DEF 14A: Definitive proxy statements

Published on March 27, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

| |||||

Filed by a Party other than the Registrant o

| |||||

| Check the appropriate box: | |||||

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| x | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material under §240.14a-12 | ||||

| (Name of Registrant as Specified In Its Charter) | |||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||||

| Payment of Filing Fee (Check the appropriate box): | |||||

| x | No fee required. | ||||

| o | Fee paid previously with preliminary materials. | ||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0 - 11 | ||||

| Notice of Annual Meeting of Stockholders | ||

|

Thursday, May 1, 2025

11:00 a.m. Eastern Time

|

Virtual Meeting Site :

www.virtualshareholdermeeting.com/PZZA2025

|

||||

Items of Business

•Election of the eight directors nominated by the Board of Directors named in the attached Proxy Statement;

•Ratification of the selection of Ernst & Young LLP as the Company’s independent auditors for 2025;

•Approval of an amendment to Papa John's International, Inc.'s 2018 Omnibus Incentive Plan to increase the amount of shares reserved for issuance by 4,900,000 shares;

•Advisory approval of the Company’s executive compensation;

•A stockholder proposal contained in this Proxy Statement, if properly presented at the Annual Meeting; and

•Such other business as may properly come before the meeting or any adjournment or postponement thereof.

Record Date March 11, 2025

A Proxy Statement describing matters to be considered at the Annual Meeting is attached to this Notice. Only stockholders of record at the close of business on March 11, 2025 are entitled to receive notice of and to vote at the meeting or any adjournment or postponement thereof.

Stockholders are cordially invited to participate in the meeting virtually via our live webcast. Following the formal items of business to be brought before the meeting, we will discuss our 2024 results and answer your questions.

Thank you for your continued support of Papa Johns.

By Order of the Board of Directors,

| Christopher L. Coleman | |||||

| Chair | March 27, 2025 | ||||

| Internet | Telephone | Webcast | ||||||||||||||||||

|

|

|

|

|||||||||||||||||

| Visit the website noted on your proxy card to vote via the Internet. |

Use the toll - free telephone number on your proxy card to vote by telephone. |

Sign, date and return your proxy card in the enclosed envelope to vote by mail. |

Participate in the meeting and vote at www.virtualshareholdermeeting.com/PZZA2025 |

|||||||||||||||||

TABLE OF CONTENTS

| Proxy Statement | ||

The Board of Directors (the “Board”) of Papa John’s International, Inc. (the “Company” or “Papa Johns”) is soliciting proxies for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually at 11:00 a.m. Eastern Time on May 1, 2025, and at any adjournment or postponement of the meeting. We have adopted a virtual format for our Annual Meeting again this year. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/PZZA2025. An audio recording of the entire Annual Meeting will be available on the Papa John’s Investor Relations website after the meeting. This Proxy Statement and the enclosed proxy card are first being mailed or given to stockholders on or about March 27, 2025.

At the Annual Meeting, stockholders will be asked to vote on the matters outlined in the Notice of Annual Meeting of Stockholders. These include the election of eight directors to the Board; the ratification of the selection of Ernst & Young LLP (“EY”) as the Company’s independent auditors for 2025; approval of an amendment to Papa John's International, Inc.'s 2018 Omnibus Incentive Plan; an advisory approval of the compensation paid to the Company’s named executive officers; and a stockholder proposal, if properly presented at the Annual Meeting.

| Virtual Stockholder Meeting | ||

The Annual Meeting will be conducted via live webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder as of the close of business on March 11, 2025 or if you hold a valid proxy for the Annual Meeting.

You will be able to participate in the Annual Meeting online by visiting www.virtualshareholdermeeting.com/PZZA2025. You also will be able to vote your shares electronically at the Annual Meeting (other than shares held through the Papa John’s International, Inc. 401(k) Plan, which must be voted by April 27, 2025).

To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the voter instruction form that accompanied your proxy materials.

The meeting webcast will begin promptly at 11:00 a.m. Eastern Time on May 1, 2025. Online access will begin at 10:45 a.m. Eastern Time, and we encourage you to access the meeting prior to the start time.

We will also make the Annual Meeting accessible to anyone who is interested, including team members and other constituents, by visiting the same link at www.virtualshareholdermeeting.com/PZZA2025. Non-stockholder guests will not be permitted to vote or submit questions at the Annual Meeting.

Submitting questions at the Annual Meeting

If you are a stockholder as of the close of business on March 11, 2025, and access the Annual Meeting using the 16-digit control number included on your proxy card or on the voter instruction form that accompanied your proxy materials, you can submit questions electronically at the Annual Meeting during the webcast. During the live Q&A session of the meeting, members of our executive leadership team and our Chair of the Board will answer questions as they come in, as time permits. To ensure the meeting is conducted in a manner that is fair to all stockholders, the Chair (or such other person designated by our Board) may exercise broad discretion in recognizing stockholders who wish to participate, the order in which questions are asked and the amount of time devoted to any one question. We reserve the right to edit or reject questions we deem profane or otherwise inappropriate. Detailed guidelines for submitting written questions during the meeting are available at www.virtualshareholdermeeting.com/PZZA2025.

If you have technical difficulties or trouble accessing the virtual meeting

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting or during the meeting time, please call:

844-986-0822 (US)

303-562-9302 (international)

2025 Proxy Statement 1

| Corporate Governance | ||

Principles of corporate governance that guide the Company are set forth in the Company’s Board committee charters, the Company’s Corporate Governance Guidelines and the Company’s Code of Ethics and Business Conduct, all of which are available on our website at www.papajohns.com by first clicking “Investor Relations” and then “Governance.” (The information on the Company’s website is not part of this Proxy Statement and is not soliciting material.) The principles set forth in those governance documents were adopted by the Board to ensure that the Board is independent from management, that the Board adequately oversees management, and to help ensure that the interests of the Board and management align with the interests of the stockholders. The Board annually reviews its corporate governance documents.

Majority Voting Standard for Director Elections

Our Amended and Restated By-laws (the “By-laws”) provide for a majority voting standard for uncontested director elections and a mechanism for consideration of the resignation of an incumbent director who does not receive a majority of the votes cast in an uncontested election. Under the majority voting standard, a majority of the votes cast means that the number of shares voted “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee. In contested elections where the number of nominees exceeds the number of directors to be elected, the vote standard will be a plurality of votes represented in person or by proxy and entitled to vote on the election of directors. In addition, if an incumbent director is nominated in an uncontested election, the director nominee is required, as a condition of the director’s nomination, to submit an irrevocable letter of resignation to the Chair of the Board. If an incumbent director nominee does not receive a majority of the votes cast, the Corporate Governance and Nominating Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the Committee’s recommendation and publicly disclose its decision and the rationale behind the decision within 90 days from the date of certification of the election results. The director whose resignation is being considered will not participate in the recommendation of the Committee or the Board’s decision.

Code of Ethics and Business Conduct

The Company’s Code of Ethics and Business Conduct, which is the Company’s code of ethics applicable to all directors, officers and team members worldwide, embodies the Company’s global principles and practices relating to the ethical conduct of the Company’s business and its longstanding commitment to honesty, fair dealing and full compliance with all laws affecting the Company’s business.

The Board has established procedures for any person, including a team member, to submit confidential and anonymous reports of suspected or actual violations of the Company’s Code of Ethics and Business Conduct relating, among other things, to:

•violations of the federal securities laws;

•fraud or error in the Company’s accounting, audit or internal controls, financial statements and records; and

•misconduct by any member of the Company’s senior management.

The procedures for reporting issues and concerns may be found on our website at www.papajohns.com, by first clicking “Investor Relations” and then “Governance.”

Director Independence

The Board has determined that seven of the Company’s eight current directors are “independent” as defined by applicable law and Nasdaq listing standards, as follows: Christopher L. Coleman, John W. Garratt, Stephen L. Gibbs, Laurette T. Koellner, Jocelyn C. Mangan, Sonya E. Medina, and John C. Miller. Each of our Audit, Compensation, and Corporate Governance and Nominating committees is comprised only of independent directors, as identified below under the heading “Committees of the Board of Directors.”

Todd M. Penegor is not considered to be independent because he serves as President and Chief Executive Officer of the Company.

2 2025 Proxy Statement

CORPORATE GOVERNANCE

The Company maintains an Insider Trading Compliance Policy governing the purchase, sale, and/or other dispositions of our securities by directors, officers, and employees, and has implemented processes for the Company, that we believe are designed to promote compliance with insider trading laws, rules, and regulations and any applicable listing standards. A copy of our Insider Trading Compliance Policy was filed as Exhibit 19 to our Annual Report on Form 10-K for the year ended December 29, 2024.

Hedging and Pledging Policy

Pursuant to our Insider Trading Compliance Policy, we prohibit employees, officers and directors from pledging any Company securities as collateral for a loan, or from holding any Company securities in a margin account. This policy also prohibits employees, officers and directors from entering into hedging transactions involving Company securities, including purchasing financial instruments such as prepaid variable forwards, equity swaps, collars, exchange funds and similar transactions. Hedging transactions means any transaction that hedges or offsets, or is designed to hedge or offset, any decrease in the market value of Company securities.

Board Leadership Structure and Risk Management

Under our Corporate Governance Guidelines, our Board elects a Chair of the Board with the duties set forth in our By-laws. When the position of Chair of the Board is not held by an independent director, the independent directors will elect a Lead Independent Director. Christopher L. Coleman, our current Chair, is independent; accordingly, we do not currently have a Lead Independent Director.

Our Board has a standing Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee. Each of these Board committees is comprised solely of independent directors, with each of the committees having a separate chair. See “Committees of the Board of Directors” below for a description of each of these Board committees and its members.

The key responsibilities of the Board include developing the strategic direction for the Company and providing oversight for the execution of that strategy by management. The Board has an active role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s financial, strategic and operational issues, as well as the risks associated with each, and that oversight includes a thorough and comprehensive annual review of the Company’s strategic plan and Enterprise Risk Management program.

At the committee level, risks are reviewed and addressed as follows:

•The Audit Committee oversees management of financial risks; legal and regulatory risks; food safety, information technology and cybersecurity risks; as well as the Company’s Enterprise Risk Management program, reporting on such matters to the full Board. The Audit Committee’s agendas include discussions of individual and emerging risk areas throughout the year, and, through its oversight of our Enterprise Risk Management program, the Audit Committee monitors management’s responsibility to identify, assess, manage and mitigate risks. Our Enterprise Risk Management program is comprised of a cross-functional, management-level Enterprise Risk Management team that helps establish a culture of managing and mitigating risk and coordination of risk management between our executive team and the Board. Specifically, with respect to oversight of technology and cybersecurity risks, our information security officer provides regular formal updates to the Board and Audit Committee on potential cybersecurity threats and the progress of our ongoing security and privacy programs. The Audit Committee reviews with management and reports to the full Board with respect to material information on security matters and risks and management’s actions to monitor and address identified areas for improvement.

•The Compensation Committee is responsible for overseeing the assessment and mitigation of risks relating to the Company’s compensation policies and practices and incentive compensation arrangements for its employees, and also oversees succession planning and human capital management. The Compensation Committee reviews our compensation policies and practices to determine whether they subject us to unnecessary or excessive risk. As a result of that evaluation, including a review of the plan design and governance aspects of our compensation programs discussed below in the Compensation Discussion and Analysis, the Compensation Committee concluded that the risks arising from those policies and practices are not reasonably likely to have a material adverse effect on the Company.

2025 Proxy Statement 3

CORPORATE GOVERNANCE

•The Corporate Governance and Nominating Committee manages risks associated with potential conflicts of interest and reviews governance and compliance issues with a view to managing associated risks, including oversight of our compliance program with respect to our Code of Ethics and Business Conduct, monitoring of risks associated with workplace discrimination and harassment, and our policies regarding diversity, culture and internal pay equity. The Corporate Governance and Nominating Committee also oversees the Company’s initiatives on sustainability and corporate responsibility matters.

While each committee is responsible for evaluating and overseeing the management of such risks, the Board is regularly informed through committee reports about such risks. In addition, the Board and the committees receive regular reports from the President and Chief Executive Officer, Chief Financial Officer, Chief Legal and Risk Officer, and other Company officers with roles in managing risks.

Board Self-Evaluation

Pursuant to our Corporate Governance Guidelines, the Board conducts an annual self-evaluation to assess its performance, which also includes evaluations of the Audit, Compensation, and Corporate Governance and Nominating committees. In addition, the Corporate Governance and Nominating Committee annually evaluates each director’s individual performance. The Corporate Governance and Nominating Committee is responsible for developing, administering and overseeing processes for conducting evaluations.

Evaluations are designed to assess the qualifications, attributes, skills and experience represented on the Board and whether the Board, its committees and individual directors are functioning effectively. Live in-depth interviews with each director are conducted by a third party for the evaluation process. The results are compiled and discussed with the Chair of the Board and the Chair of the Corporate Governance and Nominating Committee and then reported to the full Board.

Stockholder Engagement

Our Board of Directors and our management believe it is important to proactively engage with stockholders. Our senior management team, including our CEO, CFO and members of our Investor Relations team, maintain regular contact with a broad base of investors, including through quarterly earnings calls, individual meetings and other channels of communication, to understand their perspectives and key priorities. In 2024, we had discussions with stockholders collectively holding more than a majority of our outstanding common stock.

Our proactive engagement includes a broad range of topics including our strategic priorities, macroeconomic trends, and our corporate responsibility programs.

Feedback from stockholders is shared with the Board and the applicable committees on a regular basis.

Independent Chair of the Board

Christopher L. Coleman serves as our independent Chair of the Board. He has been a member of the Board since 2012 and has served as our independent Chair since 2023. Our Board believes having an independent Chair is the appropriate leadership structure for our Board at this time. Our Board believes having an independent Chair provides a strong leadership structure and sound governance and is currently in the best interests of the Company and its stockholders. The Chair works with the Board, the Company’s Chief Executive Officer and management to establish and further the Company’s strategic objectives. When the position of Chair of the Board is not held by an independent director, the independent directors will elect a Lead Independent Director, with the duties described in the Company’s Corporate Governance Guidelines.

Meetings of the Board of Directors

The Board held twelve meetings in 2024. Each director attended all of the meetings of the Board and the Board committees on which he or she served during 2024.

Meetings of the Independent Directors

At meetings of both the Board and the Board committees, the Company’s independent directors meet in regular executive sessions in which members of management do not participate. These sessions typically occur in conjunction with regularly scheduled Board or committee meetings. The Chair of the Board currently chairs

4 2025 Proxy Statement

CORPORATE GOVERNANCE

executive sessions of the Board. If the position of Chair is not held by an independent director, the Lead Independent Director will chair such executive sessions.

Annual Meetings of Stockholders

The Company does not have a policy regarding director attendance at the Annual Meeting, but we encourage each of our directors to attend each annual meeting of the Company’s stockholders. All directors then on the Board attended the 2024 Annual Meeting.

Committees of the Board of Directors

The Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee facilitate and assist the Board in the execution of its responsibilities. In accordance with Nasdaq listing standards, each of these standing committees is comprised solely of independent directors. Charters for each of our standing committees are available on the Company’s website at www.papajohns.com by first clicking on “Investor Relations” and then “Governance.” The charter of each standing committee is also available in print to any stockholder who requests it.

Audit Committee

|

Current Members:

Laurette T. Koellner (Chair)

John W. Garratt

Stephen L. Gibbs

Meetings in Fiscal 2024: 5

|

The Audit Committee’s purpose is to assist the Board in fulfilling its oversight responsibilities for the accounting, financial reporting, internal control over financial reporting and disclosure controls and procedures of the Company and its subsidiaries. The Committee is responsible for the appointment, compensation and retention of the independent auditors and oversees the performance of the internal auditing function and the Company’s compliance program with respect to legal and regulatory requirements and risk management. The Committee meets with management and the independent auditors to review and discuss the annual audited and quarterly unaudited financial statements, reviews the integrity of our accounting and financial reporting processes and audits of our financial statements, and prepares the Audit Committee Report included in this Proxy Statement. The Committee also is responsible for oversight of the Company’s overall enterprise risk management function and reviews the Company’s practices with respect to risk assessment and risk management and discusses the Company’s risk exposures, including top risks, and the processes to identify, assess, manage and mitigate risks. In addition, the Committee oversees the Company's policies and practices with respect to publicly disclosed non-GAAP measures. The responsibilities of the Committee are more fully described in the Audit Committee’s Charter.

Each member of the Committee is independent as determined by the Board, based upon applicable laws and regulations and Nasdaq listing standards. In addition, the Board has determined that each member of the Committee is able to read and understand fundamental financial statements and each of Ms. Koellner, Mr. Garratt, and Mr. Gibbs is an “audit committee financial expert” as defined by Securities and Exchange Commission (“SEC”) rules.

|

|||||||

2025 Proxy Statement 5

CORPORATE GOVERNANCE

Compensation Committee

|

Current Members:

John W. Garratt (Chair)*

Jocelyn C. Mangan

Sonya E. Medina

John C. Miller

Meetings in Fiscal 2024: 8

*appointed to Committee and as Chair on March 16, 2025

|

The Compensation Committee oversees the Company’s compensation programs and is responsible for overseeing, making recommendations to the Board, and discussing with management, as applicable, the Company’s overall compensation strategies, succession planning and human capital management. Specifically, the Compensation Committee reviews and approves annually the compensation of the Company’s executive officers, including the executive officers named in the Summary Compensation Table of this Proxy Statement (our “named executive officers” or “NEOs”). The Committee has the authority to administer our Compensation Clawback Policy and equity plans and is responsible for all determinations thereunder with respect to participation, the form, amount and timing of any awards to be granted to any such participants, and the payment of any such awards. In addition, the Committee is responsible for recommending stock ownership guidelines for the executive officers and directors, for recommending the compensation and benefits to be provided to non-employee directors, and for reviewing and approving the establishment of broad-based incentive compensation, equity-based, retirement or other material employee benefit plans, and any perquisites and benefit policies or programs available to our CEO, executive officers, and members of our Executive Leadership Team (except to the extent the benefit policies or programs apply to employees of the Company generally). The Committee also reviews risks, if any, created by the Company’s compensation policies and practices and provides recommendations to the Board on compensation-related proposals to be considered at the Annual Meeting. When appropriate, the Committee may form and delegate authority to subcommittees consisting of one or more members to act in a manner consistent with the above or as discussed in the Committee’s Charter.

The Committee has the authority to retain compensation consultants, outside counsel and other advisers. In 2024, the Committee engaged Meridian Compensation Partners ("Meridian") to advise it and to prepare market studies of the competitiveness of components of the Company’s compensation program for its senior executive officers, including the named executive officers. Meridian does not provide any other services to the Company. The Committee also performed an assessment of Meridian’s independence to determine whether the consultant is independent and, based on that assessment, determined that the firm’s work has not raised any conflicts of interest and the firm is independent. See “Compensation Discussion and Analysis” for a further description of the Committee’s use of Meridian during 2024, as well as the role of our executive officers in determining or recommending the amount or form of compensation paid to our named executive officers during 2024, and the Committee’s process in setting compensation.

The responsibilities of the Committee are more fully described in the Committee’s Charter.

|

|||||||

6 2025 Proxy Statement

CORPORATE GOVERNANCE

Corporate Governance and Nominating Committee

|

Current Members:

Christopher L. Coleman (Chair)

Jocelyn C. Mangan

Sonya E. Medina

Meetings in Fiscal 2024: 5

|

The Corporate Governance and Nominating Committee assists the Board in identifying qualified individuals for service as directors of the Company and as Board committee members, evaluates incumbent directors and their prior service on and contributions to the Board before recommending renomination, considers all director candidates’ public company leadership positions and other outside commitments prior to recommending a candidate for appointment or nomination and election to the Board, and recommends all approved candidates to the Board for appointment or nomination to the Company’s stockholders. The Committee selects as candidates for appointment or nomination individuals of high personal and professional integrity and ability who can contribute to the Board’s effectiveness in serving the interests of the Company’s stockholders. The Committee recommended the nomination of eight directors for re-election to the Board at the Annual Meeting.

In addition, the Committee develops and monitors the process for evaluating Board effectiveness, oversees the development and administration of the Company’s corporate governance policies and the Company’s compliance program with respect to the Company’s Code of Ethics and Business Conduct. It also reviews and approves matters pertaining to possible conflicts of interest and related person transactions. See the discussion under “Approval of Related Person Transactions” below. The Committee oversees the Company’s commitment to corporate values and corporate responsibility. To fulfill this mandate, the Committee provides oversight of the Company’s human resources compliance programs, including policies and procedures for monitoring discrimination and harassment, as well as the Company’s strategies and policies regarding diversity, culture and internal pay equity. The Committee also is responsible for consideration of, and reporting to the full Board on, governance matters, including the Company’s initiatives on corporate responsibility, sustainability and environmental, social and governance matters, including reporting on such matters.

The responsibilities of the Committee are more fully described in the Committee’s Charter.

|

|||||||

Corporate Responsibility

At Papa Johns, we believe that people are our most important ingredient, and we are dedicated stewards of the communities we serve and the environment. The Company’s commitment to corporate responsibility begins with our focus and aspirations around People, Pizza and Planet. Within these focus areas, the Company continues to advance on our priority topics. The Corporate Governance and Nominating Committee has oversight of the Company’s corporate responsibility strategy and receives semi-annual updates from management on the Company’s corporate responsibility priorities and accomplishments, which, as appropriate, are communicated to the Board.

We published our first full Corporate Responsibility Report in 2020 (for fiscal year 2019). Our latest Corporate Responsibility Report for fiscal year 2024 was published in March 2025. These reports are available on the Company’s website.

Building a Strong Culture

Papa Johns' workforce includes approximately 104,000 corporate and franchise team members around the globe, representing all walks of life. We continue to build a culture that reflects our value of Everyone Belongs and creates a competitive advantage in attracting and retaining talent.

2025 Proxy Statement 7

CORPORATE GOVERNANCE

Across our restaurants, Quality Control Centers, and Restaurant Support Centers, Papa Johns team members are valued for their contributions, treated fairly, encouraged to share their feedback and ideas, provided the tools needed to ensure their safety and total wellness and given ample opportunities to grow in their careers.

We embed policies and practices that ensure fairness and build trust, and encourage behaviors that foster belonging and employee engagement, including our global inclusion resource groups, tuition reimbursement, learning and development opportunities, and our Dough & Degrees fully funded tuition program.

In 2024, our culture was recognized on Forbes list of World’s Best Employers for the second consecutive year, TIME’s list of World’s Best Companies and Newsweek’s list of America’s Most Responsible Companies.

Workplace Health, Safety, Security, and Environmental

As part of the Company’s enterprise-wide health, safety, security, and environmental management system (HSSE-MS), Papa Johns invests in training, technology and people to protect both our customers, team members, and environment. All Papa Johns team members, from those at our Restaurant Support Centers, to those working in our warehouses and restaurants, receive annual safety and security training based on the requirements of their roles. Our Quality Control Centers and restaurant operations undergo annual risk assessments, as well as random safety and security checks by our corporate safety and security teams.

Papa Johns increased its investment in team member safety and asset protection with the establishment of a Loss Prevention team. In addition to growth of the Loss Prevention team, we will continue implementing a robust strategy by combining historical data analysis with predictive analytics and risk assessments to safeguard both our team members and assets. This proactive approach is essential for mitigating potential risks and ensuring the safety and security of our organization.

Human Rights

We strive for the highest standards of integrity and human rights in all of our business activities, including our supply chain. Our standard agreements with key suppliers mandate that each product sold to Papa Johns meet good manufacturing practices requirements applicable wherever the product is manufactured, produced, distributed, transported or stored. In addition to these requirements, which include supplier audits, and as part of our ongoing efforts to achieve and improve our standards of high quality and community responsibility throughout our business, we incorporate into our standard supply agreements specific prohibitions against suppliers' use of forced labor or facilitation of slavery and human trafficking, including certification, verification and audit procedures, and we strive to ensure Company representatives receive training to support those efforts. Our commitment to human rights is also demonstrated in our Code of Ethics and Business Conduct.

Community

We aim to be a responsible corporate citizen by striving to make the communities we serve better places to work, live, and play. In partnership with customers and franchisees, we raised more than $3.6 million in 2024 for the Papa Johns Foundation for Building Community through the Shaq-a-Roni campaign. The funds support leading nonprofit organizations focused on youth leadership and entrepreneurship, and food insecurity, as well as the Building Community Fund, a grant program allowing franchisees to nominate nonprofit organizations in their communities to receive funds.

Environment

Papa Johns is committed to being a good steward of the environment. Our Environmental and Climate Change Statement outlines our priority focus areas of sustainable packaging and materials management, sustainable agriculture, food waste and greenhouse gas (GHG) emissions.

Our pizza boxes are made from 100% fiber-based materials certified by the Sustainable Forestry Initiative and the Programme for the Endorsement of Forest Certification. To reduce single-use packaging, we transport our fresh, original pizza dough from our Quality Control Centers to our restaurants in reusable dough trays. When no longer fit for use, we grind and repurpose the trays, which otherwise would be disposed. In 2024, we diverted more than 379,000 pounds of waste from landfills by recycling these trays.

We also work to reduce food waste in our restaurants by working to more accurately forecasting and sourcing ingredients and donating surplus food to community organizations serving people in need. Since 2010, we have donated four million meals through our Harvest Program in partnership with the Food Donation Connection. This included approximately 200,000 meals in 2024.

8 2025 Proxy Statement

CORPORATE GOVERNANCE

Papa Johns currently conducts an annual assessment of our full greenhouse gas (GHG) emissions inventory, which is published in our most recent annual Corporate Responsibility Report. The Scope 1 and 2 emissions reported in our Corporate Responsibility Report reflect 2024 data, while our Scope 3 emissions represent data from 2023. In 2024, we continued to improve data collection processes to refine and improve the availability of this data.

To address our environmental footprint across our restaurants, Quality Control Centers and Restaurant Support Centers, we have taken steps including installing LED lighting, outfitting power-saving technology in our pizza ovens and reducing diesel use through the implementation of a Shore Power Electric program for our delivery trucks, which reduces diesel fuel consumption by using electric power to refrigerate trucks during loading.

Political Contributions

Papa Johns does not have a political action committee (PAC) and does not currently use Company funds for direct political contributions. Any political contributions have an approval process, which is outlined in our Code of Ethics and Business Conduct.

Communications with the Board

Stockholders of the Company may communicate with the Board in writing addressed to:

Board of Directors

c/o Corporate Secretary

Papa John’s International, Inc.

P.O. Box 99900

Louisville, Kentucky 40269 - 0900

The Secretary will review each stockholder communication. The Secretary will forward to the entire Board (or to members of a Board committee, if the communication relates to a subject matter clearly within that committee’s area of responsibility) each communication that (a) relates to the Company’s business or governance, (b) is not offensive and is legible in form and reasonably understandable in content, and (c) does not merely relate to a personal grievance against the Company or a team member or further a personal interest not shared by the other stockholders generally.

2025 Proxy Statement 9

CORPORATE GOVERNANCE

Nominations for Directors

Identifying Qualified Candidates

The Corporate Governance and Nominating Committee assists the Board in identifying qualified persons to serve as directors of the Company and as Board committee members. The Committee evaluates all proposed director nominees, evaluates incumbent directors and their prior service on and contributions to the Board before recommending renomination, considers all director candidates' public company leadership positions and other outside commitments prior to recommending a candidate for appointment or nomination and election to the Board, and recommends all approved candidates to the Board for appointment or nomination to the Company’s stockholders. The Committee also reviews any director candidate nominated for election by the Company’s stockholders under applicable law and the Company’s organizational documents, determines compliance with the requirements of such provisions, and makes recommendations to the Board with respect to director candidates properly nominated by stockholders.

The Corporate Governance and Nominating Committee expects qualified candidates will have high personal and professional integrity and ability and will be able to contribute to the Board’s effectiveness in serving the interests of the Company’s stockholders. In accordance with our Corporate Governance Guidelines, the Corporate Governance and Nominating Committee looks at a range of different personal factors in light of the business, customers, suppliers and employees of the Company. The range of factors includes skills and experience, such as prior board service, financial expertise, international experience, industry experience, technology experience and leadership skills, including prior management experience, and attention to racial, gender, and occupational diversity. In addition, the Committee also considers qualifications that include evidence of: independence, judgment, integrity, the ability to commit sufficient time and attention to Board activities, and the absence of potential conflicts with the Company’s interests. The Committee considers these criteria in the context of the perceived needs of the Board as a whole. Although the Board does not establish specific goals with respect to diversity, the overall diversity of the Board is an important consideration in the nomination process. Currently half of our Board nominees self-identify as being diverse based on gender, race, or ethnicity (two of whom are diverse by race/ethnicity and three by gender), and the Board’s collective experience covers a range of experience across different countries and industries. The Corporate Governance and Nominating Committee also considers the length of service of the Company’s Board members, balancing the value of long-standing Board service with the perspective of directors more recently joining the Board.

We limit the number of other public company boards that our directors can serve on to four, including our Board, and also restrict the number of public company board audit committees that our directors can serve on to three, including the Audit Committee of our Board, to mitigate risks of director overcommitment. Each of our directors are in compliance with these limitations.

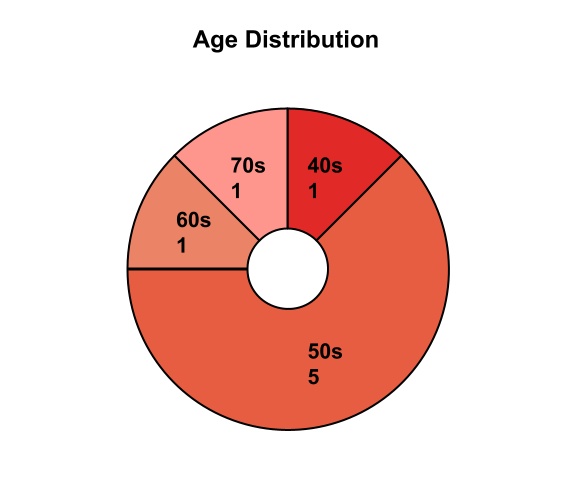

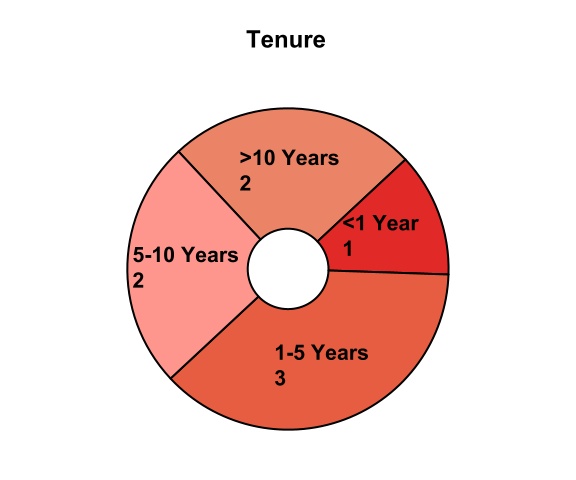

The charts below illustrate the composition of our directors by age distribution, tenure, skills and self-identified demographic statistics:

| Average Age: 58 | Average Tenure: 5.48 years |

|||||||

10 2025 Proxy Statement

CORPORATE GOVERNANCE

| Board Skills and Demographics Matrix (As of March 27, 2025) | ||||||||||||||||||||||||||

| ● - Denotes experience/skill in this area; ✓ - Denotes one of the Director's top four areas of expertise | ||||||||||||||||||||||||||

| Coleman | Garratt | Gibbs | Koellner | Mangan | Medina | Miller | Penegor | |||||||||||||||||||

| Board Skills | ||||||||||||||||||||||||||

| Accounting/Finance | ✓ | ✓ | ✓ | ✓ | ● | ● | ● | ✓ | ||||||||||||||||||

| Consumer Marketing/Brand Building | ● | ✓ | ✓ | ✓ | ✓ | ● | ||||||||||||||||||||

| Cybersecurity/IT/Digital | ● | ✓ | ● | ✓ | ● | |||||||||||||||||||||

| Corporate Responsibility/ Governance | ✓ | ● | ✓ | ● | ✓ | ✓ | ● | |||||||||||||||||||

| Food & Beverage Industry | ✓ | ● | ✓ | ✓ | ✓ | |||||||||||||||||||||

| Franchise Development | ● | ● | ✓ | ● | ||||||||||||||||||||||

| Human Capital Management | ● | ● | ✓ | ✓ | ● | ✓ | ||||||||||||||||||||

| International/Global Operations | ✓ | ✓ | ✓ | ✓ | ● | ● | ● | ● | ||||||||||||||||||

| Strategic Planning | ✓ | ✓ | ● | ● | ✓ | ✓ | ● | ✓ | ||||||||||||||||||

| PUBLIC COMPANY EXPERIENCE - YES/NO | ||||||||||||||||||||||||||

| Public Company Board | Y | Y | N | Y | Y | Y | Y | Y | ||||||||||||||||||

| Large Company C-Suite Leadership | Y | Y | Y | Y | Y | Y | Y | Y | ||||||||||||||||||

| Gender | ||||||||||||||||||||||||||

| Female | x | x | x | |||||||||||||||||||||||

| Male | x | x | x | x | x | |||||||||||||||||||||

| Did Not Disclose Gender | ||||||||||||||||||||||||||

| Demographic Background | ||||||||||||||||||||||||||

| African American or Black | x | |||||||||||||||||||||||||

| Alaskan Native or Native American | ||||||||||||||||||||||||||

| Asian | ||||||||||||||||||||||||||

| Hispanic or Latinx | x | |||||||||||||||||||||||||

| Native Hawaiian or Pacific Islander | ||||||||||||||||||||||||||

| White | x | x | x | x | x | x | ||||||||||||||||||||

| Two or More Races or Ethnicities | ||||||||||||||||||||||||||

| LGBTQ+ | ||||||||||||||||||||||||||

| Did Not Disclose Demographic Background | ||||||||||||||||||||||||||

The Board Skills and Demographics Matrix above highlights those skills that the Corporate Governance & Nominating Committee believes are most responsive to the current needs of our Board. The descriptions below provide additional insight into these skills.

•Accounting / Finance: Understanding of complex financial reporting and compliance matters, including accounting principles, financial statements and audit processes.

•Consumer Marketing / Brand Building: Possess consumer business experience, including scaling brands through strategic enterprise-wide marketing, brand recognition strategies and consumer engagement initiatives.

2025 Proxy Statement 11

CORPORATE GOVERNANCE

•Cybersecurity / IT / Digital: Experience with oversight of information security, data privacy and cybersecurity programs, including relevant risks, threats and strategies to business and with development and implementation of innovative technologies and digital focused strategies.

•Corporate Responsibility / Governance: Experience assessing or overseeing corporate risks related to environmental, social, sustainability and/or governance matters.

•Food & Beverage Industry: In-depth understanding of food, beverage, restaurant, sourcing and/or supply chains with insights on evolving industry risks.

•Franchise Development: Experience with franchisees, including understanding the franchisor/franchisee relationship, franchising regulations, and development opportunities.

•Human Capital Management: Specialized background in managing global labor-intensive operations, including with experience overseeing enterprise-wide talent development and retention programs.

•International / Global Operations: Experience managing risks and operational complexities associated with large-scale, global footprint.

•Strategic Planning: Experience leading companies through transformative changes or complex business strategies, including M&A, capital allocation and/or other strategic alternatives evaluations.

•Public Company Board: Current or previous service on a public company board with demonstrated corporate governance expertise.

•Large Company C-Suite Leadership: Previous service as a senior executive, or the equivalent thereof, of a multi-billion dollar public or private company.

The Corporate Governance and Nominating Committee reports regularly to the full Board on its assessment of the composition and functioning of the Board. The Company has focused on assembling a group of Board members who collectively possess the skills and experience necessary to oversee the business of the Company, structure and oversee implementation of the Company’s strategic plan, and maximize stockholder value in a highly competitive environment.

The Corporate Governance and Nominating Committee will consider candidates for election to the Board recommended by a stockholder in accordance with the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) and will do so in the same manner as the Committee evaluates any other properly recommended nominee. Any nomination by a stockholder of a person for election to the Board at an annual meeting of stockholders, or a special meeting of stockholders called by the Board for the purpose of electing directors, must be received at the Company’s principal offices not less than 60 days nor more than 90 days prior to the scheduled date of the meeting and must comply with certain other requirements set forth in the Company’s Certificate of Incorporation. However, if less than 70 days’ notice of the date of the annual meeting is given, notice by the stockholder must be received no later than ten days following the earlier of (i) the day on which such notice of the date of the meeting was mailed or (ii) the day on which public disclosure of the date of the meeting was made by the Company.

Nominations must be addressed to the Chair of the Corporate Governance and Nominating Committee in care of the Secretary of the Company at the Company’s headquarters address listed below and must be received on a timely basis in order to be considered for the next annual election of directors:

Chair of the Corporate Governance and Nominating Committee

c/o Corporate Secretary

Papa John’s International, Inc.

P.O. Box 99900

Louisville, Kentucky 40269-0900

12 2025 Proxy Statement

| Item 1. Election of Directors | ||

Our By-laws provide that the Board is authorized to fix from time to time the number of directors within the range of three to fifteen members, and currently the Board size is set at eight members. Directors are elected annually to one-year terms and each director nominee has consented to being named in this Proxy Statement and has agreed to serve if elected.

We believe the nominees set forth below possess an appropriate mix of skills, experience, and leadership designed to drive Board performance and properly oversee the interests of the Company, including our long-term corporate strategy. Our nominees include seven independent directors (88%) and a broad range of professional experience and backgrounds. The nominees also reflect a balanced approach to tenure that will allow the Board to benefit from a mix of newer directors who bring fresh perspectives and seasoned directors who bring continuity and a deep understanding of our complex business.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR.

Set forth below is information concerning the nominees for election, including their principal occupations, business experience, background, key skills and qualifications, and ages as of the date of this Proxy Statement. The key skills and qualifications are not intended to be an exhaustive list of each nominee’s skills or contributions to the Board, but rather the specific skills and qualifications that led to the conclusion that the person should serve as a director for the Company.

Nominees for Election to the Board

| Christopher L. Coleman | ||||||||

Age: 56

Director since 2012

Chair of the Board

Committees: Corporate Governance and Nominating (Chair)

|

Key Experience and Skills

Mr. Coleman’s extensive financial experience and international business acumen provide insight and expertise to the Board in these key areas.

Professional Experience

Mr. Coleman is based in the UK, where he is Group Head of Banking at Rothschild & Co. He is a Global Partner of Rothschild & Co, Chairman of Rothschild & Co Bank International and also serves on a number of other boards and committees of the Rothschild & Co Group, which he joined in 1989.

Mr. Coleman currently serves as a non-executive director of Barrick Gold Corporation (NYSE: GOLD) (and is a member of its compensation committee and its ESG and nominating committee). Mr. Coleman was previously non-executive Chairman of Randgold Resources until the Barrick/Randgold merger in 2019.

|

|||||||

2025 Proxy Statement 13

ITEM 1. ELECTION OF DIRECTORS

| John W. Garratt | ||||||||

Age: 56

Director since 2023

Committees: Audit, Compensation (Chair)

|

Key Experience and Skills

Mr. Garratt’s broad experience in finance leadership positions brings to the Board financial expertise and additional insights into the retail and restaurant industries. In addition, as a director of other public companies, he brings corporate governance, audit, and compensation experience.

Professional Experience

Mr. Garratt most recently served as President and Chief Financial Officer of Dollar General (NYSE: DG) until May 2023 after serving as Executive Vice President and Chief Financial Officer from 2015 to 2022. Prior to his positions with Dollar General, he spent ten years in leadership positions with Yum! Brands (NYSE: YUM).

He currently serves on the board of directors of Humana, Inc. (NYSE: HUM) (including service as chair of its investment committee and member of its audit committee), and Cracker Barrel (NASDAQ: CBRL) (including chair of its audit committee and member of its compensation committee).

|

|||||||

| Stephen L. Gibbs | ||||||||

Age: 52

Director since 2023

Committee: Audit

|

Key Experience and Skills

Mr. Gibbs’ considerable accounting and management experience provides the Board with financial expertise and additional insights into the retail and food and beverage industries.

Professional Experience

Mr. Gibbs most recently served as Vice President, Chief Accounting Officer and Corporate Controller for The Home Depot (NYSE: HD) from 2020 until June 2023. He joined The Home Depot from Tyson Foods (NYSE: TSN) where he served as Senior Vice President, Chief Accounting Officer and Controller from 2018 to 2020. Mr. Gibbs previously held similar roles with Keurig Green Mountain (now Keurig Dr Pepper (NASDAQ: KDP)), and Scientific Games Corporation. He spent his early career with top public accounting firms.

Mr. Gibbs currently serves on the board of PetSafe Brands (formerly Radio Systems Corporation), a privately held company (including service on its audit committee).

|

|||||||

14 2025 Proxy Statement

ITEM 1. ELECTION OF DIRECTORS

| Laurette T. Koellner | ||||||||

Age: 70

Director since 2014

Committees: Audit (Chair)

|

Key Experience and Skills

As a former executive of a publicly traded company, Ms. Koellner brings extensive experience to the Board in the areas of complex business operations, finance and accounting, and international business. In addition, she brings ample corporate governance and compensation experience and insight as a director of other public companies.

Professional Experience

Ms. Koellner most recently served as Executive Chairman of International Lease Finance Corporation, a subsidiary of American International Group, Inc. (“AIG”) from 2012 until its 2014 sale to AerCap Holdings N.V. Ms. Koellner served as President of Boeing International, a division of The Boeing Company, where she held a variety of financial and business leadership roles from 1997 until 2008, including as a member of the Office of the Chairman and Boeing’s Chief Administration and Human Resources Officer. Prior to her time with Boeing, Ms. Koellner spent 19 years at McDonnell Douglas Corp., which merged with The Boeing Company in 1997.

She currently serves on the board of directors of The Goodyear Tire & Rubber Company (Nasdaq: GT) (including service as its non-executive board chair and as a member of its compensation, governance, and executive committees) and Nucor Corporation (NYSE: NUE) (including service as chair of its audit committee and member of its compensation and executive development, and governance and nominating committees). She previously served on the board of directors of Celestica, Inc. (NYSE: CLS) until January 31, 2025.

|

|||||||

| Jocelyn C. Mangan | ||||||||

Age: 53

Director since 2019

Committees: Compensation, Corporate Governance and Nominating

|

Key Experience and Skills

Ms. Mangan’s extensive experience with technology and product strategy provides insight and expertise to the Board in these key areas. She also brings corporate governance experience as a director of another public company.

Professional Experience

Ms. Mangan is the CEO and Founder of two social impact ventures: illumyn Impact (formerly Him For Her), which is accelerating diversity on corporate boards, and illumyn, which is bridging the gap between boardroom opportunities and historically underrepresented executive talent ready for board service. She has served in this capacity since May 2018. Prior to that, Ms. Mangan held positions at Snagajob, serving as its COO from 2017 to 2018 and its Chief Product and Marketing Officer from 2016 to 2017. From 2014 to 2015, Ms. Mangan was SVP of Product at OpenTable.

Ms. Mangan currently serves on the board of Wag! (NASDAQ: PET), a technology platform that supports pet care, and ChowNow, a privately held online food ordering system and marketing platform.

|

|||||||

2025 Proxy Statement 15

ITEM 1. ELECTION OF DIRECTORS

| Sonya E. Medina | ||||||||

Age: 49

Director since 2015

Committees: Compensation, Corporate Governance and Nominating

|

Key Experience and Skills

Ms. Medina has extensive experience in corporate social responsibility, social impact, and brand management acumen. She also brings corporate governance experience as a director of other public companies.

Professional Experience

Ms. Medina currently serves as the President and Chief Executive Officer of Reach Resilience, a national foundation committed to serving communities in crisis. She has served in this capacity since May 2022. She has also served as an independent consultant since 2013. Previously, she served as Vice President of Community and External Affairs for Silver Eagle Distributors (distributor of Anheuser-Busch and Grupo Modelo products) from 2009 to 2013. Previously, Ms. Medina served as a White House commissioned officer in the capacity of Deputy Assistant to the President for Domestic Policy and Director of Projects to the First Lady, and as Director of the AT&T Global Foundation.

Ms. Medina currently serves on the board of directors of TKO Group Holdings, Inc. (NYSE: TKO) (including service on its audit, and compensation committees). She previously served on the board of directors of Delta Apparel, Inc. (NYSE: DLA). She is active in community and civic affairs.

|

|||||||

| John C. Miller | ||||||||

Age: 69

Director since 2023

Committee: Compensation

|

Key Experience and Skills

As a restaurant industry veteran with over 40 years of operational, strategic and senior management experience, Mr. Miller brings significant industry experience to our Board along with leadership and strategy insights.

Professional Experience

Mr. Miller served as Chief Executive Officer of Denny’s Corporation (NASDAQ: DENN) from 2020 until 2022, and as its President and Chief Executive Officer from 2011 to 2020. Prior to joining Denny’s Corporation, he served as Chief Executive Officer of Taco Bueno Restaurants, Inc. He also spent 17 years with Brinker International (NYSE: EAT), where he held numerous management positions overseeing several restaurant brands.

Mr. Miller continues to serve as a director of Denny’s Corporation.

|

|||||||

16 2025 Proxy Statement

ITEM 1. ELECTION OF DIRECTORS

Todd A. Penegor |

||||||||

Age: 59

Director since 2024

|

Key Experience and Skills

Mr. Penegor has extensive experience as an executive in the restaurant and consumer goods industries. He also brings financial, operational and strategic skills to the Board.

Professional Experience

Mr. Penegor was appointed as President and Chief Executive Officer of the Company on July 31, 2024. He joined Papa Johns from The Wendy's Company, where he served as President and Chief Executive Officer from 2016 to February 2024 and as Chief Financial Officer from 2013 to 2015. During his time at Wendy's, the company achieved substantial growth in sales, earnings and new restaurant counts, including the expansion of Wendy's footprint to more than 7,000 restaurants worldwide. Prior to Wendy's, Mr. Penegor held several leadership roles at Kellogg Company, including most recently Vice President of Kellogg and President of U.S. Snacks. He also held roles at Ford Motor Company within its finance organization.

Mr. Penegor currently serves on the board of directors of Ball Corporation (NYSE: BALL) (including service as chair of its human resources committee and member of its audit committee) and Dutch Bros Inc. (NYSE: BROS) (including as a member of its audit and risk committee).

|

|||||||

There are no family relationships among the Company’s directors and executive officers.

2025 Proxy Statement 17

| Security Ownership of Certain Beneficial Owners and Management | ||

The following table sets forth certain information as of March 11, 2025 (except as noted otherwise), with respect to the beneficial ownership of our capital stock by (i) each of the named executive officers identified in the Summary Compensation Table in this Proxy Statement, (ii) each director or nominee for director of the Company, (iii) all directors and current executive officers as a group and (iv) each person known to the Company to be the beneficial owner of more than five percent of the outstanding common stock. As of March 11, 2025, there were 32,709,301 shares of common stock outstanding.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1)(2) |

Percent of Common Stock Outstanding |

||||||||||||

| Christopher L. Coleman | 47,115 | * | ||||||||||||

| John W. Garratt | 3,646 | * | ||||||||||||

| Stephen L. Gibbs | 3,646 | * | ||||||||||||

| Laurette T. Koellner | 33,788 | (3) |

* | |||||||||||

| Robert M. Lynch | - | (4) |

* | |||||||||||

| Jocelyn C. Mangan | 11,988 | * | ||||||||||||

| Sonya E. Medina | 28,325 | * | ||||||||||||

| John C. Miller | 3,865 | * | ||||||||||||

| Caroline Miller Oyler | 79,388 | (5) |

* | |||||||||||

| Todd A. Penegor | 115,982 | * | ||||||||||||

| Joseph Sieve | 17,335 | * | ||||||||||||

| Ravi Thanawala | 55,026 | * | ||||||||||||

| All 12 directors and current executive officers as a group | 427,272 | (6) |

1.3% | |||||||||||

*Represents less than one percent of class.

| Common Stock Beneficially Owned | ||||||||||||||

| Other 5% Beneficial Owners | Amount and Nature of Beneficial Ownership(1) |

Percent Outstanding |

||||||||||||

|

BlackRock, Inc.(7)

50 Hudson Yards

New York, NY 10001

|

5,175,109 | 15.8 | % | |||||||||||

|

The Vanguard Group(8)

100 Vanguard Blvd.

Malvern, PA 19355

|

3,603,639 | 11.0 | % | |||||||||||

|

T. Rowe Price Investment Management, Inc.(9)

100 E. Pratt Street

Baltimore, MD 21201

|

2,953,226 | 9.0 | % | |||||||||||

|

EARNEST Partners LLC.(10)

1180 Peachtree Street NE, Suite 2300

Atlanta, GA 30309

|

2,562,079 | 7.8 | % | |||||||||||

|

River Road Asset Management, LLC(11)

462 S. 4th St., Suite 2000

Louisville, KY 40202

|

2,138,084 | 6.5 | % | |||||||||||

(1)Based upon information furnished to the Company by the named persons and information contained in filings with the SEC. Under SEC rules, a person is deemed to beneficially own shares over which the person has or shares voting or investment power or of which the person has the right to acquire beneficial

18 2025 Proxy Statement

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

ownership within 60 days. Unless otherwise indicated, the named persons have sole voting and investment power with respect to their shares and such shares are not subject to any pledge.

(2)Includes the following shares subject to options exercisable within 60 days after March 11, 2025; time - based restricted stock, over which the named persons have sole voting power; and deferred stock units.

| Name | Options exercisable within 60 days |

Restricted Stock |

Director Deferred Stock Units |

Name | Options exercisable within 60 days |

Restricted Stock |

Director Deferred Stock Units |

|||||||||||||||||||||||||||||||||||||

| Christopher L. Coleman | 11,632 | — | 15,060 | Sonya E. Medina | 12,907 | — | 12,210 | |||||||||||||||||||||||||||||||||||||

| John W. Garratt | — | — | 3,646 | John C. Miller | — | — | 3,865 | |||||||||||||||||||||||||||||||||||||

| Stephen L. Gibbs | — | — | 3,646 | Caroline Miller Oyler | 33,636 | 12,360 | — | |||||||||||||||||||||||||||||||||||||

| Laurette T. Koellner | 11,632 | — | 12,210 | Todd A. Penegor | — | 115,982 | — | |||||||||||||||||||||||||||||||||||||

| Robert M. Lynch | — | — | — | Joseph Sieve | — | 13,382 | — | |||||||||||||||||||||||||||||||||||||

| Jocelyn C. Mangan | — | — | 11,988 | Ravi Thanawala | — | 45,908 | — | |||||||||||||||||||||||||||||||||||||

(3)Ms. Koellner also holds units deemed invested in 3,888 shares of common stock through a deferred compensation plan provided by the Company, all of which are distributable in an equivalent number of shares of common stock within 60 days of termination of service on the Board and are included in the shares reported.

(4)On March 20, 2024, Robert M. Lynch resigned as President and Chief Executive Officer of the Company and as a director of the Board to assume a chief executive officer role with another company.

(5)Includes 659 shares held in the Company’s 401(k) Plan.

(6)Includes 69,807 shares subject to options exercisable within 60 days, 214,800 shares of unvested restricted stock, and 62,625 director deferred stock units, held by all directors and current executive officers. Holders of director deferred stock units or units deemed invested in common stock under the deferred compensation plan have no voting or investment power over any of the shares represented by these units.

(7)All information regarding BlackRock Inc. and its affiliates is based on a Schedule 13G/A filed with the SEC on January 22, 2024 by BlackRock, Inc. BlackRock reported that it has sole power to vote 5,119,575 shares and sole dispositive power of 5,175,109 shares.

(8)All information regarding The Vanguard Group is based on a Schedule 13G/A filed with the SEC on February 13, 2024. The Vanguard Group reported that it has shared power to vote 52,368 shares, sole dispositive power of 3,514,945 shares, and shared dispositive power of 88,694 shares.

(9)All information regarding T. Rowe Price Investment Management, Inc. is based on a Schedule 13G/A filed with the SEC on February 14, 2025. T. Rowe Price Investment Management, Inc. reported that it has sole power to vote 2,944,892 shares and sole dispositive power over 2,953,226 shares.

(10)All information regarding EARNEST Partners, LLC is based on a Schedule 13G filed with the SEC on November 13, 2024. EARNEST Partners, LLC reported that it has sole power to vote 1,823,692 shares, shared power to vote 543,388 shares, and sole dispositive power over 2,562,079 shares.

(11)All information regarding River Road Asset Management, LLC is based on a Schedule 13G filed with the SEC on February 6, 2025. River Road Asset Management, LLC reported that it has sole power to vote 1,901,734 shares and sole dispositive power over 2,138,084 shares.

2025 Proxy Statement 19

| Executive Compensation — Compensation Discussion and Analysis | ||

This section describes the Company’s philosophy and program for compensating its executive officers as well as the compensation paid to its named executive officers (“NEOs”) for fiscal year 2024.

Table of Contents

1. 2024 Highlights

Papa Johns Navigates a Challenging Consumer Environment

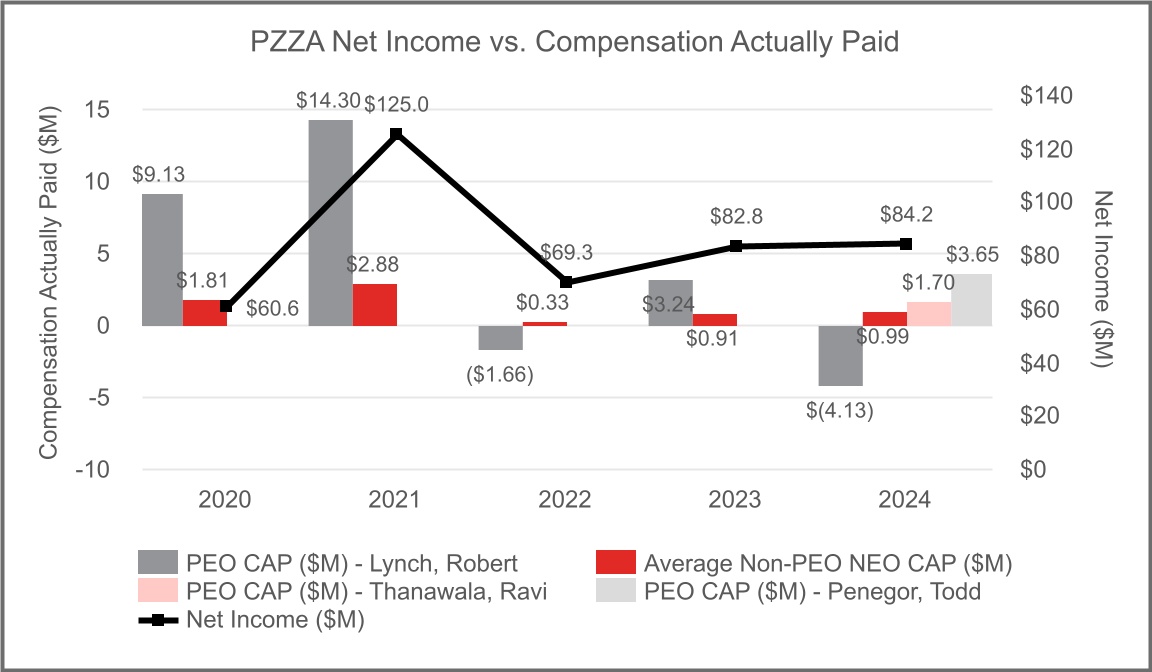

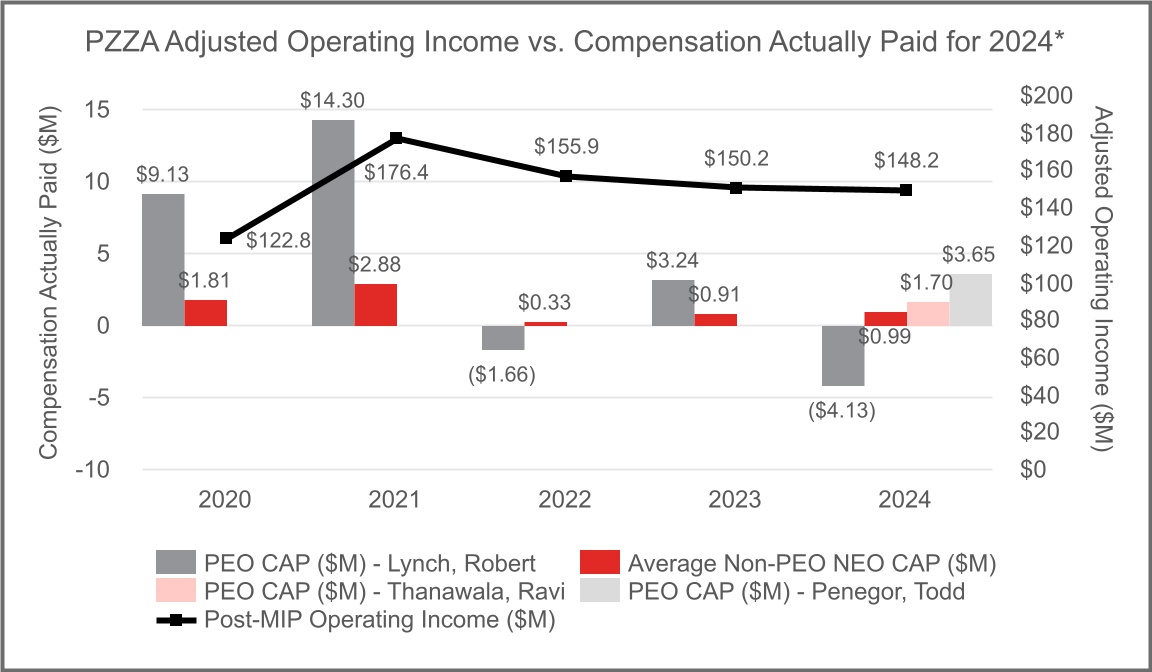

The year 2024 presented significant challenges for Papa Johns, as weakened consumer demand and increased competitive pressures across the quick-service restaurant (QSR) industry negatively impacted systemwide sales. Comparable sales in Domestic Company-owned restaurants were down 4.9%, marking the first year of negative growth following several consecutive years of positive performance. Total revenues were $2.06 billion, representing a 4% decrease as compared to the prior year, while global systemwide restaurant sales totaled $4.89 billion, representing a 3.1% decrease compared to the previous year. In response to these sector-wide headwinds, Papa Johns prioritized financial discipline, operational resilience, and strong franchise partnerships. Despite the decline in total revenue, management delivered approximately $148.2 million in adjusted operating income (a key performance metric under our short-term cash incentive program) for stockholders in 2024—comparable to the $149.1 million delivered in 2023 (on a 52-week basis).

Even with these headwinds, Papa Johns remained resilient and demonstrated strong development in North America, with 81 net new units. Internationally, although macroeconomic challenges persisted in certain regions, Papa Johns made meaningful progress in strengthening its global business, particularly in the United Kingdom, which was previously identified as a key transformation opportunity. These efforts helped sustain adjusted operating income despite pressure on domestic sales.

Leadership Transitions and Commitment to Excellence

The year 2024 was also a pivotal year of leadership changes for Papa Johns, beginning with the announced departure of former President and CEO Robert Lynch in March and the appointment of the Company’s Chief Financial Officer, Ravi Thanawala, as interim CEO. Following a thorough search process, Todd Penegor, a seasoned restaurant industry veteran, was named President and CEO in July 2024.

In addition to the CEO transition, Papa Johns hired a new Chief Technology and Digital Officer and a new Chief Marketing Officer, and also appointed a new Chief Supply Chain Officer. Additionally, two named executive officers (NEOs) assumed expanded responsibilities later in the year: Ravi Thanawala took on the dual role of Chief Financial Officer and Executive Vice President, International; and Joseph Sieve was promoted to Chief Restaurant and Global Development Officer, overseeing global development for the enterprise. Under this new leadership team, Papa Johns continued its transformative journey to become the world’s best pizza company.

20 2025 Proxy Statement

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS

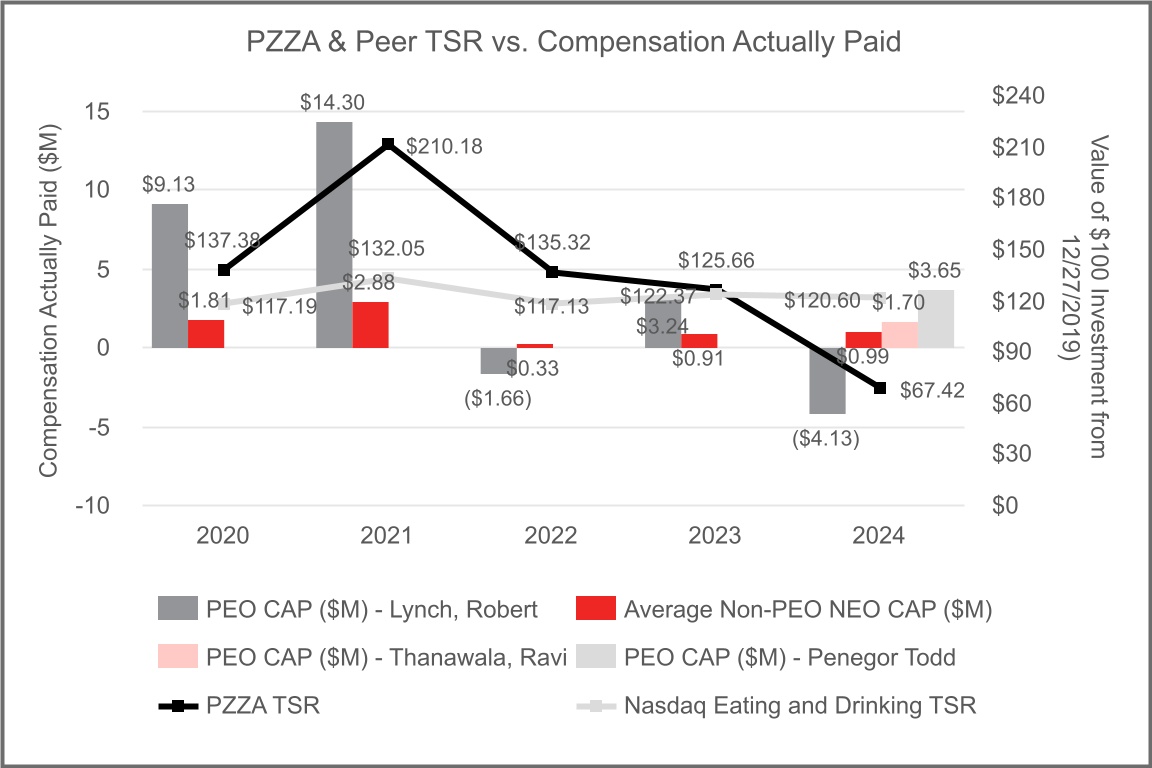

2024 Executive Compensation Reflects Continued Alignment with Pay-for-Performance

Papa Johns upholds a robust pay-for-performance philosophy, ensuring that executive incentives are closely aligned with key value drivers and stockholder value creation. Reflecting the challenging financial and operational performance in 2024, the Compensation Committee approved a payout under the Management Incentive Plan (MIP)—in which all NEOs participate—of 67.1% of target.

Market conditions and financial results also contributed to a decline in the Company’s share price. Consistent with Papa Johns’ pay-for-performance framework, performance-based units granted in 2022 under the Long-Term Incentive Program (“LTIP”) did not meet their vesting conditions, as the Company’s total shareholder return (TSR) over the 2022–2024 performance period ranked in the bottom quartile of its TSR peer group. While these outcomes are disappointing, they underscore Papa Johns’ continued commitment to aligning executive compensation with corporate performance and setting rigorous performance objectives.

2. Our NEOs

Our NEOs for fiscal year 2024 are:

•Todd Penegor, President and Chief Executive Officer;1

•Ravi Thanawala, Chief Financial Officer and EVP, International;2

•Joseph Sieve, Chief Restaurant and Global Development Officer;3

•Caroline Miller Oyler, Chief Legal and Risk Officer;

•Robert Lynch, Former President and Chief Executive Officer;4

1On July 31, 2024, the Board appointed Mr. Penegor as the Company’s President and Chief Executive Officer.

2Mr. Thanawala, the Company’s Chief Financial Officer, served in the additional position of interim Chief Executive Officer from March 20, 2024, through July 31, 2024. On September 9, 2024, Mr. Thanawala was promoted to Chief Financial Officer and EVP, International.

3On September 9, 2024, Mr. Sieve was promoted to Chief Restaurant and Global Development Officer.

4On March 18, 2024, Mr. Lynch informed the Board of his decision to resign from his positions as President and Chief Executive Officer of the Company and as a director of the Board, in each case effective March 20, 2024. Mr. Lynch continued his service with the Company as a strategic advisor through April 30, 2024, to assist in the transition of his duties.

3. Our Executive Compensation Process

Peer Group Companies and Benchmarking

Market pay levels and practices, including those of a relevant peer group, are among many factors the Compensation Committee considers in making compensation decisions. The market review is intended to provide an external framework for the range and reasonableness of compensation and to ensure we can provide competitive compensation needed to attract and retain the caliber of leadership critical to our success. The Compensation Committee reviews market data for all pay elements but does not target NEO compensation with respect to a specific benchmark, such as “median” or “50th percentile.” The Compensation Committee believes that dependence solely on benchmark data can detract from the focus on the performance of the individual NEO and his or her contribution to Company performance.

The Compensation Committee reviews the peer group annually in consultation with its independent compensation consultant. For competitive comparisons used to inform 2024 compensation decisions, the peer group included the companies in the following table.

| COMPETITIVE PEER GROUP | ||||||||||||||

| Bloomin' Brands | Dine Brands Global, Inc. | Restaurant Brands International Inc. | ||||||||||||

| Brinker International, Inc. | Domino’s Pizza, Inc. | Shake Shack, Inc. | ||||||||||||

| The Cheesecake Factory, Inc. | Jack in the Box Inc. | Texas Roadhouse, Inc. | ||||||||||||

| Chipotle Mexican Grill, Inc. | Krispy Kreme, Inc. | The Wendy’s Company | ||||||||||||

| Denny’s Corp. | Red Robin Gourmet Burgers, Inc. | Wingstop, Inc. | ||||||||||||

2025 Proxy Statement 21

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS

The Committee believes the companies in the peer group share many characteristics with the Company, including a common industry, market capitalization and other financial criteria, and are an appropriate group of comparable companies with which we compete for executive talent. In January 2024, the Committee updated the peer group used to inform 2024 compensation decisions, taking into account a review by its independent consultant. Specifically, the Committee added Krispy Kreme, Red Robin and Shake Shack to the 2024 peer group as their size, scope and competition for talent were compatible to that of Papa Johns. The Committee also removed Darden, BJ’s Restaurants and Cracker Barrel Old Country Store, Inc. as the profiles of these companies are based on primarily non-franchise full service restaurant concepts. Red Robin was removed in October 2024 due to its decline in market capitalization and stock price.

Role of Compensation Consultants in the Executive Compensation Process

The Compensation Committee conducted a compensation consultancy request for proposal in the fall of 2023. After evaluating potential advisors for industry expertise, independence, innovation, consultant and firm reputation, and other factors, it chose Meridian Compensation Partners (“Meridian”) as its independent consultant. The Compensation Committee retained Meridian for 2024.

Meridian reported directly to the Compensation Committee and did not provide any other services to the Company. The Committee sought input from Meridian on compensation trends, appropriate peer group companies and market survey data, and specific compensation decisions as discussed in this Compensation Discussion and Analysis.

The Compensation Committee has reviewed and assessed Meridian’s independence pursuant to SEC and Nasdaq rules and determined that the firm is independent and has no conflicts of interest with the Company.

Role of Management in the Executive Compensation Process

In making certain 2024 compensation decisions related to annual increases, the Compensation Committee requested input from the former CEO, who reviewed the performance of the NEOs and the other members of the executive leadership team (other than himself), provided recommendations to the Committee on the NEOs’ and other executive leaders’ compensation, and provided perspective on the performance of the executive leadership team (other than himself). The Committee also received similar input from the current CEO on certain compensation changes occurring after his appointment. The Committee reviews and discusses pay decisions related to the CEO in executive session without the CEO present, and in accordance with Nasdaq rules, neither Mr. Penegor nor Mr. Lynch was present when their respective compensation was being discussed or approved.

The Committee’s determination of each NEO’s compensation was based on a qualitative and quantitative review and assessment of many factors, including the individual’s performance, experience, scope of responsibilities, leadership and development, and the importance of the NEO to the successful execution of our strategies.

Stockholder Input/Say-on-Pay Vote

The Company considers input from stockholders, including the results of the annual advisory vote on executive compensation (“say-on-pay proposal”), in determining compensation for our NEOs. At our 2024 Annual Meeting of stockholders, 99.5% of the votes cast on the say-on-pay proposal were in favor. The Committee considers the stockholders’ positive support of our executive compensation program as one of many factors the Committee uses in determining compensation for our NEOs.

In 2024, members of our executive leadership team, along with our Chairman of the Board and other Directors when appropriate, proactively sought feedback from and covered a broad range of topics during engagement with our stockholders including our strategic priorities, macroeconomic trends, and our corporate responsibility programs. We also conducted non-deal investor roadshows and attended multiple investor conferences throughout the year. Our executive leadership team, including our CEO, CFO, and members of our investor relations team, maintains regular contact with a broad base of investors, including our quarterly earnings calls, individual meetings, and other channels for communication, to understand their perspectives and key priorities. Feedback from stockholders helps inform our executive compensation decisions.

22 2025 Proxy Statement

EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS

4. Compensation Policy Highlights

Consistent with stockholder interests and market best practices, our executive compensation program includes the following sound governance features:

•No executives have an employment agreement other than the CEO.

•No “single trigger” change of control payments.

•No guaranteed bonus or base pay increases, other than sign-on payments and inducements for new executives.

•No repricing or cash buyouts of underwater stock options or granting of discount-priced stock options. We have not issued stock options since 2019.

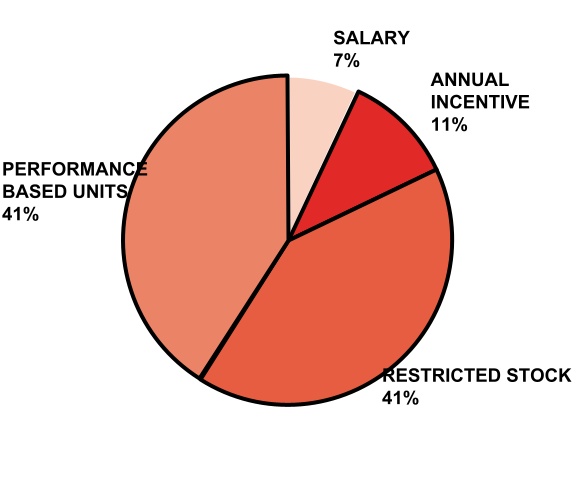

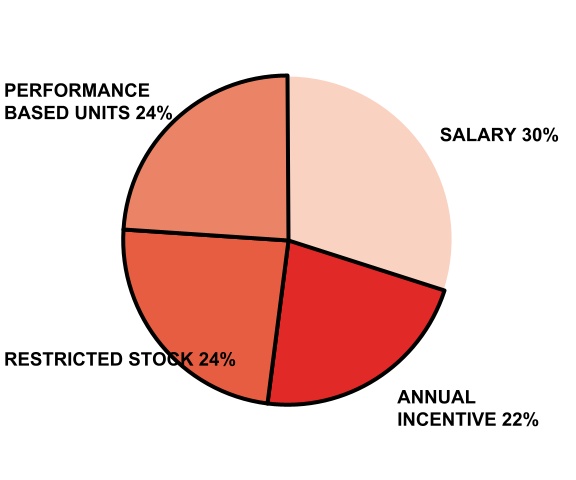

•Multi-year vesting and performance periods for annual equity grants.