leadership is critical for any company and even more so for a company in transition. We were fortunate to identify and recruit a proven restaurant industry leader and transformational CEO in Rob Lynch. Rob has the right brand, marketing, business experience, and track record for Papa John’s. Most notably, Rob has experience in his prior role as a key architect of the turnaround of Arby’s. He is having an immediate and positive impact on our brand, our products, our team members, our franchisees, and our customers.

Under Rob’s leadership, we have strengthened and streamlined the management team. We are rebuilding our culture, refocusing on the profitability of our restaurants, reinforcing the quality of our pizza and using innovation to engage customers and drive sales. I am passionate and excited about this innovation. Our fresh, never-frozen original dough, made from six simple ingredients, is amazing. We are just beginning to innovate on this dough to create tasty product extensions that increase our menu variety without adding operational complexity. Our product roadmap is exciting and delicious. |

|

As you can tell, I am excited about our positioning and excited about the future. Papa John’s is a great brand, with amazing products, fantastic team members and franchisee partners, and a delicious plan for the future. We are beginning 2020 ready to deliver continued progress. Looking beyond and considering the key trends driving growth in the global food and restaurant industry – quality, convenience, service – I believe Papa John’s is well positioned.

On behalf of the Papa John’s Board and management team, I thank you for your continued support.

Sincerely,

Jeffrey C. Smith Chairman of the Board |

|

To Our Stockholders, Team Members, Franchisees and Customers: |

||

|

|

||

|

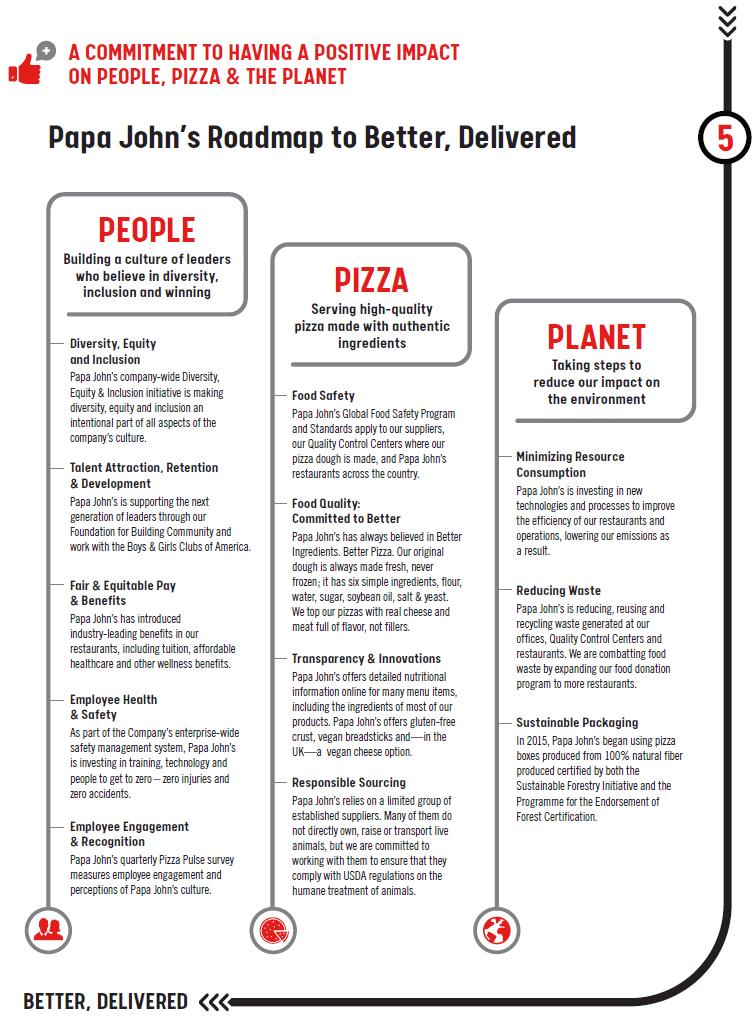

Last August I was asked to join the Papa John’s team as CEO and President, an opportunity I accepted with great excitement and humility. Leading a company with a history of delivering high-quality pizza and creating tremendous stakeholder value is a dream come true for me. I have a passion for pizza. Besides being delicious, convenient, and a great value, pizza is a food that is shared with friends and family. Pizza brings people together and Papa John’s delivers Better Ingredients. Better Pizza. – with fresh, never-frozen original dough and fresh toppings. Building on this history, I believe Papa John’s can be the best pizza delivery company in the world for the benefit of all of our stakeholders – our team members, customers, franchisees and stockholders. Here’s what we’re doing to achieve this: First, we are building a culture of leaders who believe in diversity, inclusivity and winning. A culture where everyone belongs helps us attract and retain talent in a highly competitive environment. It encourages innovation that reflects the increasing diversity of our customers, domestically and globally. It allows team members at all levels in the organization to take pride and ownership in their contributions and step forward to do the right thing. We have initiated multiple major corporate initiatives over the past year to continue improving the culture at Papa John’s. Some examples are our partnership with Purdue University Global to give employees free or reduced college tuition and our affordable healthcare plans for hourly team members; the launch of The Papa John’s Foundation for Building Community; our inaugural Day of Service with Boys and Girls Clubs of America; and the creation of multiple Employee Resource Groups. As a result of the leadership and hard work of our LGBTQ Employee Resource Group, Papa John’s recently earned a 90% score on the 2020 Corporate Equality Index for LGBTQ workplace equality. This was the first year Papa John’s was ranked in the survey, and we scored higher than our competitors in the pizza category and higher than many in the restaurant industry. Second, Papa John’s is returning to what made the brand great. All pizza is not created equal. In a sea of pizza sameness, we have BETTER INGREDIENTS. BETTER PIZZA. To realize this differentiated opportunity, we have begun thinking differently and holistically about our products, menus, marketing, apps and digital channels. This is already having an impact on sales and results. Since arriving at the company, my mandate for Papa John’s product and marketing teams has been simple: innovate and share our story with the many pizza lovers of the world in a unique and compelling way. Our team is delivering. Last November, we launched Garlic Parmesan Crust – our first-ever innovation on our signature fresh dough – followed this February by Papadias – a toasted, hand-held alternative to sandwiches, and an entirely new product |

|

platform for the company. Both new products were introduced with fresh advertising that brings the quality of our food to life and establishes a new voice for the brand. In today’s marketplace, high-quality products require high-quality service, another reason for our commitment to a culture that inspires our team members to deliver great service to our customers. Third, we have committed ourselves to achieving top-tier unit-level economics by driving restaurants’ sales growth and taking cost and complexity out of their operations. In 2019, we began to see improvements and there’s still much more opportunity. This is critical because the Papa John’s brand will succeed and grow in the long term only if our franchisees succeed too. Fourth, we are committed to driving long-term earnings growth for the benefit of our stockholders. We had the highest total stockholder return amongst our peer group (as defined in the attached proxy statement) in 2019 and we will continue to get better. Papa John’s has multiple opportunities to improve productivity and drive operating leverage for faster earnings growth. We are now in the process of building a multi-year roadmap to guide this journey. I’m optimistic about the future of Papa John’s, with a more inclusive culture, a path to a more differentiated brand, improving unit economics and an outlook for strong long-term earnings growth. Due to the coronavirus outbreak, we are holding a virtual annual meeting. That being said, we want our shareholders to know that our delivery and carryout business model positions us to continue to serve our communities as we all navigate this difficult situation, and we will continue protocols to provide for the safety of employees and our customers. Thank you for your continued support. Sincerely,

Rob Lynch, President and CEO |

|

1 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

3 |

|

|

3 |

|

|

4 |

|

|

4 |

|

|

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

|

|

10 |

|

|

10 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

16 |

|

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS |

20 |

|

31 |

|

|

33 |

|

|

34 |

|

|

35 |

|

|

36 |

|

|

37 |

|

|

39 |

|

|

40 |

|

|

43 |

|

|

43 |

|

|

43 |

|

|

43 |

|

|

45 |

|

|

ITEM 2. RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORS |

47 |

|

ITEM 3. ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION |

49 |

The Board of Directors (the “Board”) of Papa John’s International, Inc. (the “Company”) is soliciting proxies for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually at 11:00 a.m. Eastern Time on April 23, 2020, and at any adjournment or postponement of the meeting. We have adopted a virtual format for our Annual Meeting to provide a consistent experience to all shareholders regardless of location, and to support the health and well-being of our employees and stockholders due to the emerging public health impact of the coronavirus outbreak (COVID-19) . We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/PZZA2020. An audio recording of the entire Annual Meeting will be available on the Papa John’s Investor Relations website after the meeting. This Proxy Statement and the enclosed proxy card are first being mailed or given to stockholders on or about March 20, 2020.

At the Annual Meeting, stockholders will be asked to vote on the matters outlined in the Notice of Annual Meeting of Stockholders. These include the election of ten directors to the Board; the ratification of the selection of Ernst & Young LLP (“EY”) as the Company’s independent auditors for 2020; and an advisory approval of the Company’s executive compensation.

This year's Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder as of the close of business on February 24, 2020 or if you hold a valid proxy for the Annual Meeting.

You will be able to participate in the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/PZZA2020. You also will be able to vote your shares electronically at the annual meeting (other than shares held through the Papa John’s International, Inc. 401(k) Plan, which must be voted at least three days prior to the meeting).

To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

The meeting webcast will begin promptly at 11:00 a.m. Eastern Time on April 23, 2020. Online access will begin at 10:45 a.m. Eastern Time, and we encourage you to access the meeting prior to the start time.

We will also make the Annual Meeting accessible to anyone who is interested, including team members and other constituents, by visiting the same link at www.virtualshareholdermeeting.com/PZZA2020. Non-stockholder guests will not be permitted to vote or submit questions at the Annual Meeting.

Submitting questions at the Annual Meeting

You can submit questions electronically at the Annual Meeting during the webcast. During the live Q&A session of the meeting, members of our executive leadership team and our Chairman of the Board will answer questions as they come in, as time permits. To ensure the meeting is conducted in a manner that is fair to all stockholders, the Chairman (or such other person designated by our Board) may exercise broad discretion in recognizing stockholders who wish to participate, the order in which questions are asked and the amount of time devoted to any one question. However, we reserve the right to edit or reject questions we deem profane or otherwise inappropriate. Detailed guidelines for submitting written questions during the meeting are available at www.virtualshareholdermeeting.com/PZZA2020.

If you have technical difficulties or trouble accessing the virtual meeting

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting or during the meeting time, please call:

800-586-1548 (toll-free)

303-562-9288 (international)

2020 Proxy Statement 1

Principles of corporate governance that guide the Company are set forth in the Company’s Board committee charters, the Company’s Corporate Governance Guidelines and the Company’s Code of Ethics and Business Conduct, all of which are available on our website at www.papajohns.com by first clicking “Investor Relations” and then “Corporate Governance.” (The information on the Company’s website is not part of this Proxy Statement and is not soliciting material.) The principles set forth in those governance documents were adopted by the Board to ensure that the Board is independent from management, that the Board adequately oversees management, and to help ensure that the interests of the Board and management align with the interests of the stockholders. The Board annually reviews its corporate governance documents.

Majority Voting Standard for Director Elections

Our Amended and Restated By-laws (the “By-laws”) provide for a majority voting standard for uncontested director elections and a mechanism for consideration of the resignation of an incumbent director who does not receive a majority of the votes cast in an uncontested election. Under the majority voting standard, a majority of the votes cast means that the number of shares voted “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee. In contested elections where the number of nominees exceeds the number of directors to be elected, the vote standard will be a plurality of votes represented in person or by proxy and entitled to vote on the election of directors. In addition, if an incumbent director is nominated in an uncontested election, the director nominee is required, as a condition of the director’s nomination, to submit an irrevocable letter of resignation to the Chairman of the Board. If an incumbent director nominee does not receive a majority of the votes cast, the Corporate Governance and Nominating Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Committee’s recommendation and publicly disclose its decision and the rationale behind the decision within 90 days from the date of certification of the election results. The director whose resignation is being considered will not participate in the recommendation of the Committee or the Board’s decision.

Code of Ethics and Business Conduct

The Company’s Code of Ethics and Business Conduct, which is the Company’s code of ethics applicable to all directors, officers and employees worldwide, embodies the Company’s global principles and practices relating to the ethical conduct of the Company’s business and its longstanding commitment to honesty, fair dealing and full compliance with all laws affecting the Company’s business.

The Board has established procedures for any person, including a team member, to submit confidential and anonymous reports of suspected or actual violations of the Company’s Code of Ethics and Business Conduct relating, among other things, to:

|

· |

violations of the federal securities laws; |

|

· |

fraud or error in the Company’s accounting, audit or internal controls, financial statements and records; or |

|

· |

misconduct by any member of the Company’s senior management. |

The procedures for reporting issues and concerns may be found on our website at www.papajohns.com, by first clicking “Investor Relations” and then “Corporate Governance.”

The Board has determined that eight of the Company’s ten current directors are “independent” as defined by applicable law and NASDAQ listing standards, as follows: Christopher L. Coleman, Michael R. Dubin, Olivia F. Kirtley, Laurette T. Koellner, Jocelyn C. Mangan, Sonya E. Medina, Anthony M. Sanfilippo and Jeffrey C. Smith. Each of our Audit, Compensation, and Corporate Governance and Nominating committees is comprised only of independent directors, as identified below under the heading “Committees of the Board of Directors.”

Robert M. Lynch is not independent because he serves as President and Chief Executive Officer of the Company. Shaquille O’Neal is not an independent director because he is a franchisee of the Company and a brand ambassador of the Company as described under “Transactions with Related Persons” below.

2 2020 Proxy Statement

CORPORATE GOVERNANCE

Ms. Kirtley is a member of the board of directors of U.S. Bancorp. We have a banking relationship with U.S. Bancorp that predates Ms. Kirtley’s appointment to the U.S. Bancorp board of directors. Ms. Kirtley is also a member of the board of directors of Delta Dental, the Company’s dental insurance carrier. The Board reviewed these relationships and determined that they do not impact Ms. Kirtley’s independence or her business judgment.

Pursuant to our Insider Trading Compliance Policy, we prohibit employees, officers and directors from pledging any Company securities as collateral for a loan, or from holding any Company securities in a margin account. This policy also prohibits employees, officers and directors from entering into hedging transactions involving Company securities, including purchasing financial instruments such as prepaid variable forwards, equity swaps, collars, exchange funds and similar transactions. Hedging transactions means any transaction that hedges or offsets, or is designed to hedge or offset, any decrease in the market value of Company securities. Notwithstanding this restriction, pursuant to the terms of the Securities Purchase Agreement, dated as of February 3, 2019 (the “Securities Purchase Agreement”), by and among the Company and certain funds affiliated with, or managed by, Starboard Value LP (collectively, “Starboard”), Starboard is expressly permitted to pledge Company securities acquired under the Securities Purchase Agreement. As Chief Executive Officer of Starboard Value LP, our Chairman, Jeffrey C. Smith, may be deemed to beneficially own the securities owned by Starboard. Mr. Smith expressly disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein.

Board Leadership Structure and Risk Management

Under our Corporate Governance Guidelines, our Board elects a Chairman of the Board with the duties set forth in our By-laws. When the position of Chairman of the Board is not held by an independent director, the independent directors will elect a Lead Independent Director. Jeffrey C. Smith, our current Chairman, is independent; accordingly, we do not currently have a Lead Independent Director.

Our Board has three standing committees — the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee. In addition, the Board had two other committees during a part of 2019 that have since been dissolved. A Special Committee of the Board consisting solely of independent directors was formed in July 2018 with various responsibilities related to the evaluation of a range of strategic options for the Company, among other matters. The Special Committee was dissolved on April 30, 2019 following the conclusion of its work. A Marketing Committee was formed on April 11, 2019 to assist the Board in overseeing the Company’s marketing activity. Michael Dubin served as Chairman with Jocelyn Mangan and Shaquille O’Neal sitting as members. It was dissolved as of the end of the 2019 fiscal year. Each of the current Board committees is comprised solely of independent directors, with each of the committees having a separate chairman. See “Committees of the Board of Directors” below for a description of each of these Board committees and its members. The key responsibilities of the Board include developing the strategic direction for the Company and providing oversight for the execution of that strategy by management. The Board has an active role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s financial, strategic and operational issues, as well as the risks associated with each, and that oversight includes a thorough and comprehensive annual review of the Company’s strategic plan. At the committee level, risks are reviewed and addressed as follows:

|

· |

The Audit Committee oversees management of financial risks, legal and regulatory risks, food safety, information technology and cyber security risks, as well as the Company’s Enterprise Risk Management program, reporting on such matters to the full Board. The Audit Committee’s agendas include discussions of individual and emerging risk areas throughout the year, and through its oversight of our Enterprise Risk Management program, the Audit Committee monitors management’s responsibility to identify, assess, manage and mitigate risks. Our Enterprise Risk Management program is comprised of a cross-functional, management-level Enterprise Risk Management team that helps establish a culture of managing and mitigating risk and coordination of risk management between our executive team and the Board. |

|

· |

The Compensation Committee is responsible for overseeing the management of risks relating to the Company’s compensation plans and arrangements and also oversees succession planning. The Compensation Committee reviews our compensation policies and practices to determine whether they subject us to unnecessary or excessive risk. As a result of that evaluation, including a review of the plan design and governance aspects of our compensation programs discussed below in the Compensation Discussion and Analysis, the Compensation Committee concluded that the risks arising from those policies and practices are not reasonably likely to have a material adverse effect on the Company. |

|

· |

The Corporate Governance and Nominating Committee manages risks associated with potential conflicts of interest and reviews governance and compliance issues with a view to managing associated risks, including oversight of our |

2020 Proxy Statement 3

CORPORATE GOVERNANCE

compliance program with respect to our Code of Ethics and Business Conduct and monitoring of risks associated with workplace discrimination and harassment. The Corporate Governance and Nominating Committee also oversees the Company’s initiatives on sustainability and environmental, social and governance matters. |

While each committee is responsible for evaluating and overseeing the management of such risks, the Board is regularly informed through committee reports about such risks. In addition, the Board and the committees receive regular reports from the President and Chief Executive Officer, Chief Financial Officer, Chief Legal and Risk Officer, and other Company officers with roles in managing risks.

Stockholder Engagement in 2019

Our Board of Directors and our management believe it is important to proactively engage with stockholders. In 2019, we requested meetings with and spoke with stockholders collectively holding over a majority of our outstanding common stock. This engagement was conducted by senior decision-makers at the Company, including the Chairman of the Board, the CEO and other members of management.

Areas of particular focus of the engagement included Board composition, CEO succession, human capital and diversity initiatives, sustainability and corporate social responsibility, and business strategy and financial performance. Of note, stockholder engagement contributed to the preparation of our first full sustainability report which will be published during the second quarter 2020.

In addition, we have engaged constructively with the Los Angeles City Employees Retirement System and its counsel at the Los Angeles City Attorney’s Office in response to concerns raised regarding human resources and workplace culture matters. As a result of that engagement, we agreed to enhance our workplace training program related to anti-harassment, anti-discrimination and diversity and inclusion. We also agreed to engage a third party consultant to help us identify ways to further improve our culture of diversity and inclusion. Beginning next year, we will prepare a report regarding our workplace culture and our diversity and inclusion initiatives, which we intend to make available on our website as part of our annual sustainability reporting. We also committed to implement enhancements to our Code of Ethics, Corporate Governance Guidelines, Corporate Governance and Nominating Committee Charter and certain other human resources policies and procedures, designed to further strengthen our anti-discrimination, anti-harassment, and anti-retaliation policies, and otherwise improve our human resources compliance program.

Feedback from stockholders is shared with the Board and the applicable Committees on a regular basis.

Independent Chairman of the Board

Jeffrey C. Smith serves as our independent Chairman of the Board. Our Board believes an independent Chairman provides a strong leadership structure and sound governance in the best interests of the Company and its stockholders, working with the Board, the Company’s Chief Executive Officer and management to establish and further the Company’s strategic objectives. When the position of Chairman of the Board is not held by an independent director, the independent directors will elect a Lead Independent Director, with the duties described in the Company’s Corporate Governance Guidelines.

Meetings of the Board of Directors

The Board held sixteen meetings in 2019. Each director attended at least 75% of the meetings of the Board and the Board committees on which he or she served during the period of service in 2019, except for Shaquille O’Neal, who was unable to attend several board meetings due to prior business and broadcasting commitments made prior to Mr. O’Neal’s appointment to the Board, which could not be rescheduled. The Company and Mr. O’Neal do not expect these scheduling conflicts to recur in 2020.

Meetings of the Independent Directors

At both the Board and committee levels, the Company’s independent directors meet in regular executive sessions in which members of management do not participate. These sessions typically occur in conjunction with regularly scheduled Board or committee meetings. The Chairman of the Board currently chairs executive sessions of the Board. If the position of Chairman is not held by an independent director, the Lead Independent Director will chair such executive sessions.

4 2020 Proxy Statement

CORPORATE GOVERNANCE

Annual Meetings of Stockholders

The Company does not have a policy regarding director attendance at the Annual Meeting, but we encourage each of our directors to attend each Annual Meeting of the Company’s stockholders whenever attendance does not unreasonably conflict with the director’s other business and personal commitments. Ten directors attended the 2019 Annual Meeting.

Committees of the Board of Directors

The Board has three standing committees to facilitate and assist the Board in the execution of its responsibilities: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. In accordance with NASDAQ listing standards, all of the standing committees are comprised solely of independent directors. Charters for each of our standing committees are available on the Company’s website at www.papajohns.com by first clicking on “Investor Relations” and then “Corporate Governance.” The charter of each standing committee is also available in print to any stockholder who requests it.

Audit Committee

|

Members: Laurette T. Koellner (Chairman) Olivia F. Kirtley Jocelyn C. Mangan Meetings in Fiscal 2019: 12 |

|

The Audit Committee’s purpose is to assist the Board in fulfilling its oversight responsibilities for the accounting, financial reporting and internal control functions of the Company and its subsidiaries. The Audit Committee is responsible for the appointment, compensation and retention of the independent auditors and oversees the performance of the internal auditing function and the Company’s compliance program with respect to legal and regulatory requirements and risk management. The Audit Committee meets with management and the independent auditors to review and discuss the annual audited and quarterly unaudited financial statements, reviews the integrity of our accounting and financial reporting processes and audits of our financial statements, and prepares the Audit Committee Report included in this Proxy Statement. The responsibilities of the Audit Committee are more fully described in the Audit Committee’s Charter. Each member of the Audit Committee is independent as determined by the Board, based upon applicable laws and regulations and NASDAQ listing standards. In addition, the Board has determined that each of Ms. Koellner and Ms. Kirtley is an “audit committee financial expert” as defined by Securities and Exchange Commission (“SEC”) rules. |

|

|

Compensation Committee

|

Members: Anthony M. Sanfilippo (Chairman) Christopher L. Coleman Sonya E. Medina Meetings in Fiscal 2019: 13 |

|

The Compensation Committee oversees the Company’s compensation programs and is responsible for overseeing and making recommendations to the Board regarding the Company’s overall compensation strategies and succession planning. Specifically, the Compensation Committee reviews and approves annually the compensation of the Company’s executive officers, including the executive officers named in the Summary Compensation Table below (our “named executive officers” or “NEOs”). The Committee has the authority to administer our equity plans and is responsible for all determinations with respect to participation, the form, amount and timing of any awards to be granted to any such participants, and the payment of any such awards. In addition, the Committee is responsible for recommending stock ownership guidelines for the executive officers and directors, for recommending the compensation and benefits to be provided to non-employee directors, and for reviewing and approving the establishment of broad-based incentive compensation, equity based, and retirement or other material employee benefit plans. The Committee also reviews risks, if any, created by the Company’s compensation policies and practices and provides recommendations to the Board on compensation related proposals to be considered at the Annual Meeting.

|

2020 Proxy Statement 5

CORPORATE GOVERNANCE

|

|

|

The Committee has the authority to retain compensation consultants, outside counsel and other advisers. The Committee has engaged Frederick W. Cook & Company (“FW Cook”) to advise it and to prepare market studies of the competitiveness of components of the Company’s compensation program for its senior executive officers, including the named executive officers. FW Cook does not provide any other services to the Company. The Committee performed an assessment of FW Cook’s independence to determine whether the consultant is independent and, based on that assessment, determined that the firm’s work has not raised any conflict of interest and the firm is independent. See “Compensation Discussion and Analysis” for a further description of the Compensation Committee’s use of FW Cook during 2019, as well as the role of our executive officers in determining or recommending the amount or form of compensation paid to our named executive officers during 2019, and the Committee’s process in setting compensation. The responsibilities of the Compensation Committee are more fully described in the Committee’s Charter. |

|

|

Corporate Governance and Nominating Committee

|

|

|

|

|

Members: Christopher L. Coleman (Chairman) Sonya E. Medina Anthony M. Sanfilippo Meetings in Fiscal 2019: 14 |

|

The Corporate Governance and Nominating Committee assists the Board in identifying qualified individuals for service as directors of the Company and as Board committee members, evaluates incumbent directors before recommending renomination, and recommends all such approved candidates to the Board for appointment or nomination to the Company’s stockholders. The Corporate Governance and Nominating Committee selects as candidates for appointment or nomination individuals of high personal and professional integrity and ability who can contribute to the Board’s effectiveness in serving the interests of the Company’s stockholders. The Corporate Governance and Nominating Committee recommended the nomination of ten directors for election to the Board at the Annual Meeting. In addition, the Committee develops and monitors the process for evaluating Board effectiveness, oversees the development and administration of the Company’s corporate governance policies and the Company’s compliance program with respect to the Company’s Code of Ethics and Business Conduct. It also reviews and approves matters pertaining to possible conflicts of interest and related person transactions. See the discussion under “Approval of Related Person Transactions” below. The Committee oversees the Company’s commitment to corporate values of diversity, equity and inclusion, the Company’s human resources compliance programs, including policies and procedures, for monitoring discrimination and harassment, and the Company’s initiatives on sustainability and environmental, social and governance matters. The responsibilities of the Corporate Governance and Nominating Committee are more fully described in the Committee’s Charter. |

Sustainability, Environmental and Social

At Papa John’s, we believe that people are our most important ingredient, and we are dedicated stewards of our communities and the environment. As noted above, the Corporate Governance and Nominating Committee has been tasked with overseeing the Company’s commitment to corporate values of diversity, equity and inclusion and the Company’s initiatives on sustainability and environmental, social and governance matters.

6 2020 Proxy Statement

CORPORATE GOVERNANCE

Diversity, Equity and Inclusion

Our Papa John's family includes 120,000 corporate and franchise team members around the globe, representing all walks of life. We are in communities large and small and are proud to serve customers from all backgrounds, reflecting our Company value of “Everyone Belongs.” Our commitment to diversity, equity and inclusion is rooted in our belief that having a Papa John's family that fully reflects and celebrates the global nature of our brand is the right way to do business.

How we look at our culture is how we create a high-performing Company. We are building a culture of leaders who believe in inclusivity, diversity and winning. Our efforts, led by our Chief People and Diversity Officer, embed our culture in our day-to-day practices through performance, recognition, and innovation.

We are building diversity, equity and inclusion capabilities that integrate our culture and values in daily work and critical processes; improve recruiting and retention capabilities; and enhance training, development and succession planning of talent.

Workplace Health and Safety

As part of the Company’s enterprise-wide safety management system, Papa John’s is investing in training, technology and people to get to zero -- zero injuries and zero accidents -- starting with its newly expanded Global Safety Team.

All Papa John’s team members– from those at our corporate headquarters to those working in our warehouses and restaurants – receive annual safety training based on the requirements of their roles. Both Quality Control Centers and restaurant operations undergo annual safety audits, as well as random observations by regional safety managers and field safety coordinators.

Human Rights

We strive for the highest standards of integrity and human rights in all of our business activities, including our supply chain. Our standard agreements with key suppliers mandate that each product sold to Papa John's will meet good manufacturing practices requirements applicable wherever the product is manufactured, produced, distributed, transported or stored. In addition to these requirements, which include supplier audits, and as part of our ongoing efforts to achieve and improve our standards of high quality and community responsibility throughout our business, we are incorporating into our standard supply agreements specific prohibitions against suppliers' use of forced labor or facilitation of slavery and human trafficking, including certification, verification and audit procedures, and we strive to ensure Company representatives receive training to support those efforts. Our commitment to human rights is also demonstrated in our Code of Ethics.

Sustainability

Papa John’s is committed to being a good steward of the environment. We have undertaken numerous initiatives related to environmental sustainability, including in the areas of energy savings and recycling. Papa John’s is investing in new technologies and processes to improve the efficiency of our restaurants and commercial operations in several ways. In doing so, we are also lowering our greenhouse gas emissions. Specifically, we have taken the following actions at our Quality Control Centers, restaurants, and corporate headquarters. We have made progress in saving energy throughout our operations, including through the use of installing LED lighting at our restaurants, outfitting power-saving technology in our pizza ovens, and reducing hot water and natural gas use in our Quality Control Centers. We transport our fresh pizza dough from our Quality Control Centers to our restaurants in reusable dough trays. When no longer fit for use, we grind and repurpose the trays, helping to divert more than 80,000 trays – nearly 250,000 pounds – from landfills in 2019.

Stockholders of the Company may communicate with the Board in writing addressed to:

Board of Directors

c/o Corporate Secretary

Papa John’s International, Inc.

P.O. Box 99900

Louisville, Kentucky 40269‑0900

The Secretary will review each stockholder communication. The Secretary will forward to the entire Board (or to members of a Board committee, if the communication relates to a subject matter clearly within that committee’s area of responsibility) each communication that (a) relates to the Company’s business or governance, (b) is not offensive and is legible in form and reasonably understandable in content, and (c) does not merely relate to a personal grievance against the Company or a team member or further a personal interest not shared by the other stockholders generally.

2020 Proxy Statement 7

CORPORATE GOVERNANCE

Identifying Qualified Candidates

The Corporate Governance and Nominating Committee assists the Board in identifying qualified persons to serve as directors of the Company. The Committee evaluates all proposed director nominees, evaluates incumbent directors before recommending renomination, and recommends all approved candidates to the Board for appointment or nomination to the Company’s stockholders.

The Corporate Governance and Nominating Committee expects qualified candidates will have high personal and professional integrity and ability and will be able to contribute to the Board’s effectiveness in serving the interests of the Company’s stockholders. The Committee considers diversity in its nomination of directors to the Board, and in its assessment of the effectiveness of the Board and its committees. In considering diversity, the Corporate Governance and Nominating Committee looks at a range of different personal factors in light of the business, customers, suppliers and employees of the Company. The range of factors includes diversity of race, ethnicity, gender, age, cultural background and personal background. The Committee considers skills and experience, such as prior board service, financial expertise, international experience, industry experience, technology experience and leadership skills, including prior management experience. In addition, the Committee also considers qualifications that include: independence, judgment, integrity, the ability to commit sufficient time and attention to Board activities, and the absence of potential conflicts with the Company’s interests. The Committee considers these criteria in the context of the perceived needs of the Board as a whole and seeks to achieve and maintain the diversity of the Board. Although the Board does not establish specific goals with respect to diversity, the overall diversity of the Board is a significant consideration in the nomination process. Half of our Board nominees for election at the Annual Meeting are diverse based on gender or ethnicity, and the Board’s collective experience covers a range of experience across different countries and industries. The Corporate Governance and Nominating Committee also considers the length of service of the Company’s Board members, balancing the value of long-standing Board service with the perspective of directors more recently joining the Board.

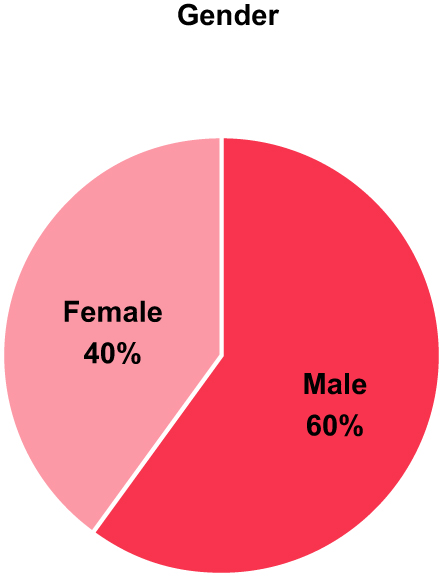

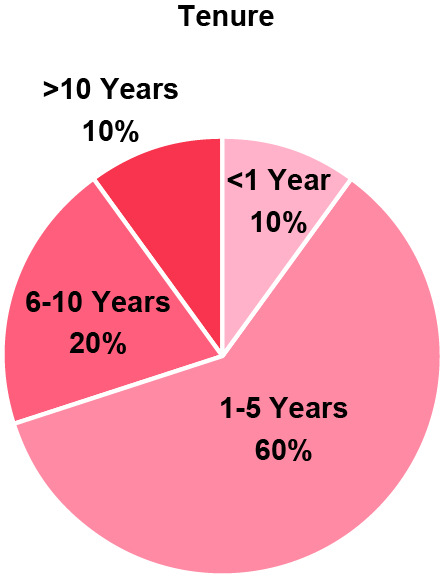

The charts below illustrate the composition of our nominees by gender and tenure:

The Corporate Governance and Nominating Committee reports regularly to the full Board on its assessment of the composition and functioning of the Board. The Company has focused on assembling a group of Board members who collectively possess the skills and experience necessary to oversee the business of the Company, structure and oversee implementation of the Company’s strategic plan and maximize stockholder value in a highly competitive environment. The Board undertook a significant refreshment process leading up to the 2019 Annual Meeting to enhance the skills and capabilities of the Board, which resulted in the addition of four new independent directors and Mr. O’Neal to the Board during 2019.

The Corporate Governance and Nominating Committee will consider candidates for election to the Board recommended by a stockholder in accordance with the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) and will do so in the same manner as the Committee evaluates any other properly recommended nominee. Any nomination by a stockholder of a person for election to the Board at an annual meeting of stockholders, or a special meeting of stockholders called by the Board for the purpose of electing directors, must be received at the Company’s principal offices not less than 60 days nor more than 90 days prior to the scheduled date of the meeting and must comply with certain other requirements set forth in the Company’s Certificate of Incorporation. However, if less than 70 days’ notice of the date of the annual meeting is given, notice by the stockholder must be received no later than 10 days following the earlier of (i) the day on which such notice of the date of the meeting was mailed or (ii) the day on which public disclosure of the date of the meeting was made by the Company.

8 2020 Proxy Statement

CORPORATE GOVERNANCE

Nominations must be addressed to the Chairman of the Corporate Governance and Nominating Committee in care of the Secretary of the Company at the Company’s headquarters address listed below and must be received on a timely basis in order to be considered for the next annual election of directors:

Chairman of the Corporate Governance and Nominating Committee

c/o Corporate Secretary

Papa John’s International, Inc.

P.O. Box 99900

Louisville, Kentucky 40269‑0900

Contractual Rights of Starboard to Designate Nominees

In September 2018, the Company, led by the Special Committee, began a process to evaluate a wide range of strategic options with the goal of maximizing value for all stockholders and serving the best interests of the Company’s stakeholders. As a result of this strategic review, on February 3, 2019, the Company entered into the Securities Purchase Agreement with Starboard pursuant to which Starboard made a $250 million strategic investment in the Company’s newly designated Series B Convertible Preferred Stock (the “Series B Preferred Stock”).

As part of that investment, the Board granted to Starboard certain rights related to the Company’s corporate governance, including director designation rights. Pursuant to the Governance Agreement, dated as of February 4, 2019 and amended on March 4, 2019, by and among the Company and Starboard (the “Governance Agreement”), so long as certain criteria are satisfied, including that Starboard satisfies a minimum ownership threshold, the Board has agreed to nominate, recommend, support and solicit proxies for two directors appointed by Starboard (currently Mr. Smith and Mr. Sanfilippo) for election at the Annual Meeting.

The Company also agreed to appoint Mr. Smith as Chairman of the Board pursuant to the Governance Agreement, and agreed that Mr. Sanfilippo would be a member of the Compensation Committee and the Corporate Governance and Nominating Committee.

In addition, during the Standstill Period (as defined below), Starboard has agreed not to (i) nominate or recommend for nomination any person for election as a director at any stockholder meeting, (ii) submit any stockholder proposals for consideration at, or bring any business before, any stockholder meeting or (iii) initiate, encourage or participate in any “vote no,” “withhold” or similar campaign with respect to the Company’s common stock.

Starboard has agreed, from the date of the Governance Agreement until the earlier of (i) the date that is 15 days prior to the deadline for the submission of stockholder nominations for the 2021 annual meeting of stockholders pursuant to the Company’s organizational documents and (ii) the date that is 100 days prior to the anniversary of the Annual Meeting (the “Standstill Period”), to customary standstill restrictions. Such deadlines are the result of Starboard exercising its option in January 2020 to extend its original Standstill Period under the Governance Agreement for one year, and Starboard has one remaining option to continue the Standstill Period for another year. If Mr. Smith is removed as Chairman of the Board during the Standstill Period for any reason other than due to the occurrence of a resignation event (as defined in the Governance Agreement) or his resignation as Chairman of the Board or as a director of the Company, Starboard will have the right to terminate the Standstill Period. The Governance Agreement terminates upon the expiration of the Standstill Period.

2020 Proxy Statement 9

Our By-laws provide that the Board is authorized to fix from time to time the number of directors within the range of three to fifteen members, and currently the Board size is set at ten members. Directors are elected annually to one-year terms and each director nominee has consented to being named in this Proxy Statement and has agreed to serve if elected.

We believe the nominees set forth below possess an appropriate mix of skills, experience, and leadership designed to drive board performance and properly oversee the interests of the Company, including our long-term corporate strategy. Our nominees include eight independent directors (80%), four female directors (40%), and a broad range of professional experience. The nominees also reflect a balanced approach to tenure that will allow the Board to benefit from a mix of newer directors who bring fresh perspectives and seasoned directors who bring continuity and a deep understanding of our complex business.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR.

Set forth below is information concerning the nominees for election, including their principal occupations, business experience, background, key skills and qualifications, and ages as of the date of this Proxy Statement. The key skills and qualifications are not intended to be an exhaustive list of each nominee’s skills or contributions to the Board, but rather the specific skills and qualifications that led to the conclusion that the person should serve as a director for the Company.

Nominees for Election to the Board

|

Christopher L. Coleman |

|

|

|

Age: 51 Director since 2012 Committees: Compensation, Corporate Governance & Nominating (Chairman) |

|

Key Experience and Skills Mr. Coleman’s extensive financial experience and international business acumen provide insight and expertise to the Board in these key areas. Professional Experience Mr. Coleman is based in the UK, where he is Group Head of Banking at Rothschild & Co. He is a Global Partner of Rothschild & Co, Chairman of Rothschild & Co Bank International and also serves on a number of other boards and committees of the Rothschild & Co Group, which he joined in 1989. Mr. Coleman currently serves as a non-executive director of Barrick Gold Corporation (and is a member of its compensation committee and its corporate governance and nominating committee). Mr. Coleman was previously non-executive Chairman of Randgold Resources until the Barrick Gold-Randgold merger on January 1, 2019. |

|

|

|

|

10 2020 Proxy Statement

ITEM 1. ELECTION OF DIRECTORS

2020 Proxy Statement 11

ITEM 1. ELECTION OF DIRECTORS

|

Laurette T. Koellner |

|

|

|

Age: 65 Director since 2014 Committees: Audit (Chairman) |

|

Key Experience and Skills As a former executive of a publicly traded company, Ms. Koellner brings extensive experience to the Board in the areas of complex business operations, finance and accounting, and international business. In addition, she brings extensive corporate governance and compensation experience and insight as a director of other public companies. Professional Experience Ms. Koellner most recently served as Executive Chairman of International Lease Finance Corporation, a subsidiary of American International Group, Inc. (“AIG”) from June 2012 until its May 2014 sale to AerCap Holdings N.V. Ms. Koellner served as President of Boeing International, a division of The Boeing Company, where she held a variety of financial and business leadership roles from 1997 until 2008, including as a member of the Office of the Chairman and Boeing’s Chief Administration and Human Resources Officer. Prior to her time with Boeing, Ms. Koellner spent 19 years at McDonnell Douglas Corp., which merged with The Boeing Company in 1997. Ms. Koellner served as an independent director of Hillshire Brands, Inc. from 2001 to 2014, at which time it was sold to Tyson Foods. She served as an independent director of AIG from 2009 to 2012. She currently serves on the board of directors of Celestica, Inc. (including service as the chairman of its audit committee, and member of its compensation and corporate governance and nominating committees), The Goodyear Tire & Rubber Company (including service as Lead Director and as a member of its compensation and finance committees) and Nucor Corporation (including service as chairman of its audit committee and member of its compensation and corporate governance and nominating committees). |

|

|

|

|

|

Robert M. Lynch |

|

|

|

Age: 43 Director since 2019 |

|

Key Experience and Skills Mr. Lynch brings to the board extensive restaurant industry and marketing experience, leading purpose-driven organizations and high performing teams and growing successful consumer brands. Professional Experience Mr. Lynch was appointed as President and Chief Executive Officer in August 2019. He joined Papa John’s from Arby’s Restaurant Group where he served as President from August 2017, and served as Brand President and Chief Marketing Officer from August 2013 to August 2017. During his time at Arby’s, he led the brand’s dramatic turn-around to strong growth and profitability. Prior to Arby’s, Mr. Lynch served as Vice President of Marketing at Taco Bell. He has more than 20 years combined experience in the quick service restaurant and consumer packaged goods industries, and also held senior roles at HJ Heinz Company and Procter & Gamble. |

|

|

|

|

12 2020 Proxy Statement

ITEM 1. ELECTION OF DIRECTORS

|

Jocelyn C. Mangan |

|

|

|

Age: 48 Director since 2019 Committees: Audit |

|

Key Experience and Skills Ms. Mangan’s extensive experience with technology and product strategy provides insight and expertise to the Board in these key areas. Professional Experience Ms. Mangan is the CEO and Founder of Him For Her, a social enterprise whose aim is to change for-profit boards of directors to include the world’s most talented women. She has served in this capacity since May 2018. Prior to that, Ms. Mangan held positions at Snagajob, serving as its COO from February 2017 to April 2018 and its Chief Product and Marketing Officer from May 2016 to February 2017. From May 2014 to October 2015, Ms. Mangan was SVP of Product at OpenTable. Ms. Mangan currently serves on the board of ChowNow, an online food ordering system and marketing platform. |

|

|

|

|

|

Sonya E. Medina |

|

|

|

Age: 44 Director since 2015 Committees: Compensation, Corporate Governance & Nominating |

|

Key Experience and Skills Ms. Medina has extensive experience in the area of brand management and communications, multi-cultural communities, corporate social responsibility, and diversity, equity, and inclusion. Professional Experience Ms. Medina is a public affairs and communications strategist. Prior to becoming a consultant, she served as Vice President of Community and External Affairs for Silver Eagle Distributors, the nation’s largest distributor of Anheuser-Busch products from 2009 to 2013. Ms. Medina served as a White House commission officer in the capacity of Deputy Assistant to the President for Domestic Policy and Director of Projects to the First Lady from 2001 to 2006 and again in 2008, and as Director of the AT&T Global Foundation from 2006 to 2008. She is active in community and civic affairs, specifically in the area of collaborative partnerships and women and girl leadership issues. She currently serves on the Next Gen Board Leaders Advisory Council. |

|

|

|

|

|

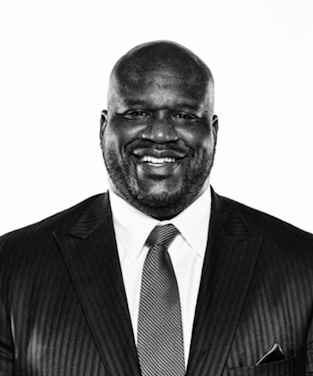

Shaquille R. O’Neal |

|

|

|

Age: 48 Director since 2019 |

|

Key Experience and Skills Mr. O’Neal brings an entrepreneurial background and creative marketing skills to the Board. Professional Experience Mr. O’Neal’s business career includes success in broadcasting, endorsements, music, television and gaming. He has served as an analyst on Inside the NBA since 2011. He has been an investor in franchised and other restaurants since 2010, and actively operates Big Chicken, a fast casual fried chicken restaurant in Las Vegas and Shaquille’s, a fine dining restaurant in Los Angeles. Mr. O’Neal is considered to be one of the most dominant basketball players in NBA history, drafted by the Orlando Magic with the first overall pick in the 1992 NBA draft. His NBA career spanned from 1992 until 2011. He serves on the national board of directors of Communities In Schools, a non-profit devoted to empowering students to stay in school and achieve in life. |

2020 Proxy Statement 13

ITEM 1. ELECTION OF DIRECTORS

|

|

|

|

|

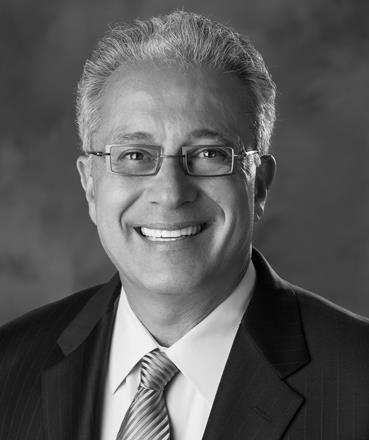

Anthony M. Sanfilippo |

|

|

|

Age: 61 Director since 2019 Committees: Compensation (Chairman), Corporate Governance & Nominating |

|

Key Experience and Skills Mr. Sanfilippo brings extensive operational, strategic and senior leadership experience in the hospitality industry, including casinos, hotels, restaurants and entertainment businesses. Professional Experience Mr. Sanfilippo is the co-founder of Sorelle Capital, Sorelle Entertainment and Sorelle Hospitality, a series of firms focused on investing in and helping entrepreneurs grow companies in hospitality sectors and related real estate ventures. Mr. Sanfilippo most recently served as Chief Executive Officer and a member of the board of directors of Pinnacle Entertainment, Inc., a publicly traded gaming hospitality company with 16 casino locations in ten states across the U.S. from March 2010 until its October 2018 sale to Penn National Gaming. He served as Pinnacle’s chairman of the board from May 2017 until its sale. Prior to joining Pinnacle, Mr. Sanfilippo served as president, Chief Executive Officer and a board member of Multimedia Games Inc., a publicly traded creator and supplier of comprehensive technology systems, content and electronic gaming devices for various segments of the gaming industry. Prior to joining Multimedia Games, he served as division president at Harrah's Entertainment, Inc., currently known as Caesars Entertainment, Inc., including serving as president and chief operating officer for Harrah’s New Orleans and a board member of Jazz Casino Corporation. Mr. Sanfilippo also serves on the board of Tivity Health, Inc. Mr. Sanfilippo was initially appointed to the Board, and has been selected as a director nominee, pursuant to the Governance Agreement.

|

|

|

|

|

14 2020 Proxy Statement

ITEM 1. ELECTION OF DIRECTORS

|

Jeffrey C. Smith |

|

|

|

Age: 47 Director since 2019 Chairman of the Board |

|

Key Experience and Skills Mr. Smith brings extensive experience to the Board as an active change agent investor, having worked with more than 50 different public companies to improve operations, strategy and corporate governance for the benefit of stockholders, including oversight of successful restaurant turnaround and board transformation. Professional Experience Mr. Smith is a Managing Member, Chief Executive Officer and Chief Investment Officer of Starboard Value LP, a New York-based investment adviser with a focused and fundamental approach to investing primarily in publicly traded U.S. companies, which he founded in April 2011, with a spin-off of the existing Value and Opportunity Fund. He currently serves as Chairman of our Board of Directors. From January 1998 to April 2011, Mr. Smith was at Ramius LLC, a subsidiary of the Cowen Group, Inc., where he was a Partner and Managing Director and the Chief Investment Officer of the funds that comprised the Value and Opportunity investment platform. Prior to joining Ramius LLC in January 1998, he served as Vice President of Strategic Development and a director of The Fresh Juice Company, Inc. Mr. Smith began his career in the Mergers and Acquisitions department at Société Générale. Mr. Smith has served as chairman of the board of Advance Auto Parts, Inc. since May 2016. Mr. Smith previously served as chairman of the board of Darden Restaurants, Inc. from October 2014 to April 2016. Mr. Smith was formerly on the boards of Perrigo Company plc from February 2017 to August 2019; Yahoo! Inc from April 2016 to June 2017; Quantum Corporation from May 2013 to May 2015; Office Depot, Inc. from August 2013 to September 2014; Regis Corporation from October 2011 until October 2013; and Surmodics, Inc. from January 2011 to August 2012. Mr. Smith also previously served as chairman of the board of directors of Phoenix Technologies Ltd.; and as a director of Zoran Corporation, Actel Corporation, S1 Corporation, Kensey Nash Corporation, and the Fresh Juice Company, Inc. Mr. Smith was initially appointed to the Board, and has been selected as a director nominee, pursuant to the Governance Agreement. |

There are no family relationships among the Company’s directors and executive officers.

2020 Proxy Statement 15

The following table sets forth certain information as of February 24, 2020 (except as noted otherwise), with respect to the beneficial ownership of our capital stock by (i) each of the named executive officers identified in the Summary Compensation Table in this Proxy Statement, (ii) each director or nominee for director of the Company, (iii) all directors and current executive officers as a group and (iv) each person known to the Company to be the beneficial owner of more than five percent of the outstanding common stock or Series B Preferred Stock.

|

|

|

|

|

Percent of |

|

|

|

|

Amount and Nature of |

|

Common Stock |

|

|

Name of Beneficial Owner |

|

Beneficial Ownership(1)(2) |

|

Outstanding |

|

|

Marvin Boakye |

|

4,519 |

(3) |

* |

|

|

Christopher L. Coleman |

|

35,063 |

|

* |

|

|

Michael R. Dubin |

|

2,587 |

|

* |

|

|

Olivia F. Kirtley |

|

206,295 |

(4) |

* |

|

|

Laurette T. Koellner |

|

29,220 |

(5) |

* |

|

|

Robert M. Lynch |

|

68,461 |

|

* |

|

|

Jocelyn C. Mangan |

|

2,587 |

|

* |

|

|

Sonya E. Medina |

|

17,551 |

|

* |

|

|

Michael R. Nettles |

|

7,546 |

(6) |

* |

|

|

Shaquille R. O'Neal |

|

2,587 |

(7) |

* |

|

|

Caroline Miller Oyler |

|

67,434 |

(8) |

* |

|

|

Steven M. Ritchie |

|

209,185 |

(9) |

* |

|

|

Anthony M. Sanfilippo |

|

7,856 |

(10) |

* |

|

|

Jeffrey C. Smith |

|

5,002,369 |

(11) |

9.99(15) |

% |

|

Joseph H. Smith |

|

35,746 |

(12) |

* |

|

|

C. Max Wetzel |

|

6,696 |

|

* |

|

|

All 18 directors and current executive officers as a group |

|

5,744,327 |

(13) |

17.58 |

% |

*Represents less than one percent of class.

|

|

|

Common Stock Beneficially Owned |

|

Series B Preferred Stock Beneficially Owned |

||||||

|

|

|

Amount and Nature of |

|

Percent |

|

|

Amount and Nature of |

|

Percent |

|

|

Other 5% Beneficial Owners |

|

Beneficial Ownership(1) |

|

Outstanding |

|

|

Beneficial Ownership(1) |

|

Outstanding |

|

|

Starboard Value LP(14) |

|

|

|

|

|

|

|

|

|

|

|

777 Third Avenue, 18th Floor |

|

|

|

|

|

|

|

|

|

|

|

New York, NY 10017 |

|

4,995,003 |

(14) |

9.99(15) |

% |

|

250,000 |

|

99.0 |

% |

|

AllianceBernstein L.P.(16) |

|

|

|

|

|

|

|

|

|

|

|

1345 Avenue of the Americas |

|

|

|

|

|

|

|

|

|

|

|

New York, NY 10105 |

|

3,423,576 |

|

10.7 |

% |

|

|

|

|

|

|

T. Rowe Price Associates, Inc.(17) |

|

|

|

|

|

|

|

|

|

|

|

100 E. Pratt Street |

|

|

|

|

|

|

|

|

|

|

|

Baltimore, MD 21202 |

|

3,272,257 |

|

10.2 |

% |

|

|

|

|

|

|

BlackRock, Inc.(18) |

|

|

|

|

|

|

|

|

|

|

|

55 East 52nd Street |

|

|

|

|

|

|

|

|

|

|

|

New York, NY 10055 |

|

2,574,707 |

|

8.1 |

% |

|

|

|

|

|

|

Jackson Square Partners, LLC(19) |

|

|

|

|

|

|

|

|

|

|

|

101 California Street, Suite 3750 |

|

|

|

|

|

|

|

|

|

|

|

San Francisco, CA 94111 |

|

2,587,767 |

|

8.1 |

% |

|

|

|

|

|

|

The Vanguard Group(20) |

|

|

|

|

|

|

|

|

|

|

|

100 Vanguard Blvd. |

|

|

|

|

|

|

|

|

|

|

|

Malvern, PA 19355 |

|

2,177,946 |

|

6.8 |

% |

|

|

|

|

|

|

John H. Schnatter(21) |

|

|

|

|

|

|

|

|

|

|

|

11411 Park Road |

|

|

|

|

|

|

|

|

|

|

|

Anchorage, KY 40223 |

|

1,946,106 |

|

6.1 |

% |

|

|

|

|

|

|

(1) |

Based upon information furnished to the Company by the named persons and information contained in filings with the SEC. Under SEC rules, a person is deemed to beneficially own shares over which the person has or shares voting or |

16 2020 Proxy Statement

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

investment power or of which the person has the right to acquire beneficial ownership within 60 days. Unless otherwise indicated, the named persons have sole voting and investment power with respect to their shares and such shares are not subject to any pledge. |

|

(2) |

Includes the following shares subject to options exercisable within 60 days after February 24, 2020, and time‑based restricted stock, over which the named persons have sole voting power, and deferred stock units. |

|

|

|

Options |

|

|

|

Director |

|

|

|

Options |

|

|

|

Director |

|

|

|

|

exercisable |

|

Restricted |

|

Deferred |

|

|

|

exercisable |

|

Restricted |

|

Deferred |

|

|

Name |

|

within 60 days |

|

Stock |

|

Stock Units |

|

Name |

|

within 60 days |

|

Stock |

|

Stock Units |

|

|

Marvin Boakye |

|

2,517 |

|

2,002 |

|

— |

|

Michael R. Nettles |

|

7,546 |

|

— |

|

— |

|

|

Christopher L. Coleman |

|

24,819 |

|

694 |

|

2,787 |

|

Shaquille R. O'Neal |

|

— |

|

— |

|

2,587 |

|

|

Michael R. Dubin |

|

— |

|

— |

|

2,587 |

|

Caroline Miller Oyler |

|

37,559 |

|

19,606 |

|

— |

|

|

Olivia F. Kirtley |

|

35,316 |

|

972 |

|

2,787 |

|

Steven M. Ritchie |

|

161,981 |

|

32,739 |

|

— |

|

|

Laurette T. Koellner |

|

16,867 |

|

694 |

|

2,787 |

|

Anthony M. Sanfilippo |

|

— |

|

— |

|

2,985 |

|

|

Robert M. Lynch |

|

— |

|

68,461 |

|

— |

|

Jeffrey C. Smith |

|

— |

|

— |

|

4,777 |

|

|

Jocelyn C. Mangan |

|

— |

|

— |

|

2,587 |

|

Joseph H. Smith |

|

12,599 |

|

20,975 |

|

— |

|

|

Sonya E. Medina |

|

11,556 |

|

694 |

|

2,787 |

|

C. Max Wetzel |

|

— |

|

6,696 |

|

— |

|

|

(3) |

Mr. Boakye also holds units deemed invested in 56 shares of common stock through a deferred compensation plan provided by the Company, which are not included in the shares reported. |

|

(4) |

Ms. Kirtley also holds units deemed invested in 74,109 shares of common stock through a deferred compensation plan provided by the Company, 50,206 of which are distributable in an equivalent number of shares of common stock within 60 days of termination of service on the Board and are included in the shares reported, and 23,903 of which are not included in the shares reported. |

|

(5) |

Ms. Koellner also holds units deemed invested in 3,508 shares of common stock through a deferred compensation plan provided by the Company, all of which are distributable in an equivalent number of shares of common stock within 60 days of termination of service on the Board and are included in the shares reported. |

|

(6) |

Mr. Nettles’ last day of employment with the Company was November 30, 2019. |

|

(8) |

Includes 609 shares held in the Company’s 401(k) Plan. |

|

(9) |

Mr. Ritchie’s last day of employment with the Company was August 27, 2019. |

|

(10) |

Includes 3,000 shares held in a family trust over which Mr. Sanfilippo and his wife serve as trustees. Mr. Sanfilippo also holds units deemed invested in 2,181 shares of common stock through a deferred compensation plan provided by the Company, 1,871 of which are distributable in an equivalent number of shares of common stock within 60 days of termination of service on the Board and are included in the shares reported, and 310 of which are not included in the shares reported. |

|

(11) |

Includes shares of our common stock issuable upon conversion of 250,000 shares of Series B Preferred Stock directly held by Starboard Value and Opportunity Master Fund Ltd, (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard P Fund LP (“Starboard P LP”), Starboard Value and Opportunity Master Fund L LP (“Starboard L Master”) and Starboard Value LP through a managed account (the “Starboard Value LP Account”, and all such entities collectively, the “Starboard Entities”). Mr. Smith, solely by virtue of his position as a member of the Management Committee of Starboard Value GP LLC ("Starboard Value GP"), the general partner of the investment manager of Starboard V&O Fund, and as a member and member of the Management Committee of Starboard Principal Co GP LLC ("Principal GP"), the general partner of the member of Starboard Value GP, may be deemed to beneficially own the securities directly and beneficially owned by Starboard V&O Fund. Mr. Smith, solely by virtue of his position as a member of the Management Committee of Starboard Value GP, the general partner of the manager of Starboard S LLC, and as a member and member of the Management Committee of Principal GP, the general partner of the member of Starboard Value GP, may be deemed to beneficially own the securities beneficially owned by Starboard S LLC. Mr. Smith, solely by virtue of his position as a member of the Management Committee of Starboard Value GP, the general partner of the investment manager of Starboard C LP, and as a member and member of the Management Committee of Principal GP, the general partner of the member of Starboard Value GP, may be deemed to beneficially own the securities beneficially owned by Starboard |

2020 Proxy Statement 17

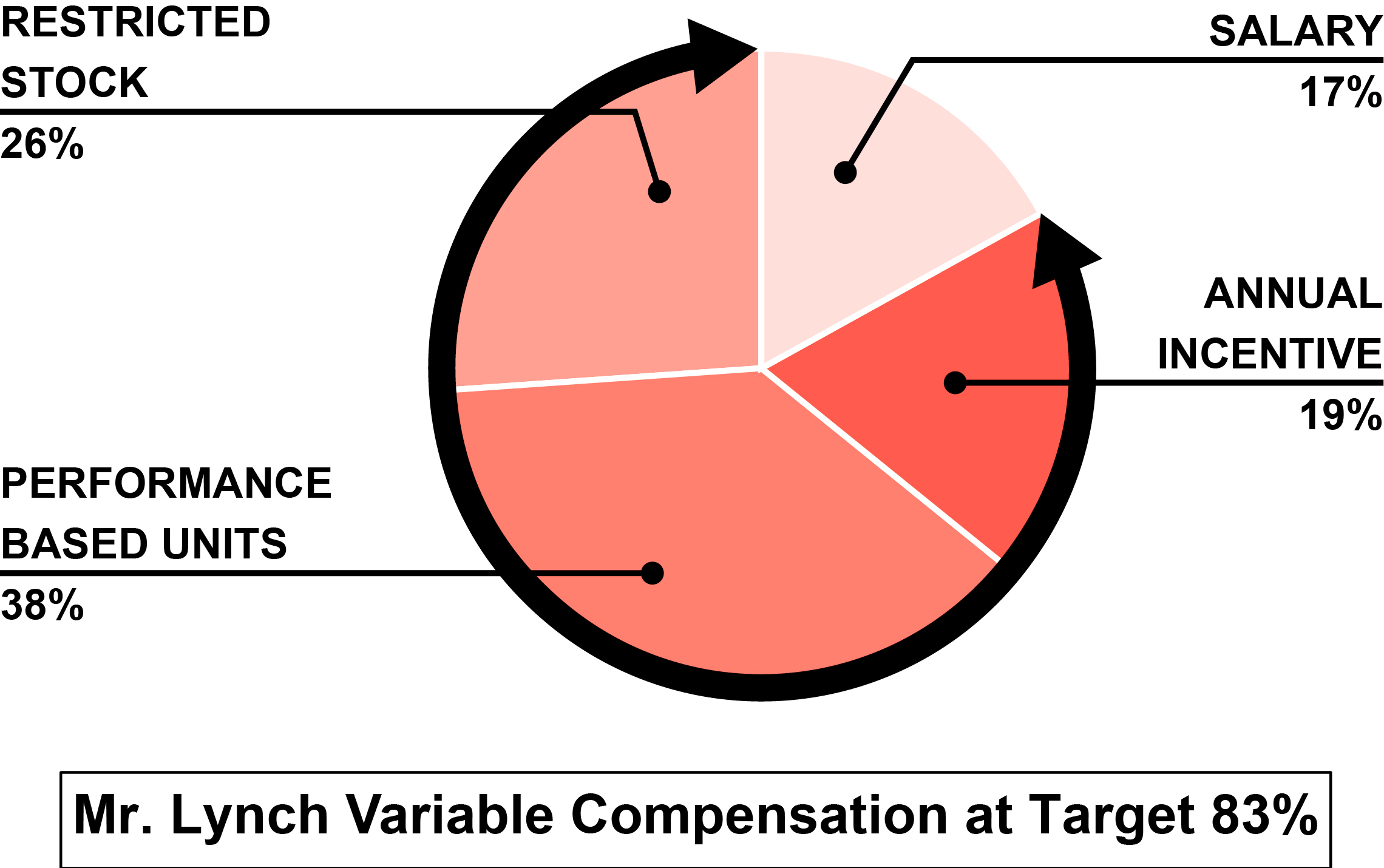

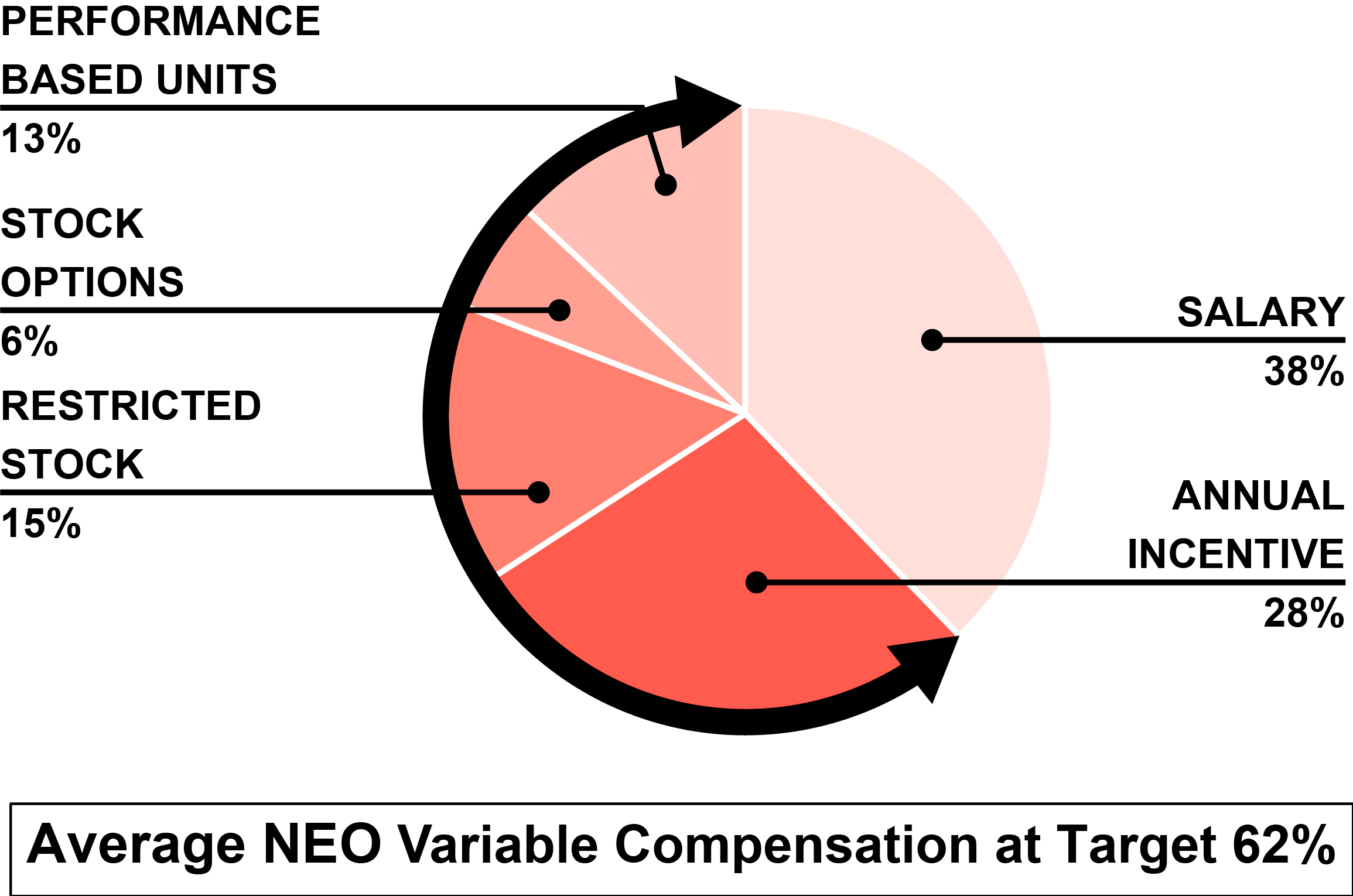

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT